Record Gold Demand: Will Gold Prices Hit New Highs This Year?

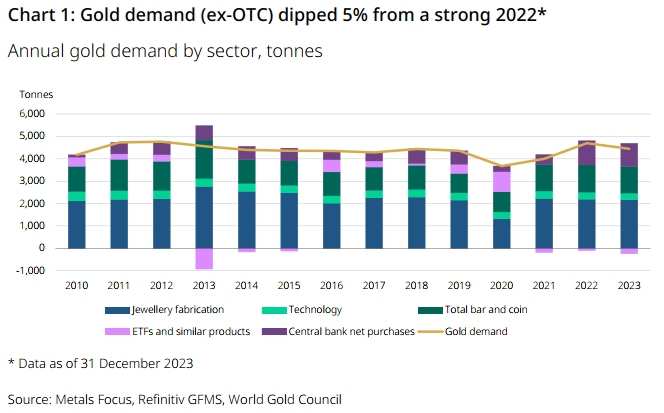

The World Gold Council (WGC) released a report on Wednesday indicating that gold demand in 2023 soared to record levels, with total consumption increasing by 3% to 4,899 tonnes. According to the report, the increase in demand was primarily driven by robust OTC market activity and continuous central bank purchases.

Over the past year, $Gold Futures(AUG4)(GCmain.US$ has captivated investors amidst economic uncertainty, heightened geopolitical tensions, and expectations of policy easing following the Fed's aggressive rate hikes to curb inflation. As a result, gold emerged as one of 2023's best-performing global assets. The international gold price surged by 13% last year, reaching a record high in early December.

As a key asset class globally, will gold hit new highs in 2024? Some factors include:

1. Anticipation of a Fed Rate Cut Cycle

The Fed's monetary policy stance has always been a significant driver for gold prices. Investors usually favor holding gold during rate cut cycles since it benefits from falling Treasury yields and a weaker dollar. As rate cuts potentially lead to lower real interest rates, the demand for gold investment is expected to rise.

A Fed rate cut is anticipated in this year. Despite indicating in the latest FOMC meeting that a rate cut in March is not likely, Fed Chair Powell maintains a positive view towards interest rate cuts for this year.

We believe that our policy rate is likely at its peak for this tightening cycle, and that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

According to the latest CME FedWatch Tool, the probability of a rate cut by May this year stands at 92.88%.

However, it is important to note that if U.S. economic indicators remain strong and resilient, this could lead to reduced expectations for the extent and pace of interest rate cuts, which may negatively impact gold prices.

2. Growth in OTC Gold Purchases

OTC gold purchases in 2023 registered a staggering 753% year-on-year increase to 450 tonnes, significantly contributing to global gold growth. While OTC buying is relatively opaque, it largely reflects a growing trend of high-net-worth individuals and corporations seeking to protect their wealth from currency weakness and economic uncertainties.

WGC Chief Market Strategist Joseph Cavatoni anticipates that investors will continue to accelerate their gold hoarding this year, spurred by the Fed's expected pivot toward easing.

3. Continued Gold Purchase by Global Central Banks

Central bank net purchases have been a vital support for robust gold demand in 2023. Last year, global central banks bought a net 1,037 tonnes of gold, which was slightly lower than the record of 1,082 tonnes from the previous year. Emerging markets have shown an increasing demand for converting dollar assets into physical gold, and the Chinese central bank has emerged as the largest single buyer of gold in 2023. WGC Senior Market Analyst Louise Street noted that

Unwavering demand from central banks has been supportive of gold demand again this year and helped offset weakness in other areas of the market, keeping 2023 demand well above the 10-year moving average.

Amidst de-dollarization, geopolitical shifts, and the drive to hedge against inflation and dollar weakness, the WGC expects central banks to continue their impressive rate of gold purchases in 2024, though possibly at a slightly lower rate than last year. Gregory Shearer, head of base and precious metals strategy at J.P. Morgan, noted that

There is still scope for boosted reserves at some central banks as institutions look to diversify reserve assets, so purchasing is likely to remain structurally elevated compared with the late 2010s.

4. Geopolitical Risks Highlight Gold's Safe-Haven Appeal

From the Israeli-Palestinian conflict to the volatile situation in the Red Sea, the Middle East continues to simmer with geopolitical risks. The Red Sea crisis, which has been ongoing since last October, is still unresolved, with Houthi forces in Yemen claiming encounters with several US naval vessels in the Gulf of Aden and the Strait of Mandeb. Rolf Habben Jansen, Hapag-Lloyd's CEO, said that the risk to shipping in the Red Sea area could last up to six months.

We don't think it will be over the day after tomorrow, whether it'll be one, three or five months - l don't know.

According to estimates from J.P. Morgan Research, gold prices are expected to dip in the near term before climbing to new highs later in the year. They forecast a peak of $2,300/oz in 2025, assuming an initial Fed cutting cycle that delivers 125bps of cuts over the second half of 2024.

Source: Bloomberg, Reuters, WSJ, Serrari

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Printing money : need gold to make micro processors

101685365 : ok