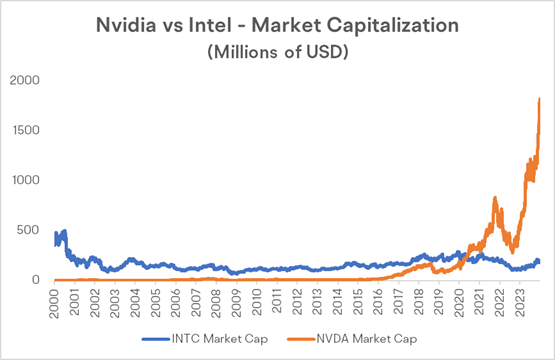

Nvidia, "Looking Up" To Intel for More Than Two Decades, Is Ready to Soar to New Heights Under the AI Trend

Looking back over the past two decades, Intel has been firmly held the throne, while the latecomer NVIDIA could only follows. However, with the surging wave of AI, the situation has completely changed.

Source: Bloomberg. As of Feb.16, 2024

NVIDIA's stock price has surged nearly 400% in the past three years, with a gain of over 240% in the past year alone. By 2024, NVIDIA's stock price continued to rise, with an increase of nearly 50%, bringing its market value to $1.79 trillion, surpassing Alphabet and Amazon to become the third-largest US company.

The searing growth in the stock price has made it more expensive to own relative to its peers. Nvidia's shares trade at 31.4 times the company's forward earnings estimate, compared with the industry average of 22.9.

Still, Goldman Sachs analyst Toshiya Hari sees more room for growth.

"We believe Nvidia will remain as the industry gold standard for the foreseeable future, given its robust hardware and software offerings and, importantly, the pace at which it continues to innovate," Hari said.

Goldman Sachs also lifted its full-year 2025-2026 earnings estimates for Nvidia by 22% on an average, citing signs of robust AI server demand and improving graphics processing unit (GPU) supply.

Meanwhile, Hari emphasized the resilience of NVIDIA's data center division, with an expected 14% YoY growth in data center revenue in 2025.

He said, "Based on recent conversations, most investors seem to have a good understanding of NVIDIA's profitability in 2024, and they are more concerned about the development trajectory of the data center business in 2025."

Source: Bloomberg.

NVIDIA's fourth-quarter earnings report is scheduled to be released on February 21. Please read more: Earnings Outlook: Nvidia's Upcoming Earnings Set to Challenge Stock Market's AI Aspirations

In contrast, Hari's attitude towards Intel is more cautious and conservative, maintaining a sell rating on Intel.

"While we are encouraged by the various strategic actions taken by INTEL management in the past 12-18 months and believe that further clarity on chip funding may boost sentiment for the stock in the short term, we maintain a sell rating on Intel and continue to wait for signs of stability in the data center computing market share and/or substantial progress in external foundry strategies," the analysts wrote.

Goldman Sachs' target price for the sell rating is $39, indicating a potential downside of 10%. Intel's stock price has already fallen more than 13% year-to-date, with a market value slightly above $180 billion as of Feb.16, 2024.

Moreover, despite Intel's fourth-quarter revenue and earnings per share were higher than expected, but the data center business, which was closely watched, declined by 10% YoY, disappointing Wall Street. The first-quarter performance guidance also fell far short of analysts' expectations.

Source: Bloomberg.

Mooers, NVIDIA or Intel, which one is your preferred choice for chip stocks?

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Jalapenoterry65 : Come an git some.

104819573 : boossmafa nepali.