Nov Nonfarm Payroll Preview: The Narrative Switches From Overheating To Recession Fears

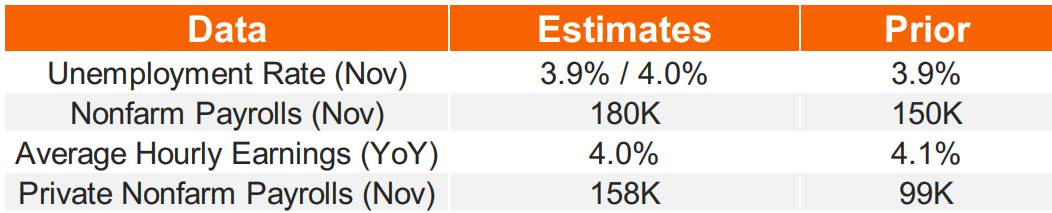

November's nonfarm payrolls report will be released at 8:30 ET this Friday. The median estimate for nonfarm payroll is 180k in November, moderately higher than 150k in October. The resolution of the UAW strikes will contribute about 30k to the manufacturing-sector gains — but that will be a one-off. Still, the manufacturing sector might see weak job gains as many firms were struggling even before the UAW strike. The professional business and government sectors may contribute to other major increments.

Economists polled by Bloomberg expect the unemployment rate to be in the range of 3.9%-4.0%. It could trigger the Sahm Rule for identifying a recession and be a sign to policymakers that monetary policy is dragging down the real economy.

In terms of wages, Bloomberg Economist Eliza Winger expected working hours to decline, and average hourly earnings to remain at 0.2% month on month – consistent with the Fed's 2% inflation mandate. According to the November ADP National Employment Report released on Wednesday, Job-stayers saw a 5.6 percent pay increase in November, the slowest pace of gains since September 2021.

■ More people filed for unemployment benefits in November

The initial jobless claims rose by 7,000 to 218,000 in the week ending November 25th, an increase from the revised number of 211,000 reported in the previous week.

Meanwhile, continuing jobless claims in the US, which measure unemployed people who have been receiving unemployment benefits for a while, surged by 86,000 to 1.927 million in the week ending November 18th, marking the highest level since November 2021 and exceeding the market consensus of 1.872 million.

The figures are the latest indication that the labor market’s strength is ebbing. Bloomberg economist Eliza Winger said,“The persistent climb in continuing claims points to a risk that the unemployment rate will reach 4.0% in November.”

■ Job vacancies fell sharply across sectors

The JOLTs report released on Tuesday showed that the number of job openings dropped significantly to 8.73 million, marking the lowest level since March 2021 and falling below the market consensus of 9.3 million. During the month, job openings decreased in health care and social assistance (-236,000), finance and insurance (-168,000), and real estate and rental and leasing (-49,000). On the other hand, job openings increased in information (+39,000).

Federal Reserve recently published its “Beige Book” survey of regional business contacts, with anecdotes and commentary on business conditions in 12 Fed districts. It also shows the easing trend in the labor market, with respondents noting reductions in headcount through layoffs or attrition and most districts reporting flat to modest increases in employment.

Bloomberg expected working hours to decline, and average hourly earnings to remain at 0.2% month on month – consistent with the Fed's 2% inflation mandate.

■ Investors bet on rate cut in the first half of 2024

As inflation alleviates, the focus of the job market may shift from whether it is overheating to whether there is a sudden spike in unemployment. Investors are worried that the employment report may trigger the emergence of a series of recession indicators. The "bad news is good news" narrative may gradually shift to "bad news is bad news."

If the unemployment rate rises faster than expected, the Fed's "Higher for longer" rhetoric may be less tenable.

CME FedWatch shows the probability for the Fed to cut rate at the end of the first quarter of 2024 reached 61.56%, while one month ago, the chance was only 20.3%. The probability to cut rates in the first half year of 2024 is 97.68%, which shows the market drastically reversed its policy expectation compared to months ago.

By Moomoo News Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Lang Lang : https://security.moomoo.com/security/auth-email/?clientver=13.43.13708&ca_cid=104583181&main_broker=WzEwMTdd&user_id_type=3&data_ticket=7ffb056fbaa9d17abd76264b079e638f&channel=4&clientlang=2&clienttype=53&user_main_broker=WzBd&is_visitor=0&skintype=1#/