[Options ABC] Covered Call: Help Hedge Risks and Potentially Improve Capital Efficiency

Hello everyone and welcome back to moomoo. I'm options explorer. In today's [Options ABC], we'll be taking a look at the covered call strategy.

Wordcount: 1200

Target Audience: Investors who are interested in using options to hedge risks of stocks

Main Content: How to construct a covered call? What can be considered a good call to sell?

Target Audience: Investors who are interested in using options to hedge risks of stocks

Main Content: How to construct a covered call? What can be considered a good call to sell?

For long-term investors, a sideways market may present an unexpected challenge due to its limited growth opportunities and significant opportunity cost of capital. For example, we'll use the following stock as a hypothetical case study to help illustrate this concept. This is not a recommendation or investment advice. In August 2023, Sea Ltd. plummeted after reporting its Q2 earnings report, which fell below expectations, causing the stock to drop 28% that day. Since then, the stock has oscillated between US$48 and US$35. For those inclined to hold the stock long-term, the extended period of sideways movement may lead some investors to feel their capital isn’t being utilized effectively.

What will you do if your long-held stocks move sideways for weeks, or even months? Some investors may choose patience, waiting for the stock's value to potentially increase. However, there’s another strategy available: mitigating the opportunity cost through methods like the covered call.

How does a Covered Call strategy help enhance capital efficiency?

Consider Alice, who previously purchased 300 shares of SEA at US$43 each, hoping to sell at US$50 per share. With SEA's current price at US$38.5, Alice could opt to sell three covered call options expiring in one month with a strike price of US$50, assuming the option premium per share is US$1. By selling these options, Alice receives an upfront premium of US$1 * 100 * 3 = US$300, which constitutes her maximum profit from this option sale.

What happens next?

Scenario 1: If, by expiration, SEA's stock price rises above US$50, and the option is assigned. Alice will sell her 300 shares at US$50 each as per the options contract, receiving US$15,000. Adding the US$300 earned from selling the calls, Alice would end up with a total of US$15,300 from this trade.

Scenario 2: If SEA's stock doesn't reach US$50, Alice doesn't lose out. The three calls she sold already brought in US$300. Since the strike price isn't met, she still holds her 300 SEA shares and can consider selling calls again in a new round for potential profit.

However, it's important to note that a covered call strategy is not risk-free.

There's a risk of loss if the stock price drops. While selling the call option generates premium income, a decline in the stock price exceeding this income can lead to losses. Therefore, when selecting stocks for this strategy, consider choosing those with less price volatility. Additionally, caution should be exercised when using covered calls around earnings report releases.

The second risk involves reduced profits, or "capping" potential gains. Once you set up a covered call, your maximum profit is fixed. In Alice's case, even if SEA's stock soars to US$60 on the expiration day, surpassing the call's strike price, she is obligated sell her 300 shares at US$50. Although Alice still makes a profit, she might regret not earning more, which is the risk of reduced gains.

Selecting call options requires careful consideration

Selling a covered call option isn't a simple task, and careful consideration is needed in choosing the right call option. First and foremost, it's important to understand that the premise of a covered call is that you are optimistic about a particular stock in the long term and intend to hold it for an extended period. You expect that the stock won't surge significantly in the short term. Based on this, suppose the risks and holding costs are equal, you can consider selling more expensive call options to earn some premium. However, you may risk a higher probability of assignment the closer the option is to being ITM.

However, if you do not plan to hold a stock long, it would be better not to use covered calls. You may consider setting a limit order to sell the stock at an appropriate price point.

When choosing a call option, consider these factors:

Expiration Date

For the same underlying asset and strike price, options with a later expiration date are usually more expensive. Think of the expiration date like a product's expiration date in everyday life – products close to their expiration date often get discounted, just as options lose value as they approach expiration. For a covered call strategy, to help minimize unexpected occurrences, people tend to buy calls that are nearer to expiration as they are perceived as less risky. However, if there is huge difference between your target price and the current stock price, you'll find that the earnings from selling a near-term call are quite limited. In this case, you can weigh your options based on your objectives.

Strike Price

Usually, the strike price for a covered call is set at the target price at where you wouldn't mind selling your stock for. For calls, the lower the strike price, the more expensive the option premium; conversely, the higher the strike price, the cheaper the premium. Therefore, when building a covered call strategy, consider the cost price of your stock holdings and don't forget to factor in transaction fees.

Implied Volatility

Simply put, implied volatility represents traders' expectations of market volatility in the future. High implied volatility indicates that most traders expect significant market fluctuations. Generally, when implied volatility is high, it's better to be a seller; when low, being a buyer may be more appropriate. For covered calls, some traders may choose to sell calls with higher implied volatility since the premium are typically greater when IV is high.

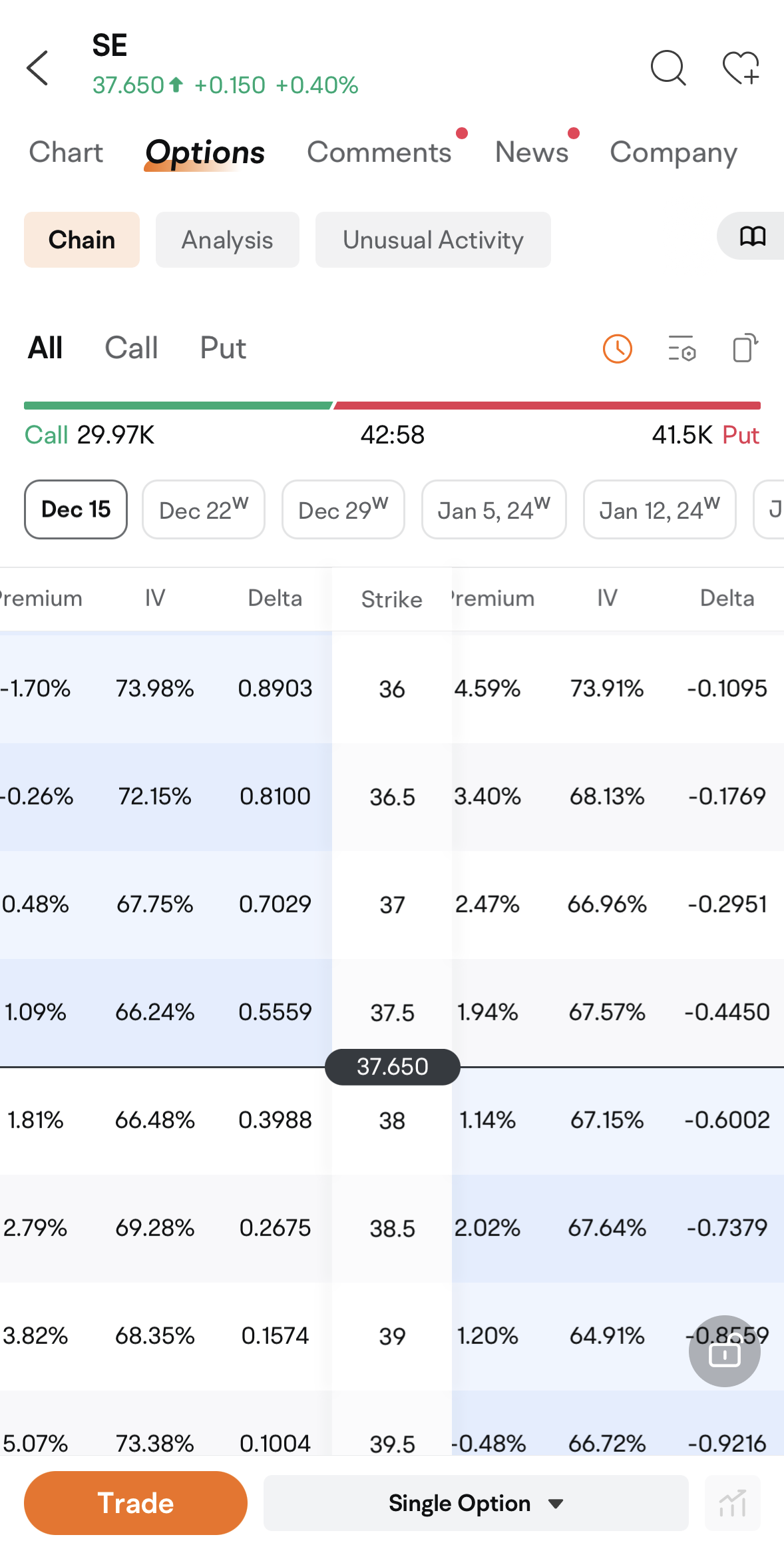

You can easily view the implied volatility of various options on moomoo.

Enter the Options Chain >> Swipe Left and Right

Enter the Options Chain >> Swipe Left and Right

![[Options ABC] Covered Call: Help Hedge Risks and Potentially Improve Capital Efficiency](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240306/1709722057306-dc4db5fd6b.png/big?area=100&is_public=true)

(Any app images provided are not current and any securities shown are for illustrative purposes only and is not a recommendation.)

Two approaches to construct a Covered Call

Back to Alice's example. Imagine Alice previously bought 300 shares of SEA. To construct a covered call strategy, all she needs to do is place an order for a single-leg option: selling 3 Call options.

If you do not hold the stock but still want to construct the covered call strategy, simply go to Options Chain > Covered Stock.

![[Options ABC] Covered Call: Help Hedge Risks and Potentially Improve Capital Efficiency](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240306/1709722116431-fc7026d435.png/big?area=100&is_public=true)

(Any app images provided are not current and any securities shown are for illustrative purposes only and is not a recommendation.)

In the investing arena, the covered call strategy offers a potential way to earn premium income during different types of markets. It's a tactic where you maintain a long position in a stock while concurrently selling call options on that same holding. The goal is to earn income from the premiums of these options, a move that can be attractive when stock prices are languishing. Yet, as with any investment strategy, risks are involved, and it's essential to deliberate carefully before taking action.

That wraps up today's Options ABC. If you have other ideas or thoughts, feel free to leave a comment and discuss.

Options trading is risky and not appropriate for everyone. Read the Options Disclosure Document (j.us.moomoo.com/00xBBz) before trading. Options are complex and you may quickly lose the entire investment. Supporting docs for any claims will be furnished upon request.Any examples, scenarios, or specific securities referenced in the article are strictly for illustrative purposes only and is not a recommendation or endorsement of any particular investment or financial strategy..

Risk Statement

The examples provided herein are for illustrative and educational purposes only and not intended to be reflective of results any investor can expect to achieve. The figures shown in the examples are not guarantees or projections, and no taxes or fees/expenses are included in the calculations which would reduce the figures shown. Actual results will vary.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

This article is for educational use only and is not a recommendation of any particular investment strategy. Content is general in nature, strictly for educational purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. All investing involves risks. Any examples are provided herein are for illustrative purposes only and not intended to be reflective of results any investor can expect to achieve.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options (https://j.us.moomoo.com/00xBBz) before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment