Presidential Election Years: A Historical Boon for Stock Market Returns

For investors, a pivotal narrative to follow in the coming year is the 2024 presidential election, anticipated to be one of the most influential events.

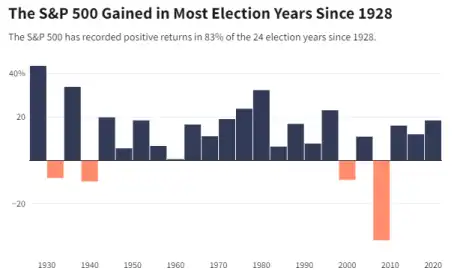

Historically, the stock market has shown an inclination to perform well in presidential election years. The $S&P 500 Index(.SPX.US$ has posted gains in 20 out of the 24 election years since 1928, representing a success rate of 83.3%. Furthermore, the average return during these election years stands at 11.58%, as per data from First Trust, surpassing the average annual return of 9.81% for all years since 1928.

There is good reason for investors to expect strong returns in re-election years like 2024. Jeffrey Buchbinder, chief equity strategist for LPL Financial, says presidents seeking re-election will often "prime the pump" by implementing fiscal stimulus measures and pro-growth regulatory policies to support the economy and the labor market.

While the stock market typically experiences appreciable gains in the final year of a president's term, these increases tend to be uneven and generally materialize in the latter half of the year.

Stephen Suttmeier, a technical strategist at Bank of America, outlines the typical pattern in his recent note:

Average monthly returns for the S&P 500 during Presidential Cycle Year 4 show a lackluster start from January through May, a summer rally from June through August, a pre-election dip in September and October, followed by a post-election relief rally in November and December."

August emerges as the strongest month, on average, with gains just over 3% and a success rate of 71%. Conversely, December usually offers the highest probability of gains, boasting an 83% success rate as election uncertainties wane. On the flip side, May typically sees the weakest performance with an average drop of 1.1%.

Even though the election year could bring unpredictability and volatility, analysts maintain a positive outlook for stock prices in 2024. According to J.P. Morgan strategists, elections might feel significant at the moment, but they have historically exerted minimal impact on the broader trajectory of the economy and market. They suggest that although volatility might increase leading up to election day, stocks are likely to advance as the haze of uncertainty clears.

Source: Business Insider, Investopedia, US News

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

safri_moomoor : maket volatiltity

让子弹飞一会儿 : Will it be different from the past because of the US debt problem?