Meta's Ad Business Booms, But Future Earnings Outlook Treads Carefully

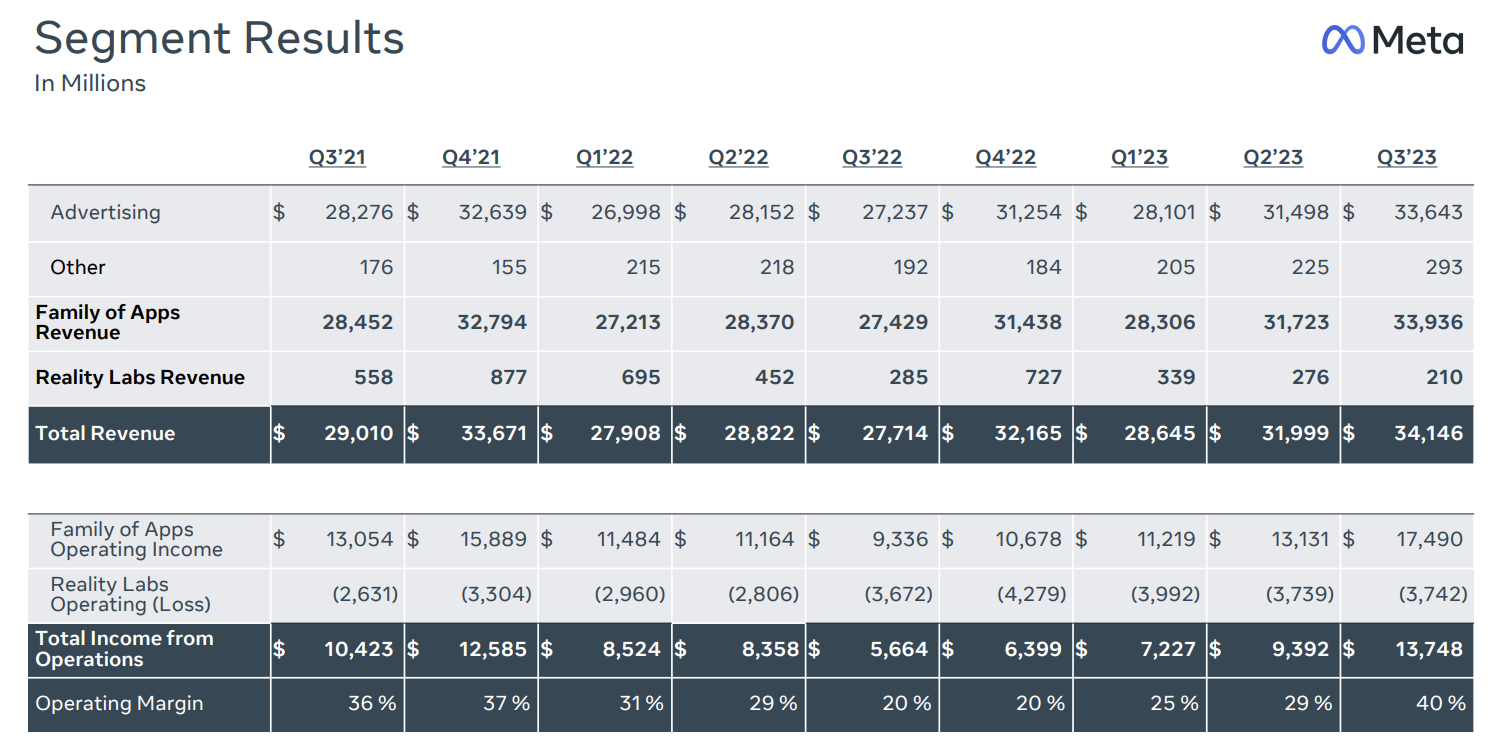

On Wednesday, October 25th, after the US stock market closed, Meta announced that its Q3 results for the year ending September 30 exceeded expectations with both revenue and earnings per share (EPS) growing significantly faster than in Q2. Q3 revenue reached $34.15 billion, a YoY increase of 23%, double the growth rate of Q2 at 11%, and close to the upper end of the company's guidance range of $32 billion to $34.5 billion. Analysts had expected revenue to grow by 20.9% to $33.51 billion, thanks to high-speed growth in advertising revenue.

In terms of diluted EPS, it reached $4.39, a YoY increase of 168%. Analysts had expected EPS to grow by 121% to $3.63, up 21% from Q2, mainly due to cost reduction and efficiency improvement initiatives.

This time, Meta adjusted its full-year expense guidance downward, from $88 billion to $91 billion to $87 billion to $89 billion, a decrease of $2 billion. This is the second time this year that Meta has lowered its annual expense guidance after releasing Q1 results.

Advertising revenue grew YoY by 24%, exceeding expectations, doubling the growth rate from the previous quarter.

Q3 advertising revenue reached $33.64 billion, slightly higher than analysts' expectations of $32.94 billion, up 11.9% YoY from Q2.

Q3 revenue for the applications family was $33.94 billion, up 24% YoY, with analysts expecting $33.08 billion, up 11.8% from Q2. The Q2 operating profit for the family was $17.49 billion, up 87% YoY, nearly 15% higher than analysts' expectations of $15.23 billion.

Revenue from Meta's metaverse-related Reality Labs, which includes AR (augmented reality) and VR (virtual reality) hardware, software, and content, fell dramatically by 26%.

Q3 operating loss for Reality Labs was $3.74 billion, flat compared to Q2, with a YoY increase of 1.9%, while analysts expected losses of about $3.94 billion, down about 5% from estimates, but QoQ losses increased by 33.3%.

Meta's active user base for the application family and Facebook continued to grow YoY in Q3, securing the social ecosystem's barriers.

By the end of Q3, the application family's daily active users (DAU) were 3.14 billion, up 7% YoY, while Facebook's DAU for the quarter was 2.09 billion, up 5% YoY, setting a new record for two consecutive quarters.

Looking at different regions, Facebook's DAUs in the United States and Canada continued to grow QoQ in the first three quarters of this year.

By the end of Q3, the application family's monthly active users (MAU) were 3.96 billion, up 7% YoY, while Facebook's MAU for the quarter was 3.05 billion, up 3% YoY, also reaching a historic high, breaking through the 3 billion mark for the first time in Q2.

Next year's expenses are expected to increase by more than 10%, partly due to significant losses in the metaverse business.

Meta expects revenue in Q4 to be between $36.5 billion and $40 billion, a growth rate of approximately 13.48%-24.36%, slightly lower than in Q3, possibly due to concerns about macroeconomic growth uncertainty.

Meta expects next year's expense guidance to be $94 billion to $99 billion, an increase of approximately 8% to 11% from this year's expected expenses.

Meta says its forecast for next year's expenses comes from three factors: infrastructure-related costs are expected to increase next year, larger-scale infrastructure will also bring higher operating costs, and employee costs to support these facilities will also increase. At the same time, talent structure will continue to shift towards technology positions with higher labor costs. Additionally, due to ongoing development of augmented reality (XR)/virtual reality (VR)-related products and investment in further expanding the scale of the related ecosystem, losses in Reality Labs' metaverse business next year will significantly increase compared to this year.

Next year's spending may increase by 20%, partly due to AI server investments. Meta expects its capital expenditure guidance for next year to be $30 billion to $35 billion, an increase of approximately 11% to 21% from this year's expenditures, mainly due to investments in AI and non-AI hardware servers and data centers.

In summary, this quarter's financial report driven by advertising revenue was very impressive, but future guidance is cautious, indicating concerns about uncertain macroeconomic growth risks, causing the market to lose some confidence. Since Meta is currently valued high, any slightly unfavorable news is likely to cause a decline in.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

103595568 : Your post greatly explain why Meta had a slump with a great financial result. Future is very essential for high valuation.