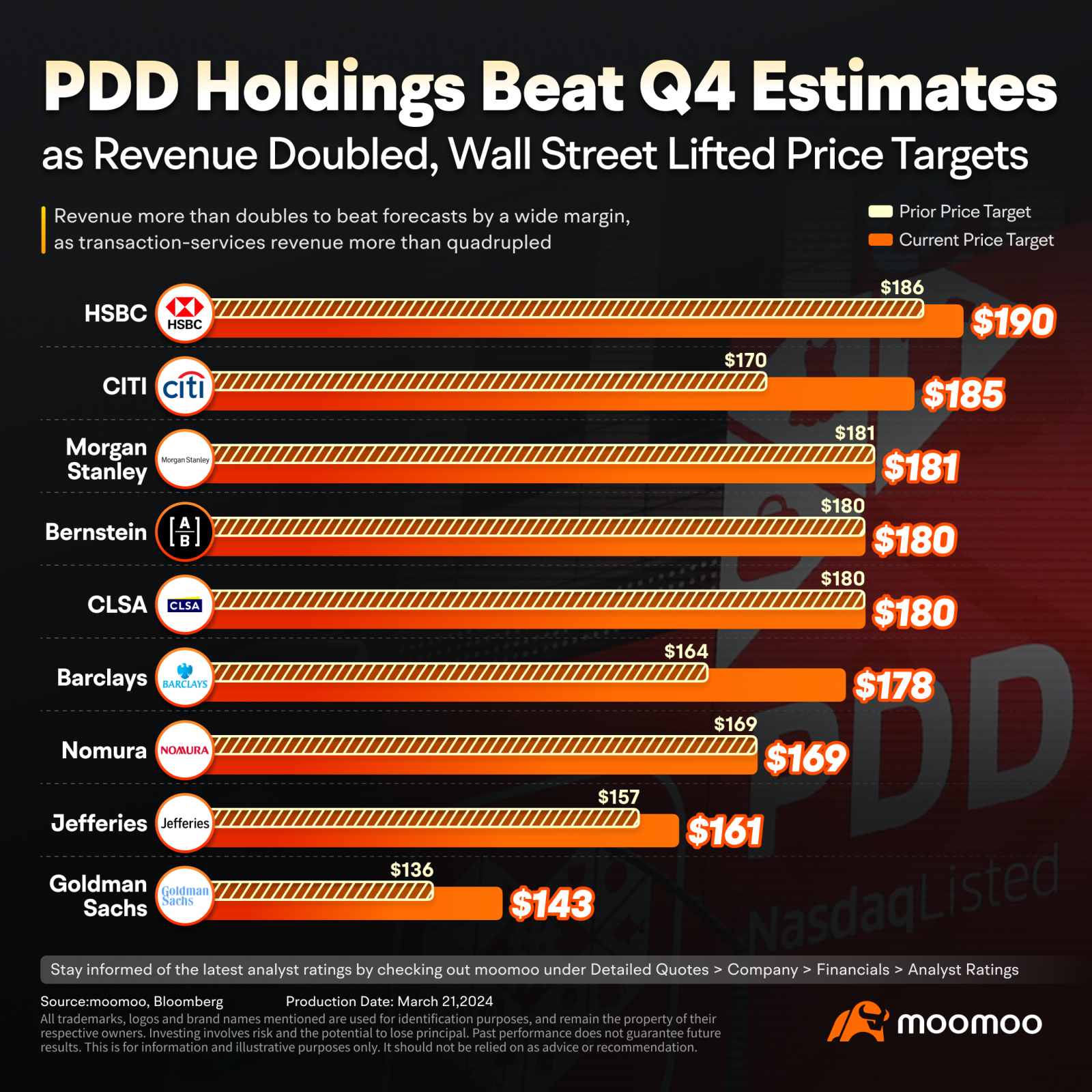

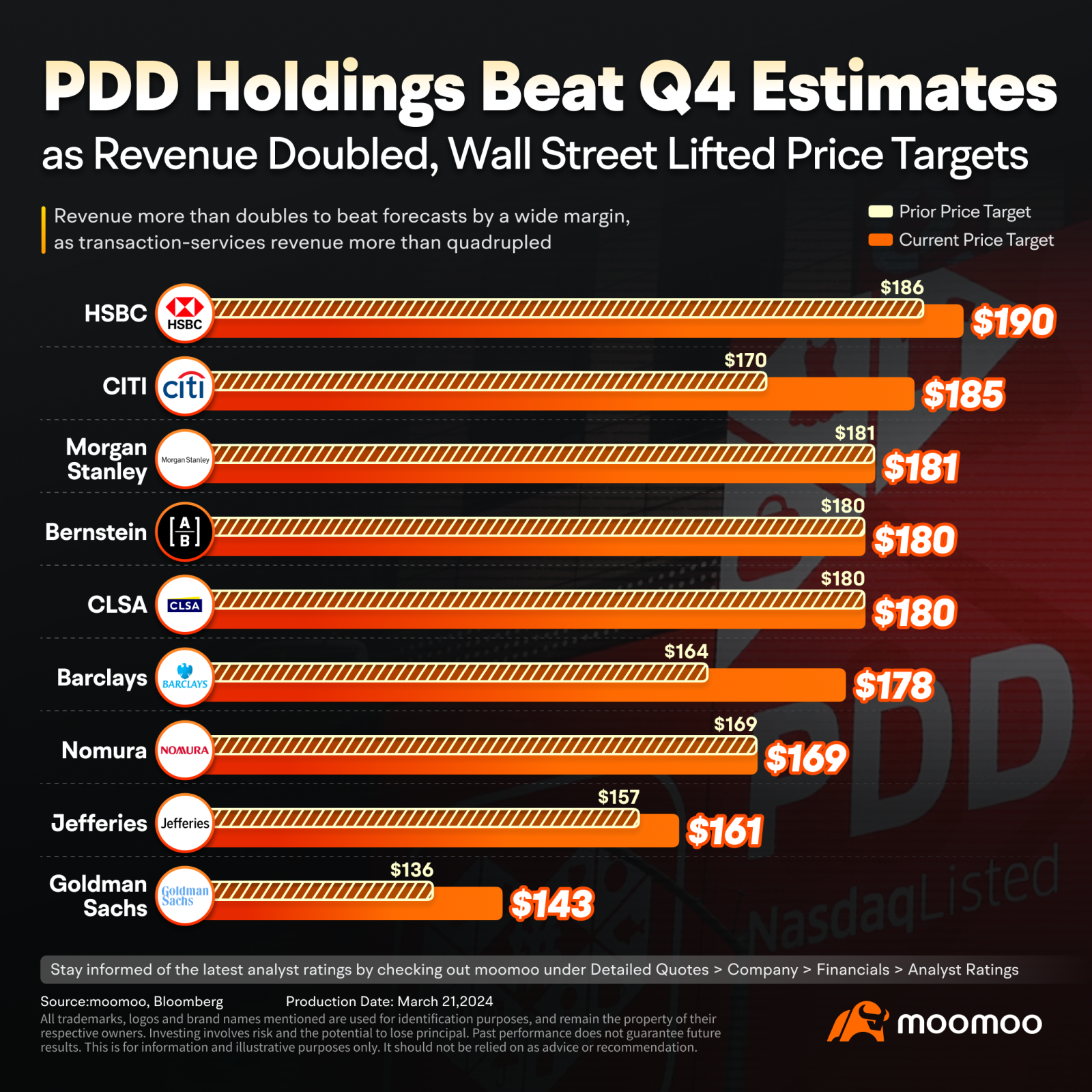

PDD Holdings Beat Q4 Estimates as Revenue Doubled, Wall Street Lifted Price Targets

PDD Holdings Inc. powered higher on Wednesday, after the e-commerce company reported fourth-quarter earnings that rose well above expectations, citing signs of improving consumer spending.

The Chinese e-commerce giant's total revenues soared nearly 123% year-over-year to RMB88.88B (about $12.52B). Both top and bottom lines surpassed analysts' estimates.

Revenue from online marketing services and others grew about 57% to RMB48.68B ($6.86B), while revenues from transaction services soared 357% year-over-year to RMB40.20B (about $5.66B).

“In the fourth quarter, we saw growing demand driven by encouraging consumer sentiment,” said co-Chief Executive Jiazhen Zhao.

“In 2024, we remain dedicated to further improving consumer experiences, enhancing technology innovations, and generating positive impacts in our communities,” added co-Chief Executive Lei Chen.

Following the release of fourth-quarter earnings, Wall Street raised their price targets for PDD.

• Citi raised the firm's price target on PDD Holdings to $185 from $170 and keeps a Buy rating on the shares. The company concluded 2023 with another impressive quarter on mindshare gains and a growing take rate, the analyst tells investors in a research note.

• Barclays analyst Jiong Shao raised the firm's price target on PDD Holdings to $178 from $164 and keeps an Overweight rating on the shares. The company's Q4 results topped expectations, and despite strong growth both in China and overseas via Temu, its costs and expenses were well controlled, resulting in better margins, Shao said.

• Jefferies analyst Thomas Chong raised the firm's price target on PDD Holdings to $161 from $157 and keeps a Buy rating on the shares after the company reported a Q4 beat and management highlighted its high quality strategies across consumption, supply and ecosystems during the call. For the domestic market, PDD highlighted improving consumer sentiment and an emphasis on satisfying demand, while for overseas operations the company said it is in early stages and is focused on innovations and operations with plans to continue to invest for the long term, Chong wrote in a note.

• PDD's earnings this year may remain supported by its Temu platform's strong momentum, Nomura analysts Jialong Shi and Rachel Guo say in a research note. Temu's revenue in 2024 could grow 96% to CNY62 billion, accounting for 19% of PDD's revenue, the analysts say. PDD's operating loss could also narrow to CNY29 per order in 2024 from Nomura's estimated loss of CNY55 per order in 2023, they say. The U.S., which is Temu's largest market, has high potential but is fraught with geopolitical risks, they say, adding that Temu will need to accelerate diversification of its overseas markets to mitigate the risk. Nomura maintains a buy call on PDD and keeps its ADR target unchanged at $169.00.

Source: Market Watch, Seeking Alpha

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Yang6688 :