Nvidia Investors, Speculators Load up on Puts With Strike Price Above $900

$NVIDIA(NVDA.US$ investors and speculators who have millions to spend on options, bought contracts that give the holders the right to sell the stock for at least $910 by tomorrow, which could help cushion the impact from downside movements.

Two big block trades with premiums costing millions of dollars were posted minutes after the market opened Thursday, just as shares of the market leader in semiconductors that power artificial intelligence (AI) applications were heading for a second straight decline.

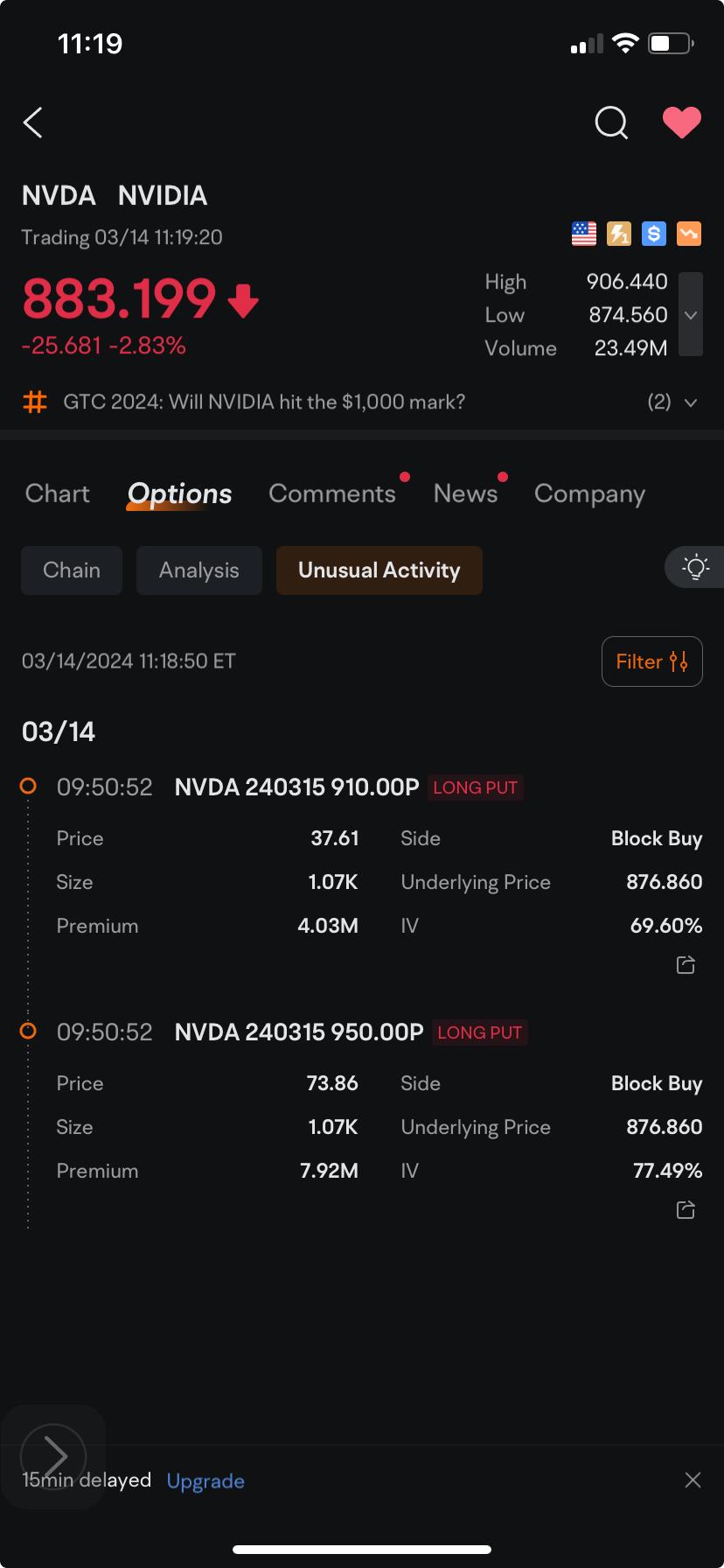

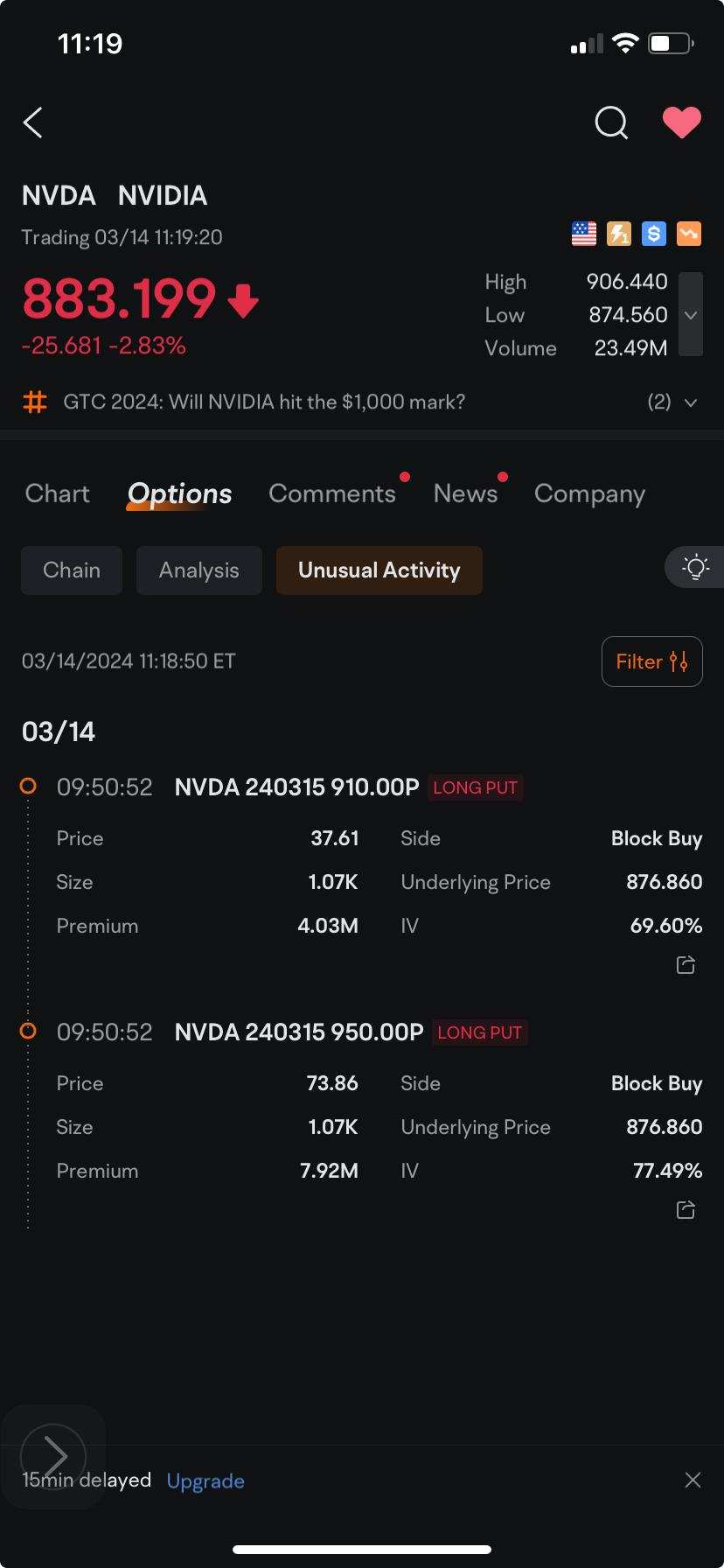

At 9:50:52 a.m., a buyer paid a premium of $7.92 million for the purchase of put options that give the holder the right to sell 107,000 Nvidia shares at $950 each by tomorrow, according to data tracked by Moomoo. If exercised, the holder will be able to sell the stock at that level even in case of a price slump.

At that exact time, right down to the second, another block trade was posted for the same amount of shares, This time, the buyer paid a premium of $4.03 million for the right to sell the stock at $910.

The buyer or buyers behind those two block trades are among the many who are piling into puts that shield holders from a potential price correction, at least until tomorrow. Around noon in New York, almost 30,000 contracts with the $850 strike price changed hands, the most active put options for Nvidia. In the case of $910 puts, 17,870 contracts were traded, up from 10,800 yesterday.

As expected, call option holders are also abandoning the contracts that give them the right to buy Nvidia shares at prices above their current level. More than 68,000 calls with $900 strike price changed hands as of 12:58 p.m., with the price of those calls tumbling more than 70%. That's the most heavily-traded Nvidia options as of that time.

The bullish calls on Nvidia unravelled as the contract moved closer to expiration and prices failed to hold above $900. The calls, which traded at just 41 cents on Jan. 31, climbed to as high as $86.16 on March 8, when the stock touched a record high of $972. The excitement faded as shares fell below the strike price just a day before the options are set to expire.

Even small investors are hitting the exit. Capital trend data compiled by Moomoo showed small orders, which make up about 55% of total, had a net outflow of $661 million as of 12:40 p.m. Thursday. That brings the total net outflow to $1.07 billion.

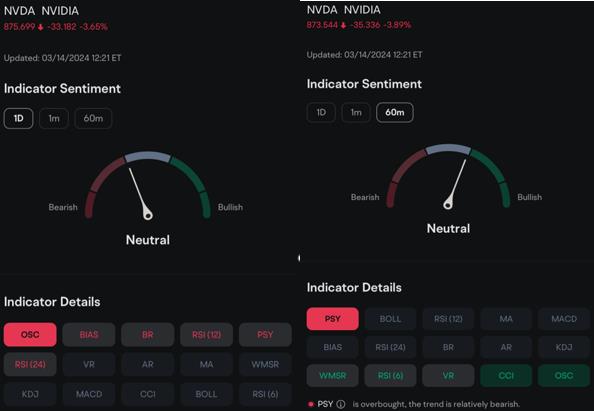

The negative sentiment may not last. While the one-day gauge for the 15 technical indicators tracked by Moomoo is now sitting right at the border between bearish and neutral, the 60-minute meter is now leaning green, with five indicators signaling the stock is now oversold. The only one still in the red is the psychological line, which measures the popularity of the security over a 13-day period. That indicator, known as PSY, is currently flagging that the trend is still relatively bearish.

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

SPACELIGHT : I don't have millions to spend . I'm working on it.

. I'm working on it.

73862652 :

70821147 :

MonkeyGee : max pain is 765, either you hurt or the market makers. who do you think is going to hurt?