Options Market Statistics: Carvana Surges After First Annual Profit and Bullish Outlook, Options Pop

News Highlights

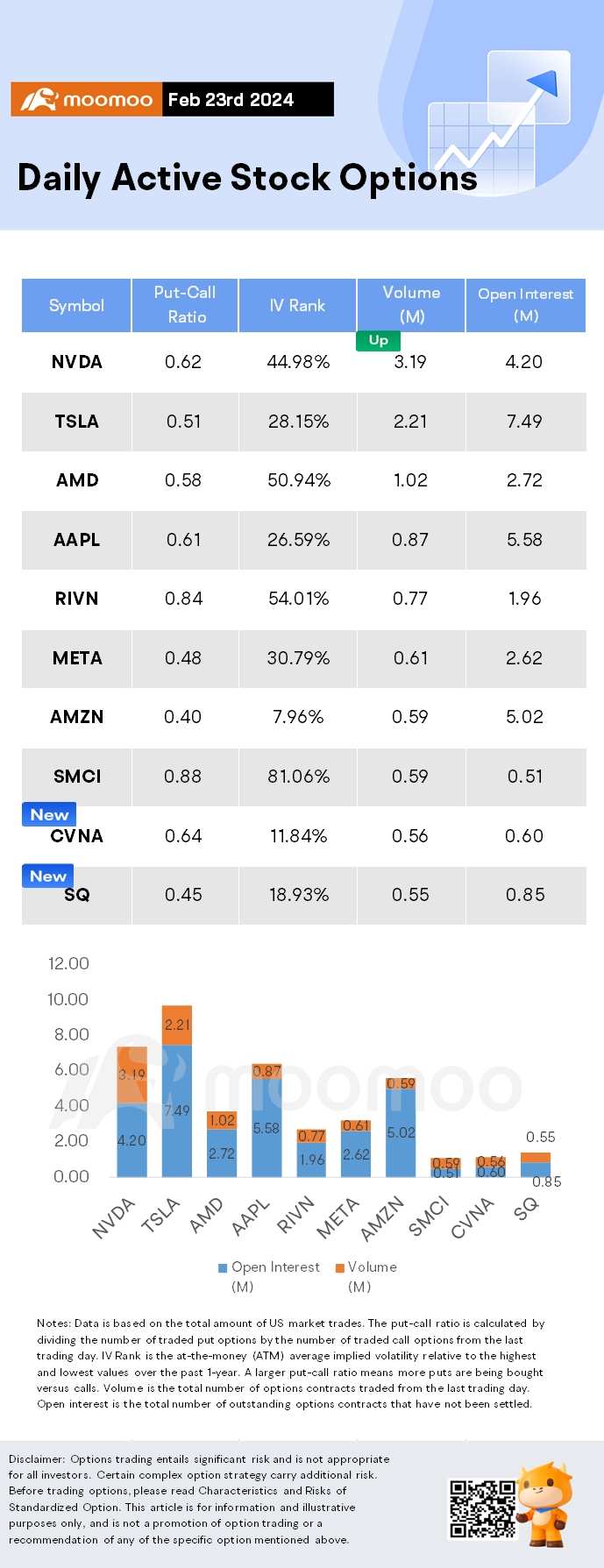

$NVIDIA(NVDA.US$ shares rose by 0.36%, closing at $788.17. Its options trading volume is 3.19 million. Call contracts account for 61.7% of the total trading volume. The most traded calls are contracts of $1300 strike price that expire on Feb 23rd. The total volume reaches 56,084 with an open interest of 16,391. The most traded puts are contracts of a $600 strike price that expires on February 23rd; the volume is 24,892 contracts with an open interest of 13,513.

NVIDIA hit a record high of $823 and briefly exceeded a market cap of $2.02 trillion on Friday morning. However, it finally hovers around the flat line. Since the explosive Q4 earnings and optimistic guidance announcement after Wednesday's market close, NVIDIA's stock price has surged by 21%, leading investors to believe that the AI trend is far from over. Many analysts have raised their target price and noted that the company's substantial profit growth and dominant position in the AI field make its forward P/E ratio reasonable, providing strong support for its skyrocketing market value.

Despite the positive sentiment, UBS has lowered its target price from $850 to $800, citing factors such as a quarterly decline in total supply and rising operating costs. UBS expects that revenue growth will slow down to a near-flat state over the next few quarters, which will be closely monitored. As a result, the earnings per share forecast for the fiscal year 2025 and 2026 has been cut by 7%.

Read More:

$Carvana(CVNA.US$ shares surged by 32.09%, closing at $69.23. Its options trading volume is 0.56 million. Call contracts account for 60.9% of the total trading volume. The most traded calls are contracts of $62 strike price that expire on Feb 23rd. The total volume reaches 1,592 with an open interest of 10,217. The most traded puts are contracts of a $43 strike price that expires on February 23rd; the volume is 2,131 contracts with an open interest of 439.

In its Thursday after-hours earnings report, Carvana announced record profits and received two upgrades from Wall Street analysts. Specifically, Carvana reported Q4 revenue of $2.42 billion, with adjusted EBITDA of $60 million, exceeding market expectations of $58.6 million. The company achieved a record net profit of $150 million for the year, thanks to $878 million in debt relief gains, while full-year adjusted EBITDA reached a record $339 million. Carvana expects Q1 retail unit sales to slightly increase YoY in 2024, with adjusted EBITDA significantly surpassing $100 million. The company also forecasts growth in retail unit sales and adjusted EBITDA for the fiscal year 2024.

CEO Ernie Garcia stated on Friday morning that the company is in an "incredible competitive position."

$Block(SQ.US$ shares surged by 16.13%, closing at $78.92. Its options trading volume is 0.55 million. Call contracts account for 69.2% of the total trading volume. The most traded calls are contracts of $66 strike price that expire on March 1st. The total volume reaches 3,607 with an open interest of 9,909. The most traded puts are contracts of a $60 strike price that expires on March 1st; the volume is 1,387 contracts with an open interest of 1,416.

Block achieved total Q4 revenue of approximately $5.77 billion, a YoY increase of 24%, exceeding analysts' expectations of around $5.7 billion. Under GAAP, Block's Q4 net loss turned into a profit, with diluted earnings per share of $0.28, beating analysts' expectations of a loss of $0.01 per share, compared to a GAAP net loss of $0.19 per share in the same period last year. Additionally, benefiting from cost-cutting measures, the company's core revenue forecast for Q1 is higher than Wall Street analysts' expectations.

Following the news, at least six brokerages have raised their target prices for the stock, with over 75% of brokers rating the stock as "buy" or higher.

Unusual Stock Options Activity

There was a noteworthy activity in $NVIDIA(NVDA.US$ , where multiple puts have topped volume to open interest ranking. The highest volume over open interest ratio reaches 318.4x, with option volume of nearly 71,000 and open interest of 223.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, Barron's, The Motley Fool

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

philosophical Fish_4 : Am I stock

sharol104622486 : Hai,