Short Squeeze Risk Looms: Hedge Funds Lose $43 Billion in Short Selling Amid Market Rally

Recently, US stocks have experienced a robust rebound, propelled by growing optimism that the Federal Reserve will soon put an end to its interest rate hike cycle and renewed hopes for a "Goldilocks" economy in America. The sudden surge, however, has caused a brutal "short squeeze," resulting in short sellers suffering significant losses. According to data from S3 Partners, hedge funds lost $43.2 billion on short bets in the US and Europe from last Tuesday to Friday.

After a series of aggressive interest rate hikes by the Federal Reserve, the current benchmark federal funds rate has reached its 22-year high at 5.25%-5.5%. Consequently, short positions have been heavily taken on "low-quality" stocks that have been hurt the most by higher interest rates throughout the past year. These companies carry significant debt and incur high borrowing costs, and their profitability and cash flow lack resilience under economic downturn pressure.

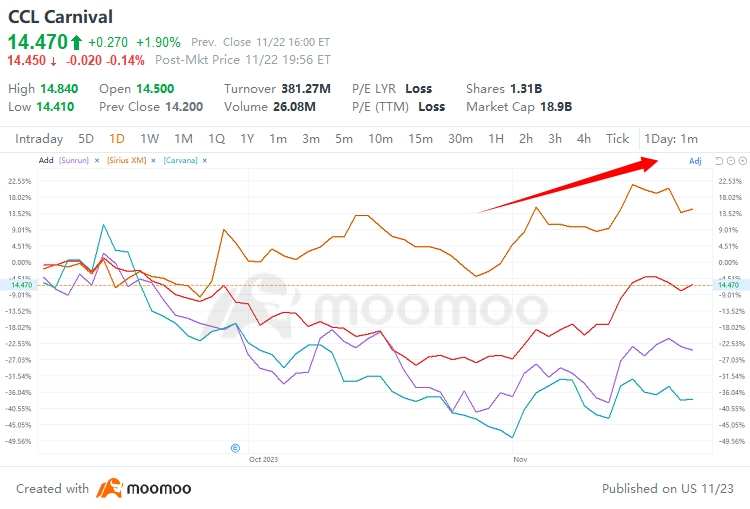

Looking into specific industries, fragile consumer goods industries, energy and technology industries that are sensitive to interest rates are all key bets of short sellers. They have also experienced quite violent reactions during the recent rebound. For instance, $Carnival(CCL.US$, a cruise company, witnessed a 14% surge in its shares in the week leading up to Monday, resulting in a $240 million loss for hedge fund short sellers, as reported by S3 Partners.

"All those shorts in these companies that are really susceptible to higher rates get this booming relief rally," explained Charlie McElligott, a cross-asset strategist at Nomura.

Barry Norris, the chief investment officer at Argonaut Capital, suggested that the recent easing of financial conditions may have led to a rebound in lower-quality stocks, which he likened to "dead cats bouncing."

A rapid shift in risk appetite and improved market sentiment caused a rebound in short-selling targets, leading hedge funds to purchase stocks to minimize their losses from negative betting. This action ultimately exacerbated the rise in stock prices, triggering what is known as a "short squeeze".

According to Bloomberg data, some indices that track heavily shorted stocks experienced significant rebound in November. Goldman Sachs' Very Important Shorts Index is expected to achieve its best monthly performance since October last year; while the Barclays Most Shorted Stocks in Europe index are likely to see their largest monthly gain in at least a decade.

Citigroup's global head of quantitative research, Chris Montagu, cautioned that the recent recovery in the U.S. stock market has taken short sellers by surprise. Losses on short positions for the $S&P 500 Index(.SPX.US$ are mounting, and investors' persistent bullish bets have further heightened the risk of short-term short squeezes. The investment bank reported that shorts on the $Nasdaq Composite Index(.IXIC.US$ are currently experiencing the largest average loss of 5.6%.

Source: Financial Times, Business Insider, Bloomberg, Citi

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

G0TCHYA : hahah who cares good

104613541 : coming for you okay

104613541 : who are you listen you who are you the big company CEO simple just put your pocket don't show me you don't know who I am but I don't know show you like that but you want to blame people simply be

104613541 : before 10 minutes I coming back seeing first one to shouting I like a buddha good

STD0313 : Well the squeezes are over, everyone pack it up

71411834 : well aslong as the little guys have a chance to recover I'm having a great day thanks

71411834 71411834: and thanks for the nalledge