Options Market Statistics: HOOD Stock Jumps and Options Pop Following the Company's Announcement of a Strong Increase in Trading Volumes

News Highlights

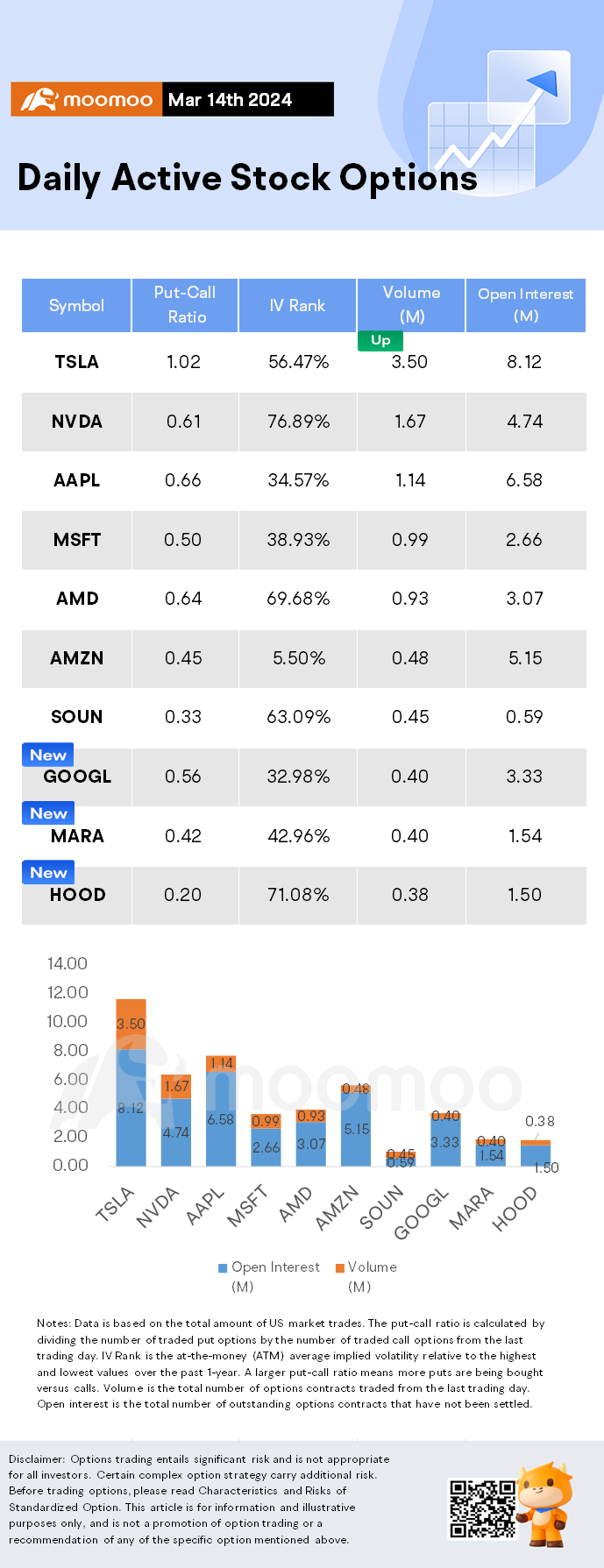

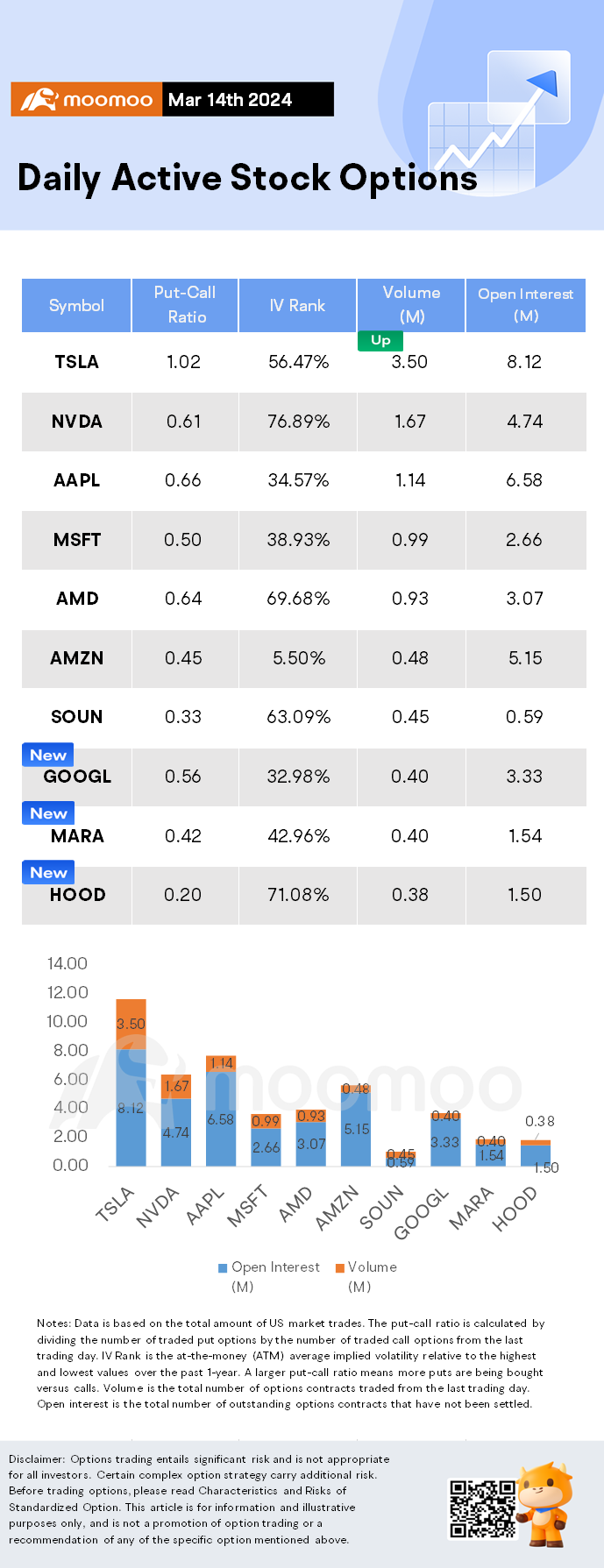

$Tesla(TSLA.US$ shares lowered by 4.12%, closing at $162.50. Its options trading volume was 3.5 million. Call contracts account for 49.5% of the total trading volume. The most traded calls are contracts of $170 strike price that expire on Mar 15th. The total volume reaches 167,030 with an open interest of 13,477. The most traded puts are contracts of a $160 strike price that expires on Mar 15th; the volume is 190,399 contracts with an open interest of 29,405.

Elon Musk's Tesla once represented the future of automaking. Now the company's own future is in question.

The once red-hot electric vehicle maker — heralded as part of the so-called Magnificent Seven behemoth tech stocks — is currently the worst performer in the $S&P 500 Index(.SPX.US$ this year, down nearly 32% since January.

The story of Tesla's decline has been well documented. The company has been plagued by safety issues and recalls, slowing growth and has even been forced to slash prices. But a new report by Wells Fargo analyst Colin Langan on Wednesday offers a darker picture than previously imagined.

$Alphabet-A(GOOGL.US$ shares rose by 2.37%, closing at $143.10. Its options trading volume was 0.4 million. Call contracts account for 64.0% of the total trading volume. The most traded calls are contracts of $142 strike price that expire on Mar 15th. The total volume reaches 27,441 with an open interest of 20,188. The most traded puts are contracts of a $142 strike price that expires on Mar 15th; the volume is 14,641 contracts with an open interest of 2,158.

$Robinhood(HOOD.US$ shares rose by 5.19%, closing at $18.05. Its options trading volume was 0.38 million. Call contracts account for 83.1% of the total trading volume. The most traded calls are contracts of $19 strike price that expire on Mar 15th. The total volume reaches 34,158 with an open interest of 7,024. The most traded puts are contracts of a $18 strike price that expires on Mar 15th; the volume is 11,553contracts with an open interest of 675.

Shares of Robinhood Markets jumped on Thursday following the company's announcement of a strong increase in trading volumes for February. The boost is seen as a positive sign for the retail-focused brokerage and indicates an uptick for similar platforms like $Coinbase(COIN.US$.

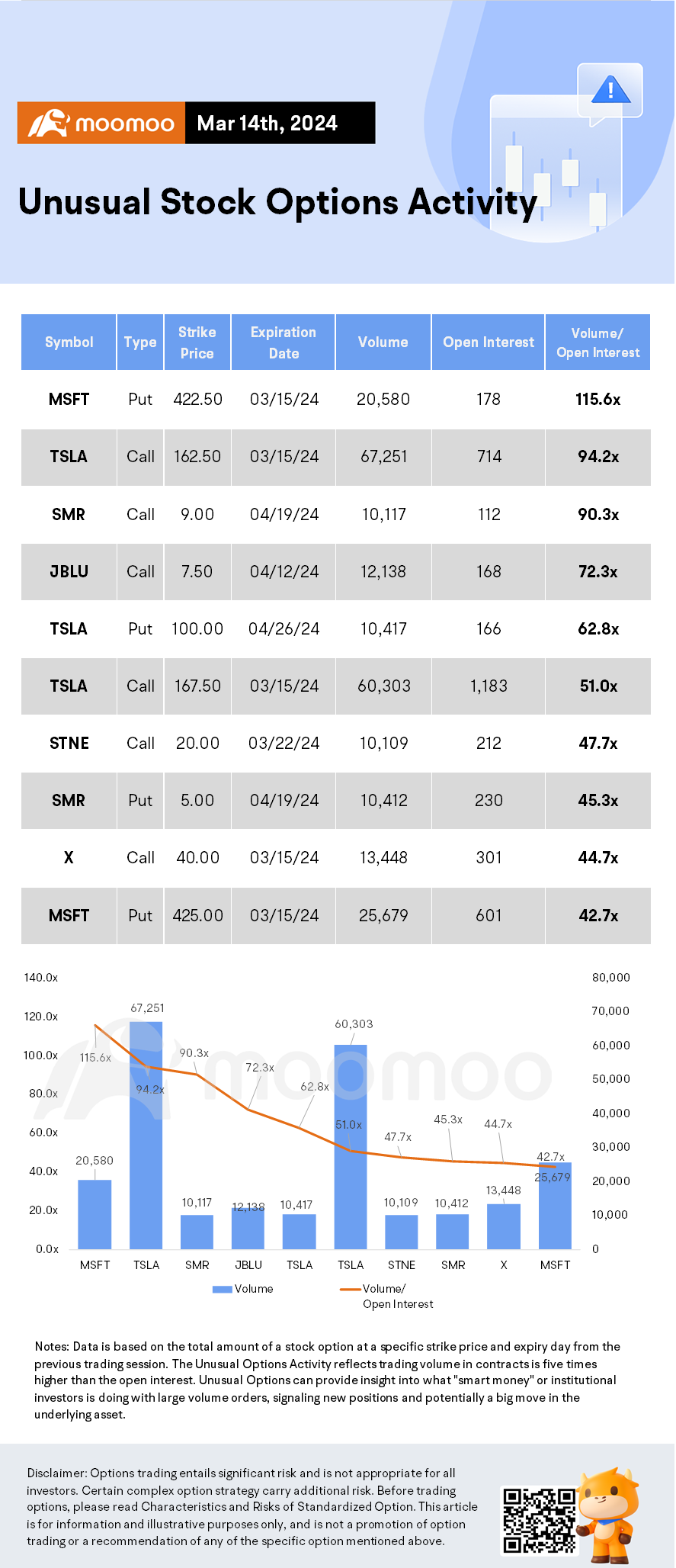

Unusual Stock Options Activity

There was a noteworthy activity in $Microsoft(MSFT.US$, where multiple puts have topped volume to open interest ranking. The highest volume over open interest ratio reaches 115.6x, with option volume of nearly 20,580 and open interest of 178.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

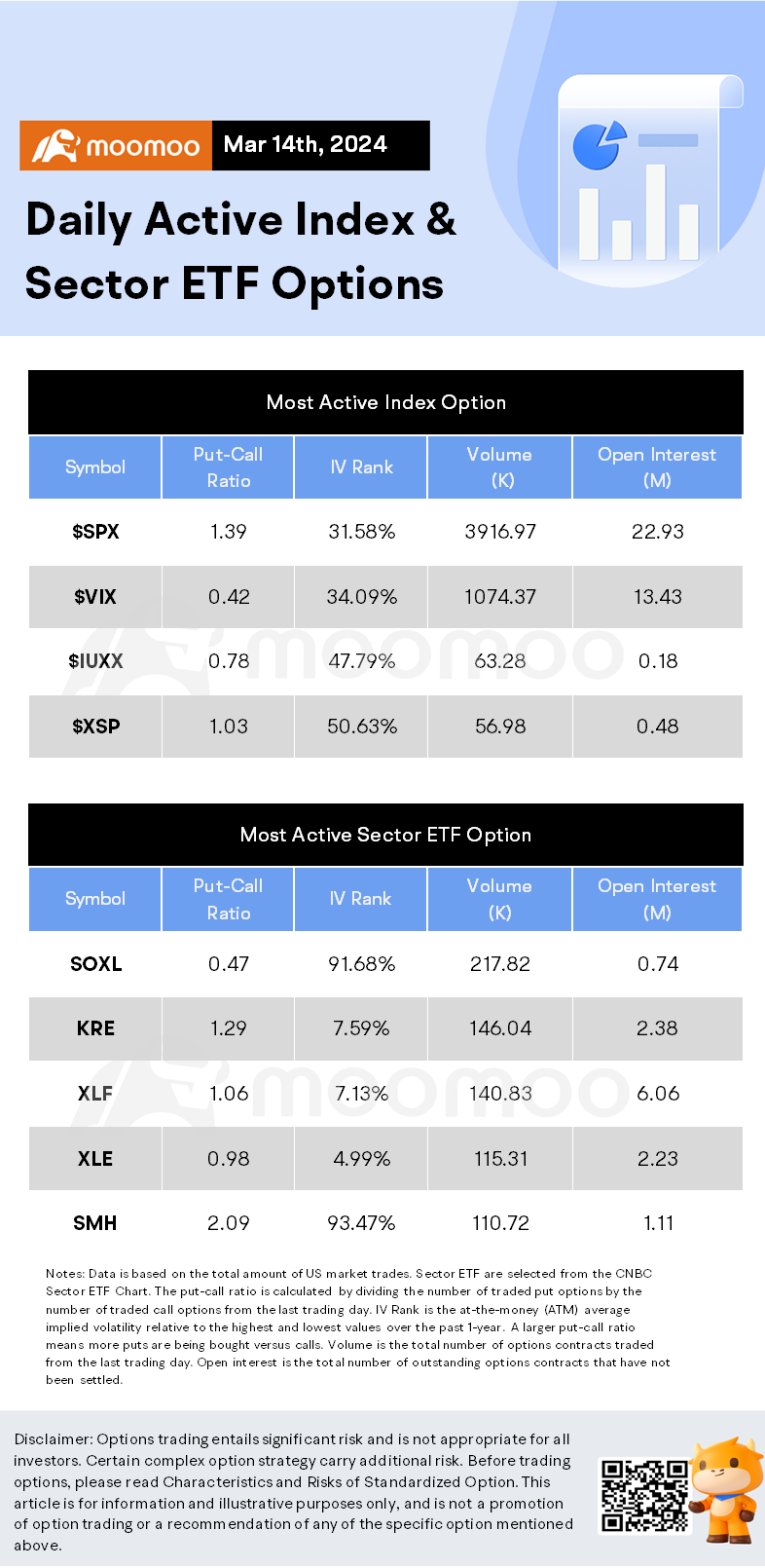

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, Barron's, The Motley Fool

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment