Options Market Statistics: Nvidia Closes with $2 Trillion Valuation as AI Market Frenzy, Options Pop

News Highlights

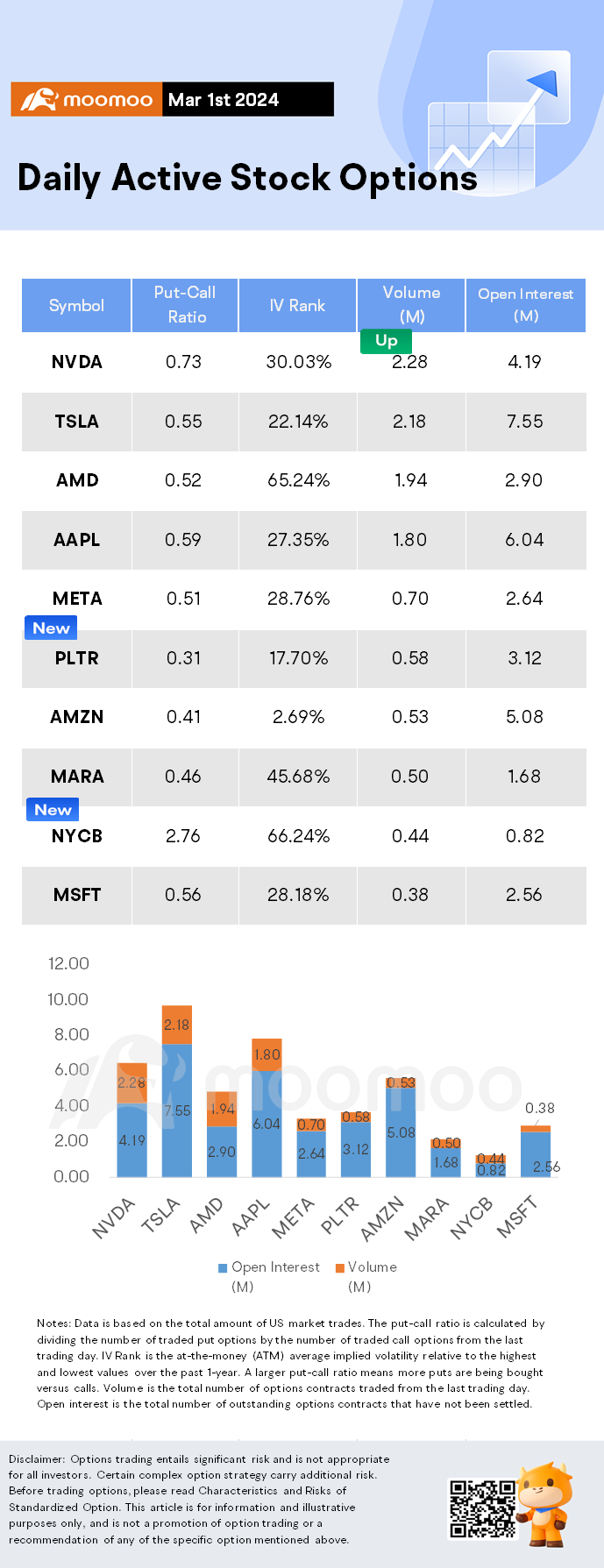

$NVIDIA(NVDA.US$shares rose by 4%, closing at $822.79. Its options trading volume is 2.28 million. Call contracts account for 57.9% of the total trading volume. The most traded calls are contracts of $820 strike price that expire on Mar 1st. The total volume reaches 187,189 with an open interest of 10,424. The most traded puts are contracts of a $815 strike price that expires on Mar 1st; the volume is 88,798 contracts with an open interest of 1,795.

Nvidia's stock market value closed above $2 trillion for the first time on Friday after an upbeat report from Dell Technologies reignited Wall Street's AI-fueled rally.

Nvidia's stock added 4% after Dell, which sells high-end servers made with Nvidia's processors, gave an upbeat forecast late on Thursday, pointing to a surge in orders for its AI-optimized servers.

Friday's rally put Nvidia's market capitalization at $2.06 trillion, making it Wall Street's third most valuable company behind Microsoft and Apple, at $3.09 trillion and $2.77 trillion, respectively.

Super Micro Computer, another company that sells servers made with Nvidia's chips, jumped 4.5%.

$Advanced Micro Devices(AMD.US$shares rose by 5.25%, closing at $202.64. Its options trading volume is 1.94 million. Call contracts account for 65.7% of the total trading volume. The most traded calls are contracts of $200 strike price that expire on Mar 1st. The total volume reaches 227,525 with an open interest of 16,187. The most traded puts are contracts of a $200 strike price that expires on Mar 1st; the volume is 81,001 contracts with an open interest of 576.

Shares of Advanced Micro Devices and Dell Technologies are moving in pre-market trading as the AI rally continues to ride high. AMD has reached a $300 billion market valuation, while Dell has received new orders for one of its chips. Shipping for the novel technology will begin this quarter, according to a note from Melius Research.

$Palantir(PLTR.US$shares fell by 0.6%, closing at $24.93. Its options trading volume is 0.58 million. Call contracts account for 76.2% of the total trading volume. The most traded calls are contracts of $25 strike price that expire on Mar 1st. The total volume reaches 46,445 with an open interest of 21,659. The most traded puts are contracts of a $24.5 strike price that expires on Mar 1st; the volume is 13,556 contracts with an open interest of 6,881.

Shares of Palantir Technologies Inc. slumped 0.60% to $24.93 Friday, closed $0.60 short of its 52-week high ($25.53), which the company achieved on February 12th.

On Friday, William Blair maintained an Underperform rating on Palantir Technologies Inc. , with a focus on the company's involvement in the Maven Smart System, a project used for weapons system targeting. A recent Bloomberg story highlighted the deployment of the system, which uses Palantir's software integrated with third-party algorithms, including Google's TensorFlow machine vision AI model.

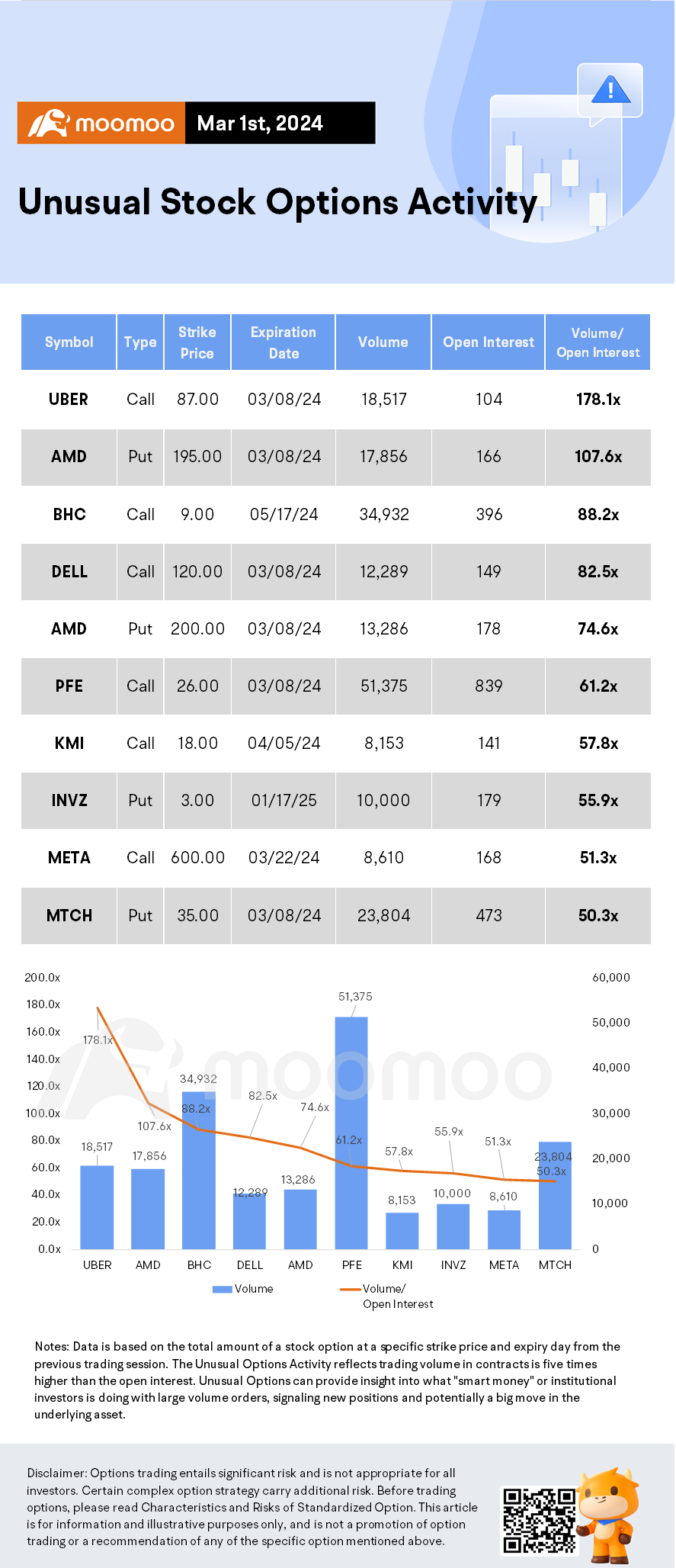

Unusual Stock Options Activity

Some notable call activity is being seen in $Uber Technologies(UBER.US$, which is primarily being driven by activity on the March 8th call. Volume on this contract is 18,517 versus open interest of 104.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

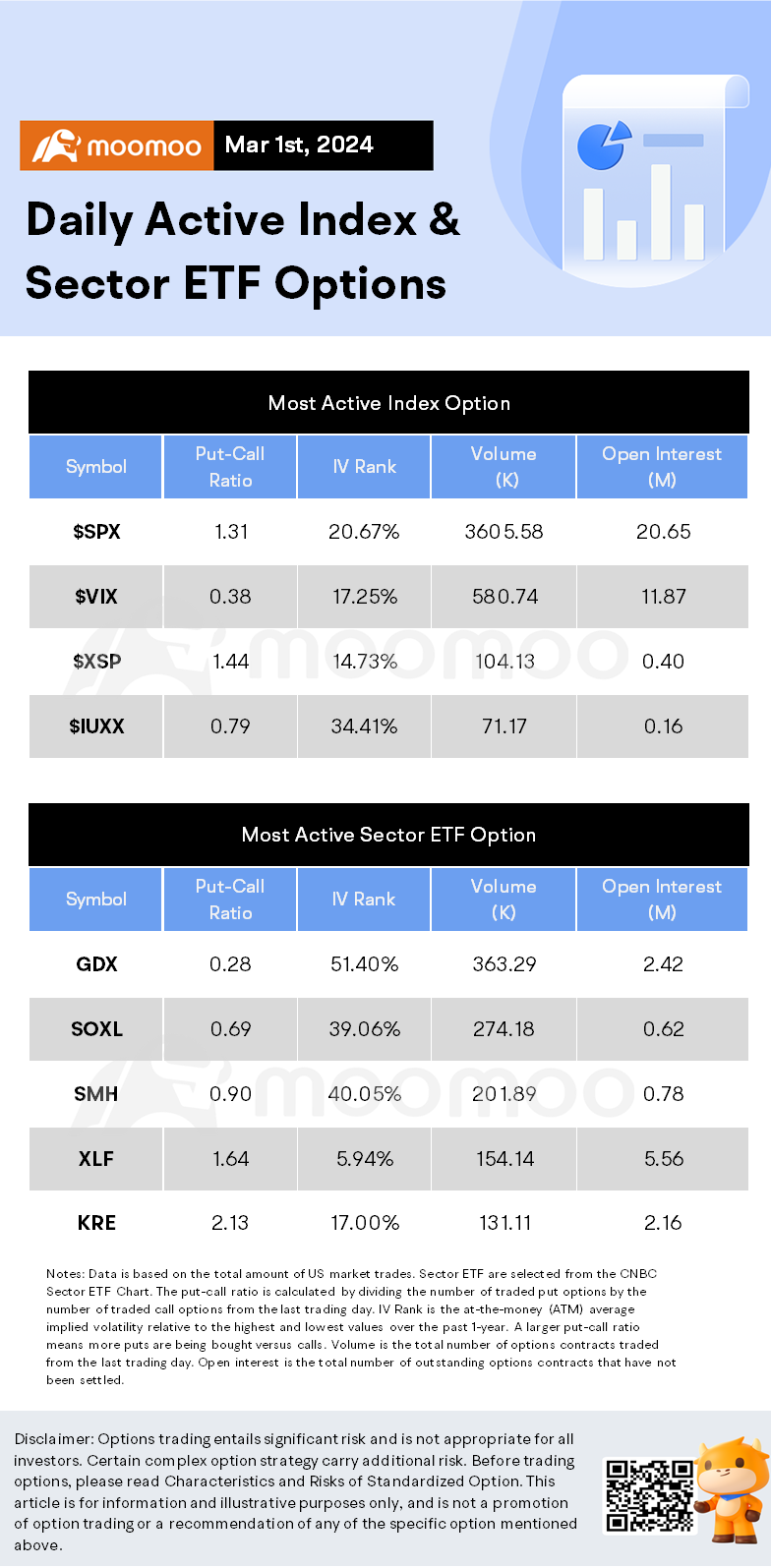

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, Barron's, The Motley Fool

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Ms V : Thanks for sharing

103617301 : good

yfuwong : What about smci?

104175183 : good

Affendi : good sharing

103711599 : good info