Skyrocketing Education Stocks!

Continuation of the Rally?

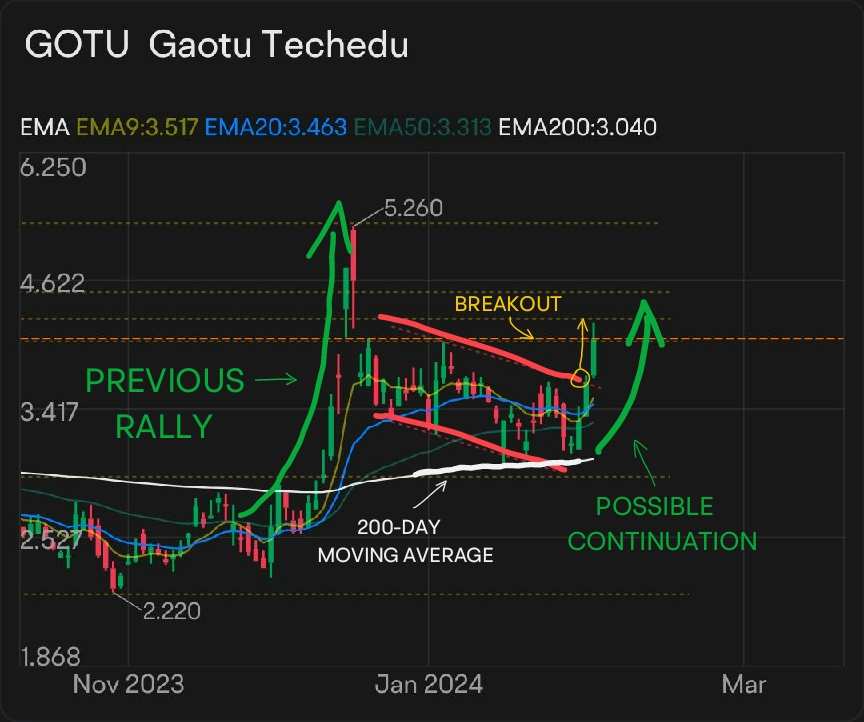

Gaotu Techedu experienced a massive rally at the end of the year last year. The run-up in price appeared to be a pump fake, just like you would see in many penny stocks, as the price quickly sold off after the huge spike in price.

The price was consolidating in a downward channel for most of Janurary. The price action was neutral but leaning towards the bearish side. More. Recently, the price action is showing signs of bullishneas. You can see in the chart directly below.

Bullish Technical Signals

There are a few factors that are pointing towards a possible continuation of the previous rally that closed out last year.

- The price action is breaking out to the upside of the consolidating price channel that I mentioned.

- The price action has rebounded off of the 200-day MA, and the remaining moving averages are beginning to expand.

- There was a large amount of volume associated with the breakout. This can possibly confirm the bullishness.

- KDJ and RSI have moved into bullish territory.

- MACD is experiencing a bullish cross just above the histogram.

Be Weary of Potential Resistance Levels

Always remember that these low priced stocks are very volatile. I always recommend to use a stoploss and take profit from time to time on the way up with very volatile names that could sell off at any moment's notice.

In the chart directly below, I have highlighted the resistance levels I will be watching to secure some profit and prepare for a potential reversal. If the price climbs above these levels, then they might be good levels for a dip buy opportunity, assuming that the rally will continue.

Of course, the rally could move higher than these resistance levels. If that is the case, then don't be surprised to see at least a small amount of selling at these technical levels.

Penny stock can tank at any moment, seemingly for no reason. I recomend using a stop loss, or a trailing stop loss, to help preserve any capital gains you might have made if you are riding this rally.

Very Volatile Sector

There have been a lot of big winners in the Chinese education industry. But there have also been a ton of losers. So sentiment is mixed in this sector. GOTU looks especially attractive mostly based on the technical setup but also due to the fact that many companies in the industry are absolutely skyrocketing.

If there is going to be more upside in this name then there is major profit potential for a swing trader like myself.

Good Luck Trading

As always, I am not a financial professional, and this is not investment advice. Be careful and be patient. Dont anticipate the market. Rather, participate in the market. Don't invest money that you can't afford to lose. Give some of your investments time and know when to cut your losses.

Don't be greedy. Don't invest in anything you don't understand. Don't put all of your eggs in one basket. Don't listen to the hype. Don't fomo or panic into or out of trades. Do your own due diligence. And just follow the trends. A trend is your friend. Good luck trading.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

MonkeyGee : Don't know if people are aware of this, but China came in and took down all of the education industry overnight. That started the ball rolling with the collapse of the China stock market. You just can't do that and expect everything to be fine.

iamiam : $Golden Sun Health Technology (GSUN.US)$ had a nice breakout, I was in that one. Good post.

SpyderCallOP MonkeyGee: Yup, major overhaul of the education industry. I believe china has incorporated something called "Xi Thought," or something like that. Seems fishy

SpyderCallOP iamiam: That one has been ripping like crazy!

Congrats on that one! I missed that ride.

I would have featured that name, but it has just been ripping so hard, and I would hate to influence anybody to jump in right before a pullback. The first pullback after a big rally can be substantial. I figured that GOTU has less risk in the immediate term and still major upside potential.

iamiam SpyderCallOP: fishy for sure, but markets don't care

iamiam SpyderCallOP: Yep!

102640653 : What’s your view on China. Can u check the technicals for hangseng index n Shanghai. Index . Thanks

SpyderCallOP 102640653: For sure. I will do that now.