Monthly Buzz: What drove the September stock swoon

Hey, mooers!

Welcome back to Monthly Buzz!

September started with light volumes. Sellers then returned to the market, giving back the gains made at the end of August. Apple's share price remained weak following its new product launch. As we entered the second half of the month, the Fed announced that it would pause rate hikes in September and maintain the target range for the federal funds rate at 5.25%-5.50%.

Despite this, the hawkish tone of the Fed and economic concerns added to the market's weakness. The market had its worst week since March as investors adjusted to the possibility that interest rates could remain higher for longer than expected. The struggle between workers and employers continues, especially in the service sector.

The three major indexes finished the month with the same results. Fueled by AI hype, the tech-heavy Nasdaq was down 5.81%, the S&P 500 decreased 4.87% during the month, and the Dow was down 3.5%.

The stock market suffered in September, the worst month of the year, as a triple whammy of soaring bond yields, rising oil prices, and slowing growth triggered a widespread sell-off, even in once-loved mega-cap tech companies. The market turmoil could put further pressure on President Biden's sagging approval ratings, especially over his handling of the economy. A wave of strikes and the growing likelihood of a government shutdown may not help. The S&P 500 eked out a minuscule gain on Wednesday after hitting a three-month low the day before. Meanwhile, the tech-heavy Nasdaq has retreated to levels last seen in late May. (Data as of Sep 30, 2023)

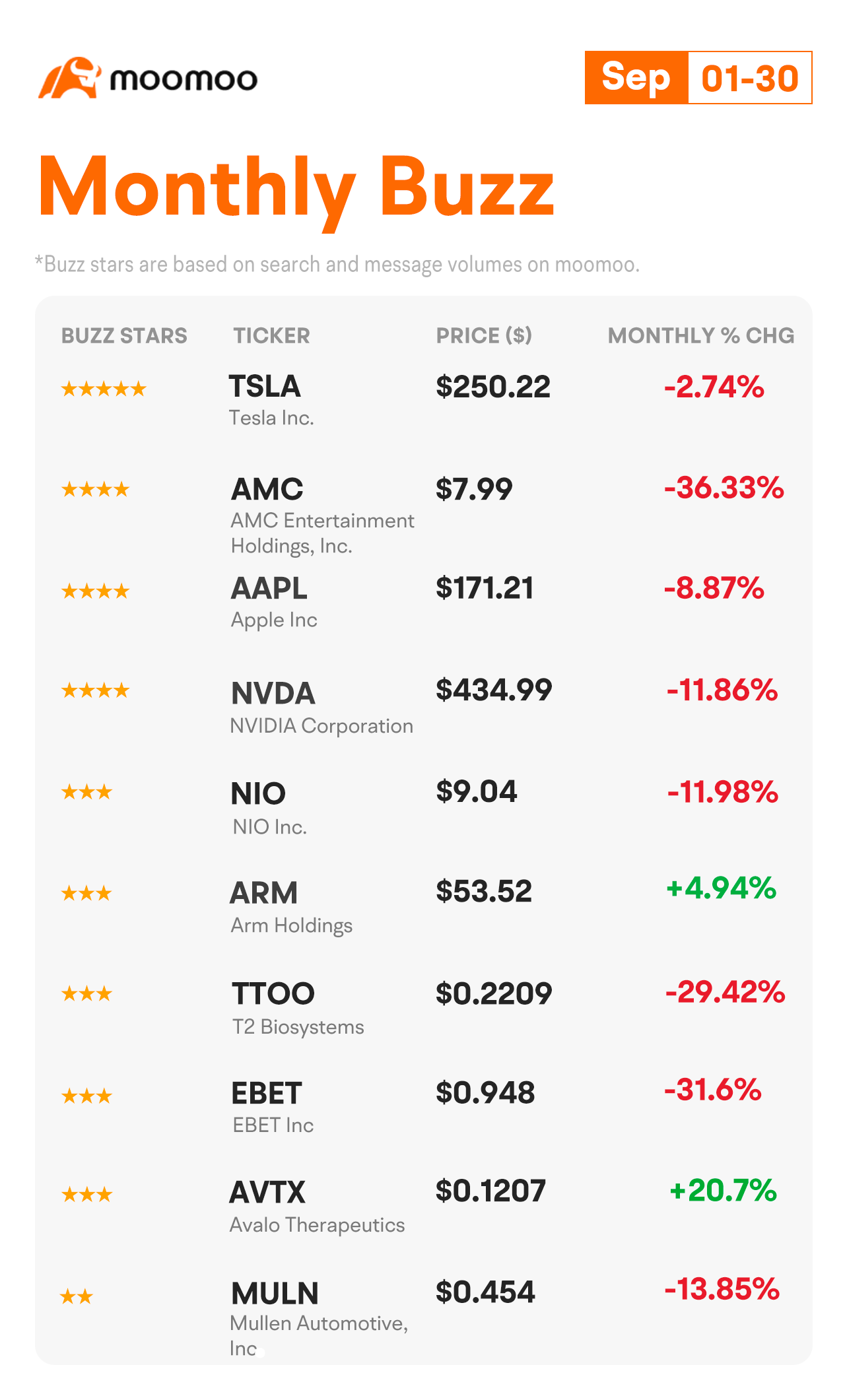

Let's take a look at how the stocks that created the most buzz on the moomoo app performed during the month.

Note: The number of buzz stars is based on the search and message volumes of the stocks on moomoo (data as of Sep 30, 2023).

1. TSLA – Buzzing Stars: ⭐⭐⭐⭐⭐

Sep 05: Tesla shares dived 5.06% after the company made price cuts to its Model S and Model X electric vehicles in the U.S.

Sep 11: Tesla shares rose 10.09% after Morgan Stanley predicted Dojo supercomputer could add $500 billion in market value. The Morgan Stanley team, led by longtime Tesla analyst Adam Jonas, predicted that the massive drive in value could come from Dojo potentially unlocking new revenue streams through the wider adoption of robotaxis and software services.

Sep 22: Tesla shares dropped 4.23% among its recent legal controversies, including accusations of employing illicit union-busting strategies. These strategies allegedly include the termination of employees who attempt to organize.

2. AMC – Buzzing Stars: ⭐⭐⭐⭐

Sep 06: AMC Entertainment stocks dropped 36.80% after the company announced a plan to sell up to 40 million common shares. AMC said it plans to use the proceeds to bolster liquidity and repay debt, among other things.

Sep 13: AMC shares rallied 8.85% after the company announced it completed its at-the-market equity offering of 40 million shares and raised roughly $325 million.

3. AAPL – Buzzing Stars: ⭐⭐⭐⭐

Sep 06: Apple shares were trading 3.58% lower amid reports of China expanding its ban on the use of iPhones to government-backed agencies and state companies.

Sep 12: Apple shares slid 1.71% after the company unveiled its iPhone 15 at an annual marketing event, and raised its price on iPhone Pro Max for the first time. Investors were also looking ahead to the widely anticipated reading on August inflation from the consumer-price index on Wednesday.

Sep 26: Apple shares dropped 2.34% amid overall market weakness as traders and investors weigh concerns about future rate hikes following last Wednesday's FOMC statement and lower-than-expected initial jobless claims data.

4. NVDA – Buzzing Stars: ⭐⭐⭐

Sep 06: NVIDIA shares dropped 3.05%. The PHLX Semiconductor Sector index dropped 0.8%, while individual chip stocks are prominent among S&P 500 laggards. Jen Hsun Huang, Director, President, and CEO, on September 01, 2023, sold 29,688 shares in Nvidia for $14 million.

Sep 13: NVIDIA shares rallied 1.37% and ended its losing streak. NVIDIA and peers, including Advanced Micro Devices, Inc., got a boost from Arm Holdings plc's (NASDAQ: ARM) initial public offering.

Sep 15: NVIDIA shares plummeted 3.69%. A slump in technology companies' shares weighed on the S&P 500 Friday, chipping away at the broad-market benchmark's recent gains and pushing it into negative territory for the week.

5. NIO – Buzzing Stars: ⭐⭐⭐

Sep 01: NIO shares were trading 7.11% higher after the company reported August deliveries. NIO delivered 19,329 vehicles in August 2023, up 81% YoY, with cumulative deliveries reaching 383,908 as of month end.

Sep 19: NIO stocks plummeted 17.07% after the electric vehicle maker announced a proposed offering of $1B in convertible bonds. The company said it would sell $500M in aggregate principal amount of convertible senior notes due in 2029 and $500M in aggregate principal amount of convertible senior notes due in 2030.

6. ARM – Buzzing Stars: ⭐⭐⭐

Sep 14: Shares of British chip designer Arm Holdings closed at $63.59 after its initial public offering priced at $51 per share, showing some positives for the cool IPO market and the continuing hype surrounding AI.

Sep 18: Arm Holdings shares were trading 4.53% lower as analysts took stock of its prospects as a listed company. Bernstein Research initiated coverage with an underperform rating and put a $46 per share price target on it, declaring that Arm wasn't yet a big beneficiary of the boom in AI and still had large exposure to mobile phones, where its circuitry is ubiquitous.

7. TTOO – Buzzing Stars: ⭐⭐⭐

T2 Biosystems shares jumped 65.55% after it received the FDA 510(k) decision of substantially equivalent for its T2 Biothreat Panel, a multiplex nucleic acid detection system for biothreat agents before the market opened on Monday.

8. EBET – Buzzing Stars: ⭐⭐⭐

Sep 29: EBET will effect a 1-for-30 reverse stock split of its common stock, the company said Friday. The company's common stock will open for trading on the Nasdaq on October 2, 2023, on a post-split basis, under the existing ticker symbol "EBET" but with a new CUSIP number of 278700 208. As a result of the reverse stock split, the number of shares of common stock outstanding will be reduced to about 14.9 million from 448.2 million. The number of authorized shares of common stock will remain at 500 million shares.

9. AVTX – Buzzing Stars: ⭐⭐⭐

Sep 13: Avalo Therapeutics, Inc. shares are trading 81.13% higher after the company said it was selling its rights, title and interest in, assets relating to AVTX-801 D-galactose, AVTX-802 D-mannose and AVTX-803 L-fucose to AUG Therapeutics. AUG will pay an upfront payment of $150,000, as well as, for each compound, make a contingent milestone payment of $15 million if the first Food and Drug Administration approval is for an indication other than a rare pediatric disease.

Sep 26: Avalo Therapeutics, Inc. shares are trading 7.36% lower after the company announced the payoff of the remainder of its $35 million debt owed to Horizon Technology Finance. The move not only signifies the company's commitment to financial stability but also paves the way for future progress toward advancing its drug candidates.

10. MULN – Buzzing Stars: ⭐⭐

Sep 07: Shares of Mullen Automotive dropped 5.64% toward a record low after the electric vehicle maker received a delisting determination from the Nasdaq for failing to maintain the minimum stock bid requirement of $1. The company said that on Wednesday it requested a hearing before the Nasdaq Listing Qualifications Panel to request an extension, and to present its plan to regain compliance. If the company didn't request a hearing, the stock would have been delisted on Sept. 15.

Sep 11: The shares of Mullen Automotive rallied 5.77% after the company announced the purchase of battery pack production assets from Romeo Power for approximately $3.5 million. The deal includes equipment, inventory and intellectual property for high-volume EV (electric vehicle) battery pack and module production.

Sep 19: Mullen Automotive shares dipped 2.32% after receiving its "qualified manufacturer" designation enabling qualification for commercial EV federal tax credits of up to $7,500 per qualified vehicle with gross vehicle weight ratings (GVWRs) of under 14,000 pounds.

Source: All the news events mentioned above are from moomoo news. The percentage change data of the above stocks are from moomoo's daily quotes.

That's all for today's Monthly Buzz. Thanks for reading! ![]()

Disclaimer:

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc.

In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) and a member of Financial Industry Regulatory Authority (FINRA)/Securities Investor Protection Corporation (SIPC).

In Singapore, investment products and services available through the moomoo app are offered through Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS).Moomoo Financial Singapore Pte. Ltd. is a Capital Markets Services Licence (License No. CMS101000) holder with the Exempt Financial Adviser Status. This advertisement has not been reviewed by the Monetary Authority of Singapore.

In Australia, financial products and services available through the moomoo app are provided by Futu Securities (Australia) Ltd, an Australian Financial Services Licensee (AFSL No. 224663) regulated by the Australian Securities and Investment Commission (ASIC). Please read and understand our Financial Services Guide, Terms and Conditions, Privacy Policy and other disclosure documents which are available on our websites https://www.moomoo.com/au. Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd. and Futu Securities (Australia) Ltd are affiliated companies.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

71707650 : And we're still controlled by the Robber Barron's scheme of the Federal Reserve

103550257。 : Can anyone help me what can I do to prosper all the way