Oil Markets Are Finally Paying Attention to Red Sea Risks

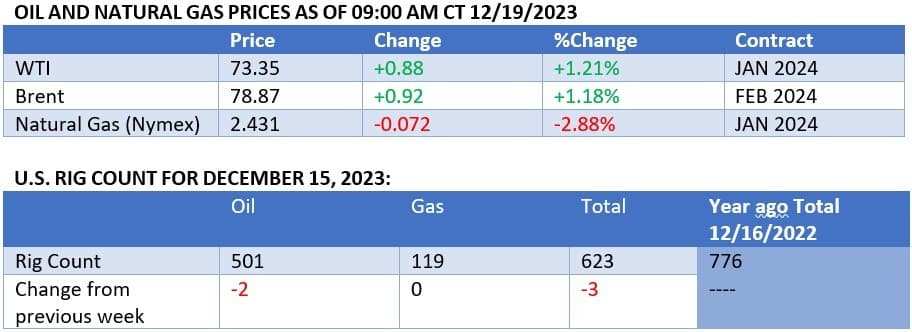

Oil markets are finally focusing on geopolitical risk, with disruptions in the Red Sea pushing Brent up toward $79 and WTI above $73.

- Shipping stocks have been on the rise since the Houthi threat in the Red Sea began to escalate, with the likes of $A.P. Moller - Maersk A/S Unsponsored ADR(AMKBY.US$ , $ZIM Integrated Shipping(ZIM.US$ and $Hapag-Lloyd Aktien(HLAGF.US$ adding some 15-20% over the past three trading sessions.

- Whilst the Suez Canal accounts for only 14% of global maritime crude and products transit, and even that mostly on the products side, shippers banning the Red Sea route will have a much more tangible impact on container shipping.

- Approximately 30% of global container trade passes through the Suez Canal and given that most container shipping deals are negotiated between December and March, container shippers might be looking forward to a much more upbeat 2024 than was initially expected.

- Asia-bound US LNG cargoes that were already diverted from the Panama Canal are now compelled to take the longer route across the Cape of Good Hope, which might provide some upside to falling JKM prices (currently at $12.4 per mmBtu). $Shell PLC(SHEL.US$ $Crude Oil Futures(JUN4)(CLmain.US$ $Occidental Petroleum(OXY.US$ $Imperial Petroleum(IMPP.US$

- Whilst the Suez Canal accounts for only 14% of global maritime crude and products transit, and even that mostly on the products side, shippers banning the Red Sea route will have a much more tangible impact on container shipping.

- Approximately 30% of global container trade passes through the Suez Canal and given that most container shipping deals are negotiated between December and March, container shippers might be looking forward to a much more upbeat 2024 than was initially expected.

- Asia-bound US LNG cargoes that were already diverted from the Panama Canal are now compelled to take the longer route across the Cape of Good Hope, which might provide some upside to falling JKM prices (currently at $12.4 per mmBtu). $Shell PLC(SHEL.US$ $Crude Oil Futures(JUN4)(CLmain.US$ $Occidental Petroleum(OXY.US$ $Imperial Petroleum(IMPP.US$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment