November CPI Preview: Falling Inflation Creates New Headaches For Fed

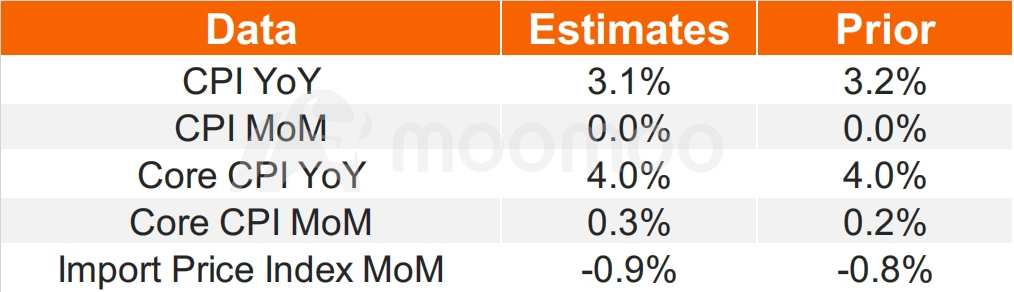

The Bureau of Labor Statistics will release the US November CPI at 8:30 ET on Tuesday. Bloomberg data shows YoY CPI inflation will fall to 3.1% (vs. 3.2% prior), with annual core inflation remaining at 4.0%. On a month-on-month basis, headline CPI inflation may remain unchanged, and core CPI may register a 0.3% increase.

■ Year-ahead inflation expectations fell to lowest since 2021

In the latest University of Michigan consumer sentiment survey released last Friday, the one-year outlook for the inflation rate slid to 3.1%, down sharply from 4.5% in November and the lowest since March 2021. The 1.4 percentage point decline from the prior month was the largest since October 2001.

The Fed officials consider consumer expectations a key in the way inflation moves, so the switch in sentiment could further convince policymakers to keep interest rates on hold and possibly start cutting rates in 2024.

■ FAO Food Price Index overall unchanged in November

The FAO (Food and Agriculture Organization) Food Price Index averaged 120.4 points in November 2023, unchanged from its revised October level, as increases in the price indices for vegetable oils, dairy products and sugar counterbalanced decreases in those of cereals and meat. The index stood 14.4 points (10.7 percent) below its corresponding level one year ago.

According to the US Department of Agriculture, food prices are expected to continue to decelerate in the next year. All food prices are expected to increase by 2.9 percent in 2024. Food-at-home prices are predicted to rise by 1.6 percent, and food-away-from-home prices are likely to increase by 4.3 percent.

■ Accumulating inventory drives down car prices

New car days of supply were up 18 days y/y in November, causing more consumers to return to the new car market from the used car market and driving down car prices.

Wholesale used-vehicle prices decreased 2.1% in November from October. The Manheim Used Vehicle Value Index (MUVVI) dropped to 205.0, down 5.8% from a year ago. CarGurus data also showed used car prices fell across multiple brands.

■ Steep rent price declines continue across areas of the Sun Belt

Apartment List's National Rent Report showed the rental market's seasonal slowdown continued this month, with the nationwide median rent falling 0.9 percent to $1,340. This is the second steepest November rent decline in the index's history since 2017.

68 of the top 100 cities have experienced year-on-year decreases in rents. Sun Belt cities such as Austin, which have over-issued construction permits in recent years, have seen an accelerated decline in rents, according to a Zumper report. Each of the nine Texas cities on Zumper’s list is down compared to November of last year, except for Fort Worth.

Meanwhile, the rebound in Midwest cities like Chicago has also ended.

Economists polled by Bloomberg expected the CPI primary rents to gain a 0.4% MoM increase, down from 0.5% in October.

■ What's next for the Fed?

As inflation falls, the market's focus gradually switches from economic overheating to recession expectations.

The Federal Reserve will release a new dot plot and quarterly economic projections at the FOMC meeting on Wednesday. The key focus is whether the economy can normalize and achieve a soft landing in a high interest-rate environment. Nomura Securities expected the CPI to be around 2.5% at the end of 2024. The difficulty is maintaining the full employment level and pushing down inflation simultaneously.

Fed watchers surveyed by Bloomberg last week expect the central bank to lower rates by 100 basis points next year. However, the policy path will depend on whether the economy deteriorates dramatically.

The motivation behind the Federal Reserve's rate cuts also has significant implications for the number and pace of the cuts. In the event of a recession or imminent economic downturn, policymakers are expected to respond with swift and substantial policy easing. If the threat of a deep downturn is not present, officials may implement smaller, slower cuts instead.

More than two-thirds of the economists polled currently expect the economy to avoid a recession in 2024, and almost three-quarters believe that the initial rate cut will be due to decreasing inflation rather than a contraction in the economy. Still, any changes in the unemployment rate and other recession-related indicators will affect subsequent market expectations and the Fed’s policy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment