Options Market Statistics: Google Stock Jumps to 52-Week High Following Report of Ad Business Restructuring, Options Pop

News Highlight

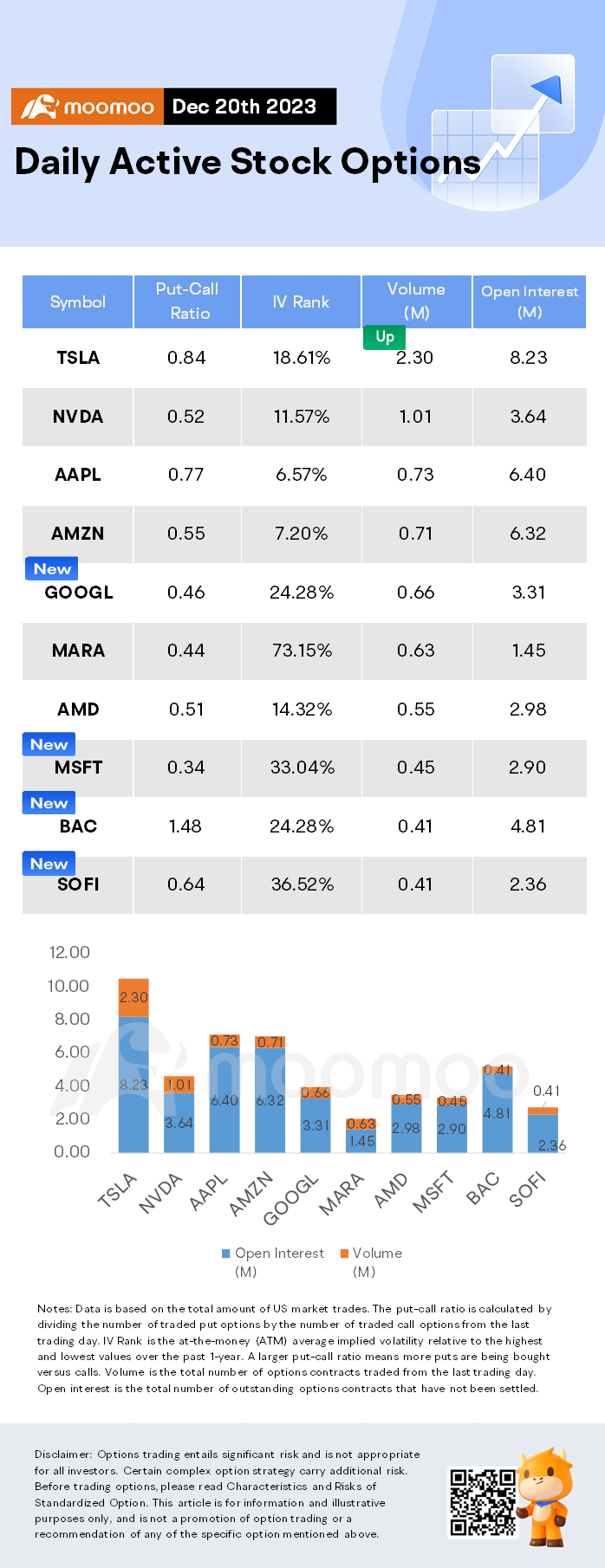

$Tesla(TSLA.US$ shares fell by 3.92%, closing at $247.14. Its options trading volume is 2.30 million. Call contracts account for 54.4% of the whole trading volume.

Tesla managers reportedly informed some salaried employees about a rather unpleasant surprise this week — there will be no merit-based equity awards for 2023.

Typically, Tesla employees receive salary adjustments and merit-based stock grants during their annual performance reviews. This year, the merit-based stock grants were reportedly not given, though employees who reached the end of their four-year vesting cycle in the company were still issued stock "refreshers."

The alleged halt in Tesla's merit-based stock awards this year stands in contrast to the company's typical approach to employee compensation. The company heavily leverages equity awards, particularly merit-based grants, to incentivize talent and encourage long-term commitment. These grants typically vest over four years, effectively binding employees to Tesla's future success and fostering loyalty.

$Alphabet-A(GOOGL.US$ shares rose by 1.24%, closing at $138.34. Its options trading volume is 0.66 million. Call contracts account for 68.3% of the whole trading volume.

Shares of Google-parent Alphabet hit a 52-week high Wednesday following reports of an impending shake-up in its core advertising business.

The Information on Tuesday reported that Sean Downey, who leads Google's ad business in North and South America, said in a department-wide meeting that the company's 30,000-person ad sales unit would be reorganized, according to people familiar with the matter. He did not specify whether the changes would involve layoffs.

The reorganization comes as Alphabet leans on artificial intelligence to generate and place ads on Google, YouTube, and its other platforms. Alphabet generated $54.5 billion in revenue — or 80% of total revenue — from ad sales in the third quarter.

Generative artificial intelligence can be substantially cheaper than conventional methods for both ad creators and sellers. WPP, the world's largest advertising firm, struck a deal with Nvidia in May to create an AI-enabled content development engine.

The savings can be 10 to 20 times," Mark Read, WPP's chief executive, told Reuters.

$Microsoft(MSFT.US$ shares fell by 0.71%, closing at $370.62. Its options trading volume is 0.45 million. Call contracts account for 74.7% of the whole trading volume.

Unusual Stock Options Activity

Some notable put activity is being seen in $Alphabet-A(GOOGL.US$, which is primarily being driven by activity on the 22-Dec-2023 put. Volume on this contract is 36,476 versus open interest of 192.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC, Reuters

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103584613 : Feie