Resource stock review ---- November 30

On November 30, the domestic commodity futures market closed with mixed ups and downs. The main contracts for the consolidated shipping index (European line) futures rose more than 5%, hitting a new high of more than two months; most of the basic metals fell, and the main contract for lithium carbonate futures fell nearly 6%, hitting a new low since listing; most energy chemicals rose, methanol and fuel rose more than 3%, soda ash rose more than 2%; most black products fell, coke fell more than 2%; agricultural products rose more than 1%; cotton yarn, cotton, peanuts rose more than 1%, pigs and white sugar fell more than 1%; and precious metals rose more than 1%;。 $SSIF DCE Iron Ore Futures Index ETF(03047.HK$

Iron ore news:

Overall, global iron ore shipments and domestic arrivals to Hong Kong continued to increase in the current period, port inventories were once again accumulated, and iron production continued to decline, but the year-on-year level was still high. Recently, the Development and Reform Commission and other departments have jointly strengthened iron ore supervision, and the pressure on policy supervision has intensified. It is expected that iron ore will maintain a volatile trend at a high level in the short term. In the later stages, we will continue to focus on changes on the demand side and the supply of overseas mines.

Offer update:

Shanzheng Iron Ore (3047.HK) closed at HK$22.72, up 0.8%

Cumulative return: 1 week: -2.24% January: 5.48% March: 13.88% June: 47.92% Launch to date: 204.97%

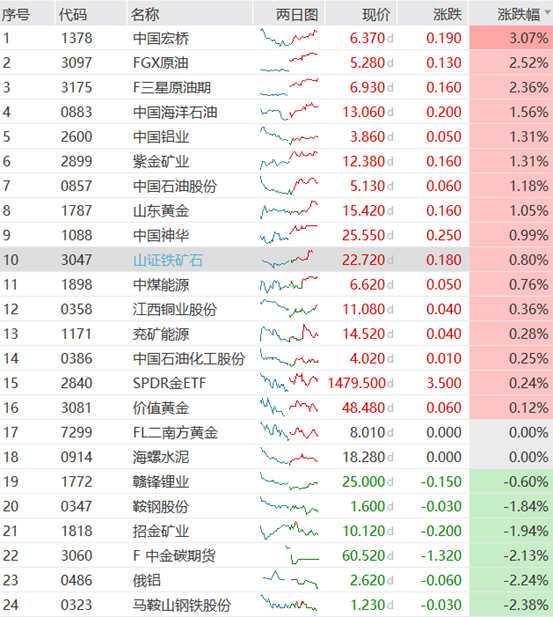

Status of the Hong Kong Resources Stock:

Recently, crude oil prices have made waves again. Analysts said that bulls are still betting that the OPEC+ meeting can reach a unified production reduction agreement, and oil prices will fluctuate drastically before the meeting. The sharp fluctuations in crude oil prices have caused the domestic petrochemical industry to face greater risks and challenges, and the industry urgently needs to strengthen risk management. Since this year, leading companies have been hedging to deal with risks.

Today, Shanghai Aluminum fluctuated weakly, and the decline slowed. The US GDP data showed strong performance, and US Treasury bonds joined forces with the US dollar to rise strongly, putting a lot of pressure on aluminum prices. The entry of short capital suppresses futures prices, offsetting the impact of production cuts in Yunnan. Coupled with poor terminal consumption, it continues to put upward pressure on aluminum prices. $CHINAHONGQIAO(01378.HK$ $CNOOC(00883.HK$

Iron ore news:

Overall, global iron ore shipments and domestic arrivals to Hong Kong continued to increase in the current period, port inventories were once again accumulated, and iron production continued to decline, but the year-on-year level was still high. Recently, the Development and Reform Commission and other departments have jointly strengthened iron ore supervision, and the pressure on policy supervision has intensified. It is expected that iron ore will maintain a volatile trend at a high level in the short term. In the later stages, we will continue to focus on changes on the demand side and the supply of overseas mines.

Offer update:

Shanzheng Iron Ore (3047.HK) closed at HK$22.72, up 0.8%

Cumulative return: 1 week: -2.24% January: 5.48% March: 13.88% June: 47.92% Launch to date: 204.97%

Status of the Hong Kong Resources Stock:

Recently, crude oil prices have made waves again. Analysts said that bulls are still betting that the OPEC+ meeting can reach a unified production reduction agreement, and oil prices will fluctuate drastically before the meeting. The sharp fluctuations in crude oil prices have caused the domestic petrochemical industry to face greater risks and challenges, and the industry urgently needs to strengthen risk management. Since this year, leading companies have been hedging to deal with risks.

Today, Shanghai Aluminum fluctuated weakly, and the decline slowed. The US GDP data showed strong performance, and US Treasury bonds joined forces with the US dollar to rise strongly, putting a lot of pressure on aluminum prices. The entry of short capital suppresses futures prices, offsetting the impact of production cuts in Yunnan. Coupled with poor terminal consumption, it continues to put upward pressure on aluminum prices. $CHINAHONGQIAO(01378.HK$ $CNOOC(00883.HK$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment