Resource stock retrading ---- November 9

On November 9, the domestic commodity futures market closed with mixed ups and downs. Most energy and chemicals rose more than 4%, LPG rose nearly 3%, pulp fell more than 4%, and crude oil fell nearly 3%; most black products rose, coking coal rose more than 2%, iron ore and hot rolls rose more than 1%; basic metals had mixed ups and downs, Shanghai nickel rose more than 2%, alumina fell more than 1%; agricultural products rose more than 1%, apples rose more than 1%, eggs fell more than 2%, peanuts and palm oil fell more than 1%; precious metals all fell. $SSIF DCE Iron Ore Futures Index ETF(03047.HK$

Iron ore news:

Recent iron ore transactions still revolve around the two lines of macro expectations and production cuts in steel mills at the industrial level, while the dominant logic is at the macro level. Looking at the industrial level, the static fundamentals of iron ore are resilient, and the decline in iron ore falls short of expectations. Coupled with the pattern of low iron ore stocks and high base differences, iron ore prices are strong; however, there are still risks. Finished materials have moved into a low season, the north has suddenly cooled down, and stocks of finished materials have been removed in the off-season. When steel mills still lose large areas, we still need to be extremely wary of the risk of falling demand brought about by production cuts.

Offer update:

Shanzheng Iron Ore (3047.HK) closed at HK$22.4, up 0.9%

Cumulative return: 1 week: 1.54% January: 13.13% March: 29.4% June: 43.41% since launch: 200.67%

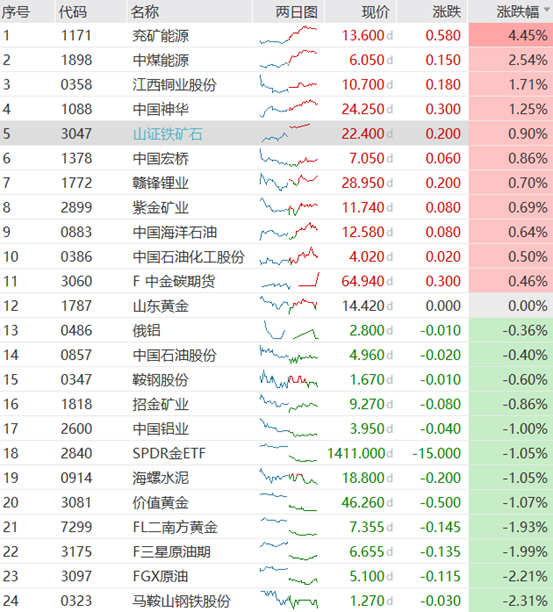

Status of the Hong Kong Resources Stock:

According to news, with some northern regions officially entering the heating season, terminal coal demand is rapidly increasing, driving coal prices to rise continuously in the short term. According to reports, at present, pessimism in northern ports has abated, the number of people inquiring about goods at terminals has increased, and traders' competitive sentiment is gradually rising. Shanxi, a major coal province, is stepping up efforts to increase coal production and supply. The price of 5,500 kcal thermal coal in the northern port has reached about 1,020 yuan per ton. Some industry insiders said that on the one hand, the rise in coal prices is due to the rise in crude oil prices, which has strengthened demand for coal chemicals, and on the other hand, it has also compounded the impact of demand during the heating season. $YANKUANG ENERGY(01171.HK$ $MAANSHAN IRON(00323.HK$

Iron ore news:

Recent iron ore transactions still revolve around the two lines of macro expectations and production cuts in steel mills at the industrial level, while the dominant logic is at the macro level. Looking at the industrial level, the static fundamentals of iron ore are resilient, and the decline in iron ore falls short of expectations. Coupled with the pattern of low iron ore stocks and high base differences, iron ore prices are strong; however, there are still risks. Finished materials have moved into a low season, the north has suddenly cooled down, and stocks of finished materials have been removed in the off-season. When steel mills still lose large areas, we still need to be extremely wary of the risk of falling demand brought about by production cuts.

Offer update:

Shanzheng Iron Ore (3047.HK) closed at HK$22.4, up 0.9%

Cumulative return: 1 week: 1.54% January: 13.13% March: 29.4% June: 43.41% since launch: 200.67%

Status of the Hong Kong Resources Stock:

According to news, with some northern regions officially entering the heating season, terminal coal demand is rapidly increasing, driving coal prices to rise continuously in the short term. According to reports, at present, pessimism in northern ports has abated, the number of people inquiring about goods at terminals has increased, and traders' competitive sentiment is gradually rising. Shanxi, a major coal province, is stepping up efforts to increase coal production and supply. The price of 5,500 kcal thermal coal in the northern port has reached about 1,020 yuan per ton. Some industry insiders said that on the one hand, the rise in coal prices is due to the rise in crude oil prices, which has strengthened demand for coal chemicals, and on the other hand, it has also compounded the impact of demand during the heating season. $YANKUANG ENERGY(01171.HK$ $MAANSHAN IRON(00323.HK$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment