Nio Q3 2023 Earnings Preview: Break Down What Wall Street Expects

$NIO Inc(NIO.US$ is scheduled to report its Q3 earnings on Tuesday, December 5th, before the market opens. As one of the famous Chinese EV startups, Nio has attracted attention from investors around the globe. Not only because it was the first Chinese EV startup to go public but also because of its controversial development path, which has been reflected in its stock prices.

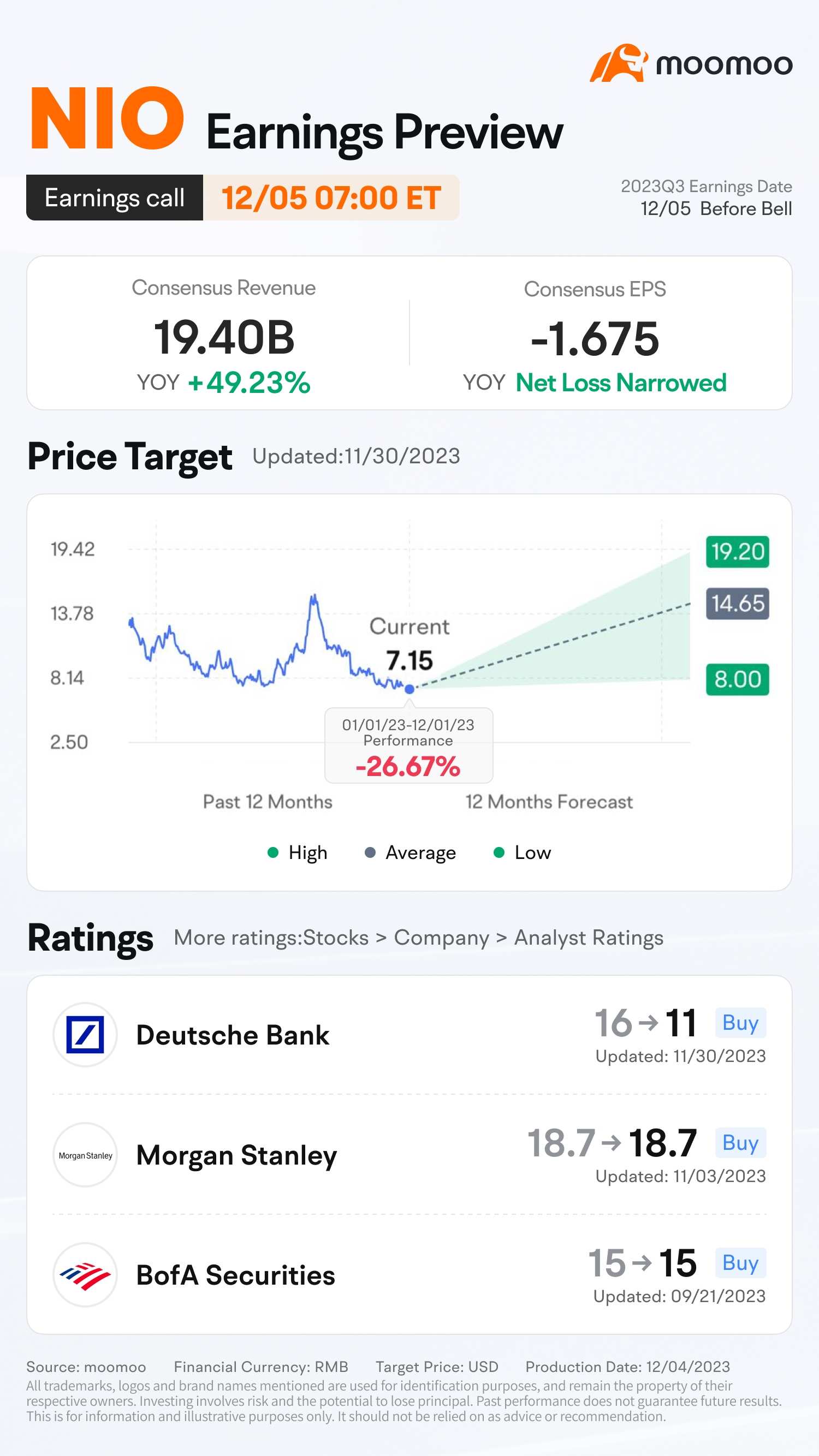

Nio stock price has dropped more than 26% this year. Its price has been falling for four consecutive months, a trend that began in August, following the announcement of new investment from the Abu Dhabi Fund at the end of June. However, the market is not convinced by the news and continues to question its future deliveries and profitability.

Wall Street analysts predict that NIO will report a larger loss of CNY 2.562 per share for the quarter, compared to CNY 2.110 per share in the same quarter of the previous year. The company's revenue for the quarter is expected to be CNY 19.31 billion, representing a substantial increase of 48.52% compared to the same quarter last year. For the current fiscal year, analysts anticipate NIO will have a loss of CNY 11.029 per share, which is more significant than last year's loss of CNY 7.320 per share.

The delivery numbers and their guidance will be a focal point; Wall Street anticipates a total of 55,915 deliveries for this quarter, representing a 76.92% year-over-year increase, and expects 59,425 deliveries in Q4. From a profitability perspective, Nio's gross profit is expected to decrease 15.8% YoY.

In an internal letter dated November 3, Nio's Founder, Chairman, and CEO William Li announced plans for organizational restructuring. This strategy includes a reduction of the workforce by 10 percent, with the process expected to be finalized within the month of November.

The layoff move will probably reduce its money-burning speed, but may not help the company to avoid potential liquidity problems. Nio's Q2 balance sheet shows that the company's quick ratio is only 0.82. Its competitors, $Li Auto(LI.US$ and $Tesla(TSLA.US$, have quick ratios of 1.59 and 1.18, respectively. Therefore, the company's approach to solving this problem will likely be a focus.(Quick ratio is an indicator that measures a company's ability to meet its short-term obligations with its most liquid assets; the higher the ratio is, the better its ability to pay back short-term obligations.)

As Nio prepares to unveil its Q3 earnings, the report is expected to provide crucial insights into the company's current challenges and its strategies for navigating a competitive EV market. So, what do you think about Nio's upcoming earnings results?

Source: Bloomberg, Nio

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102332870 : Oct and Nov deliveries total 32k, how to achieve Q4 target 59k? Most analysts already revised down and reflected in the share price.

Joseph Hudson : OMG

耐心等待2024 : Where is the future of NIO