Nancy Pelosi's Palo Alto Networks bet: What are LEAPS options?

In a recent disclosure, US Representative Nancy Pelosi reported buying call options for Palo Alto Networks (NASDAQ: PANW), with trades executed on February 12th and 21st.

These options, which are Long-term Equity Anticipation Securities (LEAPS), have a strike price of $200 and are set to expire on January 17, 2025.Pelosi invested a substantial amount, withthe option premium totaling between $600,000 and $1,250,000.

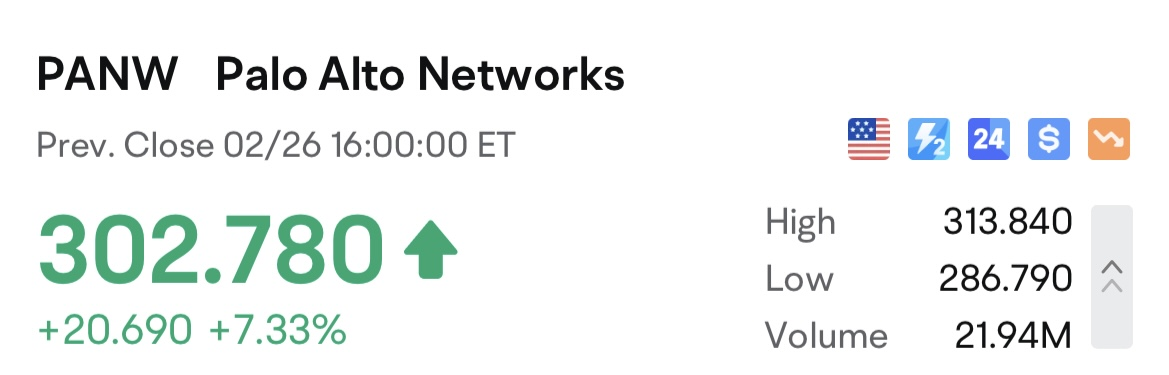

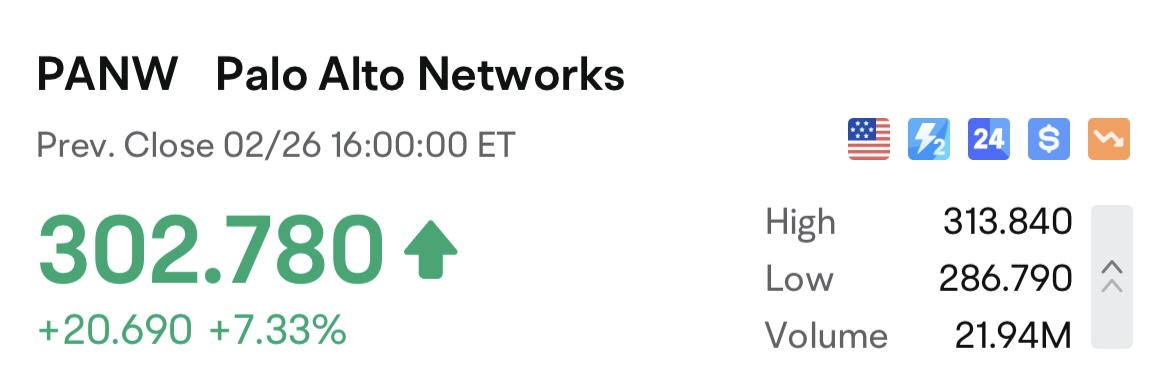

After the disclosure, PANW shares jumped 7% overnight.

Notably, Pelosi had previously engaged in a similar strategy, purchasing LEAPS call options for Nvidia, which resulted in significant profits following a notable uptick in the company's stock value over the following months.

I. What stands out in Pelosi's options trade?

Nancy Pelosi's recent options trade raises intriguing questions:

The options will expire in January 2025, over a year from the trade date, and are deep-in-the-money, carrying a hefty premium.

What could be the strategy behind this substantial investment? Let's delve into the nuances of this maneuver step by step.

II. What are LEAPS options?

Standing for Long-Term Equity Anticipation Securities, LEAPS are essentially long-dated options that extend beyond the typical one-year period of standard options. They can offer higher returns than owning stocks outright if managed properly, with potentially lower risks.

Regular options typically have a lifespan of no more than one year, whereas LEAPS are usually for periods extending beyond one year.

LEAPS are typically American-style options, allowing exercise at any time before expiration. They're offered for select stocks, indices, and ETFs but not universally.

To locate LEAPS, simply filter by expiration date in the options chain on moomoo to see longer-term options.

If you would like to learn more about the basics of LEAPS options, tap the following link to learn more: LEAPS: A Longer Term Options Strategy

III. Types of LEAPS options and trading rules:

LEAPS options come in both puts and calls, just like shorter-dated options. The contract specifics and trading rules are largely similar.

IV. Case analysis:

Let's look at Pelosi's case in more detail and the trades she made on February 12th and February 21st.

Using historical data from moomoo, we estimate the average options purchase price at around $178, while the stock's average price was roughly $325.

Risk Disclaimer: The estimated average purchase price of the option and the average purchase price of the underlying stock are based on the simple calculation from the two days' market data and may not represent the real data at the time of the order.

Pelosi's 70 LEAPS options contracts effectively covered about 7,000 shares of the underlying stock with an investment between $600,000 and $1,250,000.

At that time, the average price of PANW's underlying stock was about $325. Assuming she invested the entire $600,000 to $1,250,000 into buying the stock, she would only be able to track approximately 1,800 to 3,800 shares of the underlying stock.

The LEAPS approach required less upfront capital and provided more efficient use of funds. As a result, it could yield a higher return on investment compared to a direct stock purchase for the same profit level.

Moreover, the strategy limited her risk. In a downturn where her options became worthless, her maximum loss would be significantly lower than if she had fully invested in the stock itself.

V. Profit and loss analysis:

a. Stock price increase

Should the stock price climb significantly, LEAPS options can outperform direct stock purchases in terms of returns. With LEAPS, one could acquire the stock at a strike price of $200/share, plus the premium paid for the options at $178/share, totaling approximately $378/share. Although this initial cost is higher than the stock's price at the time ($325), the disparity diminishes as stock prices and profits rise.

(Note: The figures cited here are simple estimates based on historical market data and may not represent the actual data of that transaction.)

It's important to note that most investors typically prefer to sell their options rather than exercise them. The slow decay of a LEAPS option's extrinsic value, coupled with potentially high implied volatility, can make selling the option more profitable than exercising it.

Hence, closing a LEAPS position often yields higher returns than exercising the option itself.

b. Stock price decrease

In the event that the stock price declines, the leveraged nature of LEAPS can amplify potential losses more than holding the stock outright.

It's crucial to engage in this strategy only if you have a strong conviction about the stock's future direction.

c. Little change in stock price.

If the stock price remains relatively stable, the erosion of the time value of the LEAPS could lead to some losses.

Nonetheless, the maximum potential loss with LEAPS is capped at the amount invested in the options, which provides a safeguard if the stock price drops. While this strategy may slightly cut into profits or increase losses, it generally resembles the profit and loss profile of holding the underlying stock over an extended period.

Overall, LEAPS options provide an excellent choice for investors who are bullish on the long-term value of a stock but do not wish to tie up a significant amount of capital for an extended period.

Overall, LEAPS are a strategic choice for investors who are optimistic about a stock's long-term prospects but prefer not to commit substantial capital for a prolonged duration.

LEAPS can serve as an alternative to owning stocks, or as a tool for speculation or hedging.

VI. Risk management

Before trading, risk awareness is key. The rationale for choosing LEAPS options includes:

a. A strong bullish outlook, believing that the underlying stock will appreciate significantly.

b. Prudent risk management by ensuring a safety margin.

It's also important to recognize certain distinctions:

a. Order types:

Due to typically lower liquidity and wider bid-ask spreads in LEAPS compared to short-term options, it's recommended to avoid market orders. Instead, use limit orders set at the mid-price or experiment with different prices to secure a more favorable execution.

Tap here to learn more: Options order types? Conditional orders? How to use them!

b. Consider the risk-free interest rate:

While short-term options aren't greatly affected by changes in Rho (interest rate sensitivity), LEAPS are more susceptible. Therefore, monitoring macroeconomic trends and understanding their influence on the risk-free interest rate is crucial before formulating strategies with LEAPS.

VII. Summary

Let's recap the main points from today's discussion.

LEAPS are long-dated options with terms usually exceeding one year. They are pricier than short-term options, experience slower extrinsic value decay, and are less sensitive to short-term market swings. However, they often come with lower liquidity and wider bid-ask spreads.

The primary reason to use LEAPS, particularly call LEAPS, is for long-term investment strategies that mirror owning the actual stock. They limit potential losses and offer greater capital efficiency, which can lead to enhanced capital returns, asset diversification, and effective risk management. Nonetheless, there are situations where they may not outperform direct stock ownership. When choosing LEAPS, it's important to consider elements like delta, option pricing, and market liquidity.

In addition to speculation, LEAPS can serve for hedging or income generation but carry their own risks.

Some investors allocate limited funds across various bullish LEAPS on different stocks, while others replace stock holdings with LEAPS to free up capital for other investments or emergencies.

Some investors continually roll over LEAPS to keep a long-term position in the underlying stock, incurring certain costs, and others use LEAPS to bet on long-term index performance.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment