【Options ABC】Delta: Get to Know Delta Neutral Strategies

$PDD Holdings(PDD.US$Hello everyone and welcome back to moomoo. I'm options explorer![]() . In today's [Options ABC], we'll be taking a look at one important option Greek: Delta.

. In today's [Options ABC], we'll be taking a look at one important option Greek: Delta.

Wordcount: 1200

Target Audience: Investors interested in option Greeks.

Main Content: What is Delta? How does it work? How to build a Delta Neutral Strategy?

Target Audience: Investors interested in option Greeks.

Main Content: What is Delta? How does it work? How to build a Delta Neutral Strategy?

In previous articles, I introduced one important Option Greek: Theta. Time value is a crucial component of an option's premium. As more time passes, option time value will decrease. In such situations, understanding Theta - an indicator for measuring the time value of options - can be beneficial.![]()

To refresh your memory, you can click on this link.

Today, I will introduce another Option Greek Delta and further discuss the construction of Delta Neutral Strategy.

So let's begin with a question: In a Delta Neutral Strategy, Delta should be:_________

So let's begin with a question: In a Delta Neutral Strategy, Delta should be:_________

1.What Is Delta?

Delta represents the sensitivity of an option's price to changes in the underlying asset's price, measuring the amount by which the option price changes for every one-point move in the underlying asset's price. To put it simply, all options prices are affected by changes in the underlying asset's price, but the degree of sensitivity varies among different options and underlying assets.

For example, an underlying asset may increase by 10%, but a call option on that asset may only increase by 20%, while another underlying asset may only increase by 3%, but its call option may increase by 20%. ![]() Why do different underlying assets with varying changes in price result in similar or even the same percentage increases in options? One reason is the differing degrees of sensitivity to changes in the underlying asset's price, meaning their Delta values are not the same.

Why do different underlying assets with varying changes in price result in similar or even the same percentage increases in options? One reason is the differing degrees of sensitivity to changes in the underlying asset's price, meaning their Delta values are not the same.

Here are two formulas to help explain how it works:

Option Price Change = Delta * Underlying Asset Price Change

New Premium = Original Premium + Delta * Underlying Asset Price Change

Option Price Change = Delta * Underlying Asset Price Change

New Premium = Original Premium + Delta * Underlying Asset Price Change

Investing without goals is like a pointless battle. Before investing, it is important to set your goals. With Delta, you can calculate theoretically how much the price of an underlying asset needs to increase or decrease to achieve your investment goals.

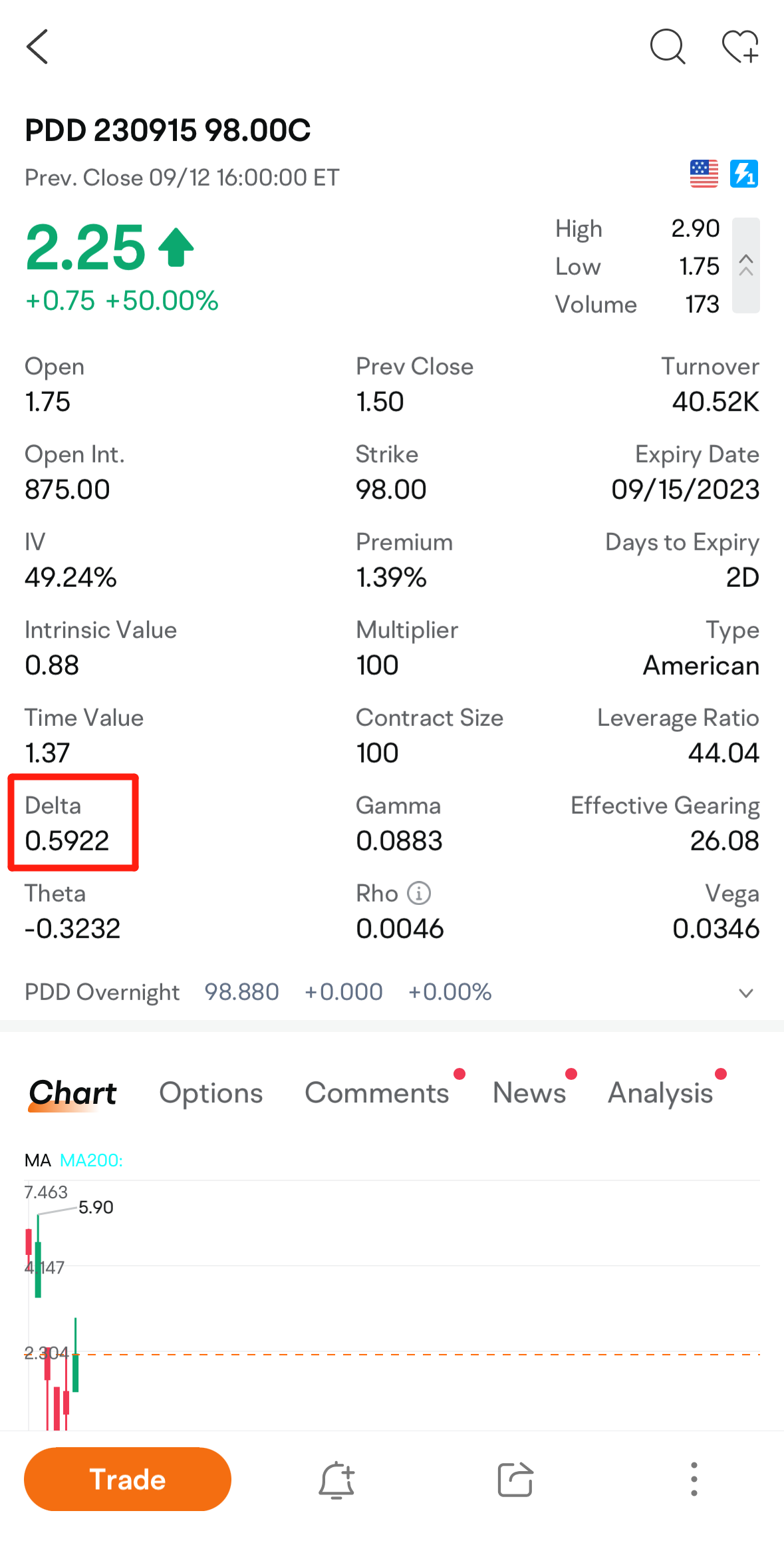

Let's take Alice as an example. Suppose Alice bought a $PDD Holdings(PDD.US$'s call option with a strike price of US$2.25 per share expiring on September 15th, 2023, with a contract multiplier of 100. At that moment, PDD’s stock price was US$98.88. She paid US$225 to open the position (US$2.25 * 100).

Assuming its Delta is 0.59 and remains constant, and PDD's stock price increases to US$103 the other day, the option's premium would be US$2.25 + (US$102 - US$98.88) * 0.59 = US$4.0908.

However, in real cases, Delta is constantly changing, and I assume that Delta remains constant for Alice's case only to help illustrate the relationship between Delta and option prices. Actual results vary![]() .

.

2.What Are Delta's Features

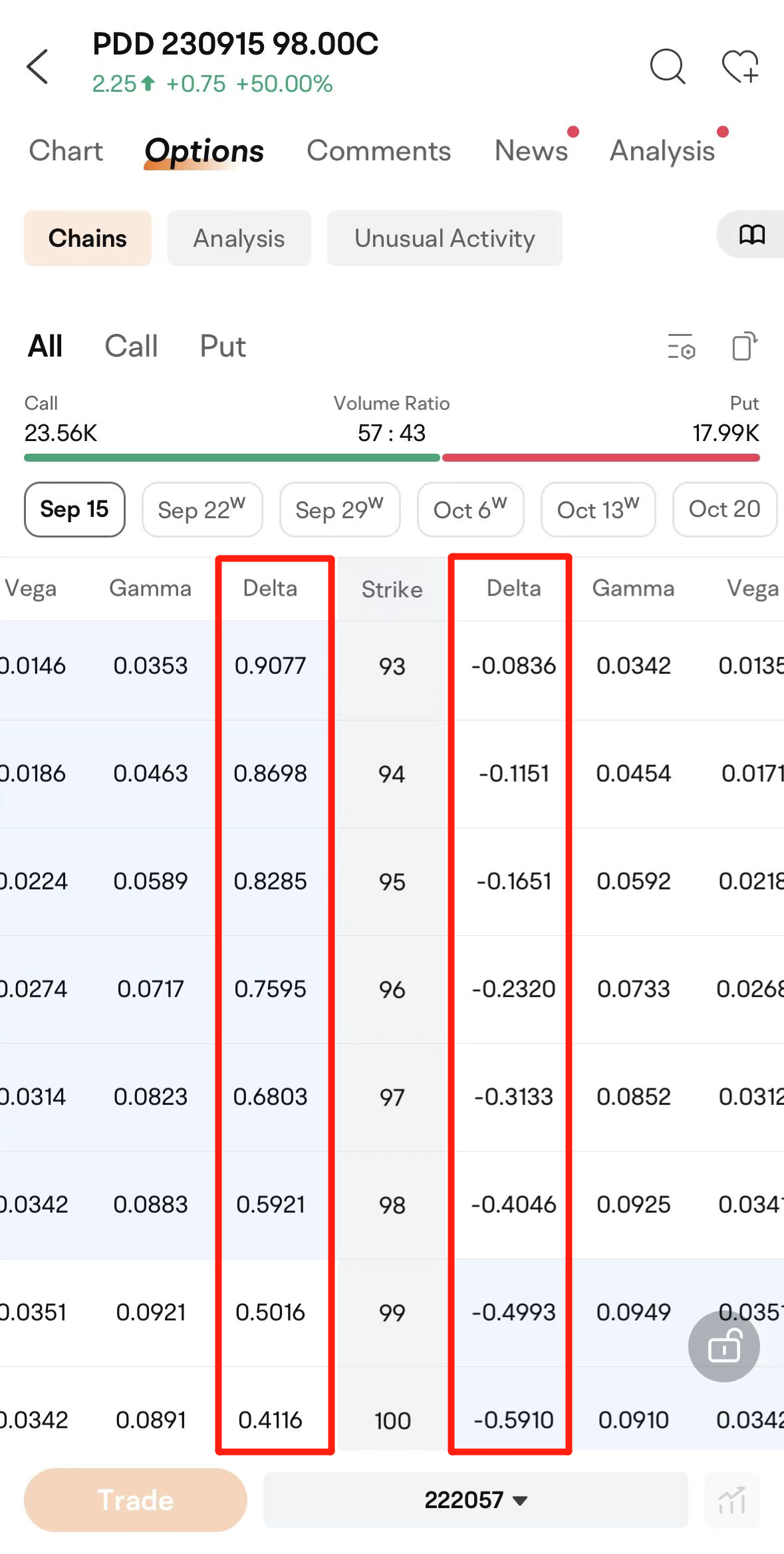

1) The larger the absolute value of Delta, the greater the likelihood that the option will expire in-the-money.

In general, options closer to being in-the-money have a larger absolute Delta, while options further out-of-the-money have a smaller absolute Delta. At-the-money options typically have an absolute Delta around 0.5.

In general, options closer to being in-the-money have a larger absolute Delta, while options further out-of-the-money have a smaller absolute Delta. At-the-money options typically have an absolute Delta around 0.5.

Did you feel a sense of familiarity when reading this![]() ? When we discussed Theta, we mentioned that it measures the impact of time on an option's price. For at-the-money options, their uncertainty is highest since they are equidistant from being in-the-money or out-of-the-money, so their Theta value is also the highest. Similarly, at-the-money options have a Delta value around 0.5 because they are equally close to being in-the-money or out-of-the-money. This means that there is a 50% chance that the option will expire in-the-money or out-of-the-money.

? When we discussed Theta, we mentioned that it measures the impact of time on an option's price. For at-the-money options, their uncertainty is highest since they are equidistant from being in-the-money or out-of-the-money, so their Theta value is also the highest. Similarly, at-the-money options have a Delta value around 0.5 because they are equally close to being in-the-money or out-of-the-money. This means that there is a 50% chance that the option will expire in-the-money or out-of-the-money.

2) Call options have positive Delta value between 0 and 1, while put options have negative Delta values between -1 and 0.

This is because if the underlying asset rises in price, call option prices are likely to rise as well, while put options prices are more likely to decrease.

This is because if the underlying asset rises in price, call option prices are likely to rise as well, while put options prices are more likely to decrease.

3) Delta is often influenced by implied volatility (IV), which represents the market's expectation for how much the underlying asset's price may fluctuate before expiration.

For out-of-the-money options,Delta is positively related to IV, meaning higher IV leads to higher Delta values. For in-the-money options, Delta is negatively related to IV, meaning higher IV leads to lower Delta values.

For out-of-the-money options,Delta is positively related to IV, meaning higher IV leads to higher Delta values. For in-the-money options, Delta is negatively related to IV, meaning higher IV leads to lower Delta values.

Understanding Delta and its relationship with IV can help investors better allocate their investment. For example, let's say Alice sold an out-of-the-money call option, but then the market experiences a significant gap up. In this situation, the implied volatility would suddenly increase. Since Delta for out-of-the-money options is positively related to implied volatility, the Delta for this call option would also be pushed higher.

3.Hedging with Delta:Delta Neutral Strategy

Now that we've discussed the features of Delta, let's take a look at how hedging with Delta can help us achieve our risk management goals.

Delta hedging involves keeping the overall Delta of a position around 0 to hedge against risks in the underlying asset's direction. Let's explore some benefits of Delta hedging:

Delta hedging involves keeping the overall Delta of a position around 0 to hedge against risks in the underlying asset's direction. Let's explore some benefits of Delta hedging:

1)Use time decay to earn premiums

As we mentioned earlier, when Delta is 0, the whole position will be unaffected by minor changes in the underlying asset's price. However, the option premium will still be affected by time decay. Therefore, a seller can use Delta hedging to earn premiums through time decay.

As we mentioned earlier, when Delta is 0, the whole position will be unaffected by minor changes in the underlying asset's price. However, the option premium will still be affected by time decay. Therefore, a seller can use Delta hedging to earn premiums through time decay.

2) Profit from volatility without directional bias

Under a Delta-hedged strategy, when the underlying asset's price does not change much, investors can profit from volatility changes.

Under a Delta-hedged strategy, when the underlying asset's price does not change much, investors can profit from volatility changes.

For example, suppose Alice notices that the implied volatility for a call option he owns has reached a three-month high due to a recent surge in the underlying asset's price. With the expectation that the implied volatility will eventually revert to its historical means, Alice decides to sell a put option to gain profits from the expected drop in implied volatility. However, since he is worried about the underlying asset continuing to rise, he constructs a Delta Neutral Strategy: buying one at-the-money call option (Delta 0.5) and one at-the-money put option (Delta -0.5). The combination results in a Delta of 0, thereby hedging the direction risks. In summary, he can profit regardless of whether the underlying asset rises or falls.

To summarize, here are some commonly used methods to construct Delta Neutral Strategy:

Option + Stock

Long a call option + short the underlying assets

Short a call option + long the underlying assets

Long a call option + long the underlying assets

Short a put option +short the underlying assets

Long a call option + short the underlying assets

Short a call option + long the underlying assets

Long a call option + long the underlying assets

Short a put option +short the underlying assets

Option Combination

Long a call option + short a call option

Long a call option + long a put option

Long a put option + short a put option

Short a call option + short a put option

Long a call option + long a put option

Long a put option + short a put option

Short a call option + short a put option

3)Reality Check: The Ideal vs. The Real

While Delta Neutral Strategies seem appealing, nothing lasts forever, especially in the unpredictable world of options trading. Delta is a real-time changeable value, which means its neutral state can only last for a moment. Therefore, traders need to continually adjust their positions to maintain a Delta value of 0. But remember, frequent trading can increase costs. Don't forget to think twice before making any moves.

While Delta Neutral Strategies seem appealing, nothing lasts forever, especially in the unpredictable world of options trading. Delta is a real-time changeable value, which means its neutral state can only last for a moment. Therefore, traders need to continually adjust their positions to maintain a Delta value of 0. But remember, frequent trading can increase costs. Don't forget to think twice before making any moves.

That's all for today! Please feel free to leave a comment if you have any questions or thoughts![]() .

.

Don't forget to follow us to stay up-to-date on all things related to options trading.

Don't forget to follow us to stay up-to-date on all things related to options trading.

Additionally, I have some good news to share with you. Starting today, you have more options to choose from when it comes to pricing plans for US options trading. We're introducing a new Tiered Pricing Plan, offering you the flexibility to pay less based on your trading volume.

Risk Statement

The examples provided herein are for illustrative and educational purposes only and not intended to be reflective of results any investor can expect to achieve. The figures shown in the examples are not guarantees or projections, and no taxes or fees/expenses are included in the calculations which would reduce the figures shown. Actual results will vary.

The examples provided herein are for illustrative and educational purposes only and not intended to be reflective of results any investor can expect to achieve. The figures shown in the examples are not guarantees or projections, and no taxes or fees/expenses are included in the calculations which would reduce the figures shown. Actual results will vary.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

This article is for educational use only and is not a recommendation of any particular investment strategy. Content is general in nature, strictly for educational purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. All investing involves risks. Any examples are provided herein are for illustrative purposes only and not intended to be reflective of results any investor can expect to achieve.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options (https://j.us.moomoo.com/00xBBz) before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment