Nvidia Earnings or Powell's Jackson Hole Speech? What Is Driving Fed Rate-Hike Expectations.

Two themes dominating markets in 2023—artificial intelligence and interest rates—threaten to collide this week with Nvidia earnings and the Jackson Hole economic symposium.

The sharp bond market moves puts Fed Chairman Jerome Powell's speech on Friday at Jackson Hole in focus. Former policymakers and economists expect Powell to emphasis this "higher-for-longer" stance on interest rates.

However, portfolio manager Ben Emons at NewEdge Wealth believes it is Nvidia's Jensen Huang who is driving Fed rate-hike expectations.

You could ask who is really running the show? Jerome Powell or Jensen Huang? Amazingly, it may not be Powell, but Jensen Huang who is driving Fed expectations."

$NVIDIA(NVDA.US$ - which reports fiscal Q2 earnings on Wednesday — acts as a bellwether for AI capital expenditures that are likely to boost productivity across the U.S. economy. And a surge of AI-related expectations is translating into higher real yields, which reflect inflation-adjusted growth in gross domestic product and productivity, according to Emons.

"People connect AI to productivity and productivity leads to growth, and to some extent this is impacting interest-rate expectations today," Emons added.

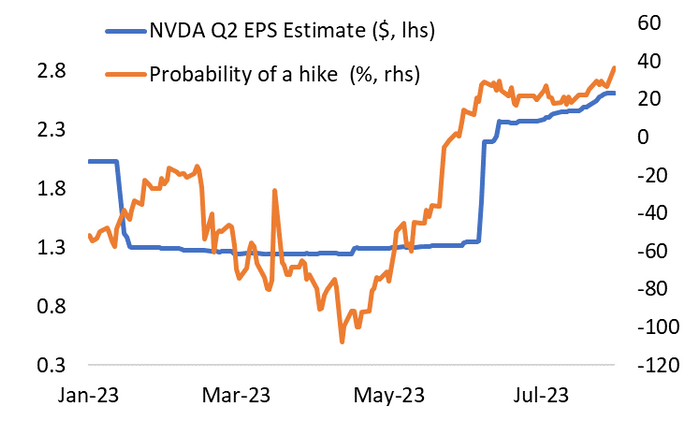

Emons shows how the median estimate of analysts for Nvidia's earnings-per-share in Q2 has been rising alongside the market-implied probabilities of a November Fed rate hike.

In addition, the yield on one of Nvidia's own corporate bonds has been rising in relation to the 10-year TIPS or real yield "because of the company's broader effect on the economy."

As University of Pennsylvania Wharton School finance professor Jeremy Siegel explained, real interest rates track real growth. Improving productivity and stronger growth "mean the Fed won't be able to cut rates as much as it would otherwise be able to."

Mooers, who is driving Fed rate-hike expectations?

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment