A Guide to Efficient Stock Selection with Moomoo Features

In the ever-changing financial market, accurately identifying stocks worth attention and investment is key for investors to achieve their investment goals. Moomoo, as a leading stock trading platform in the industry, offers investors an efficient and convenient way to select stocks within the platform. Recognizing that some users have questions about the reference indicators for stock selection and the specific operations involved, we will provide detailed answers in the following text.

I. Skillfully Using Moomoo's Stock Screener: Customized Filtering and Intelligent Sorting

Before we start selecting stocks with Moomoo's stock screener, what criteria can we determine as our reference for stock selection?

Let us first consider some of the stock selection criteria of Warren Buffett and Benjamin Graham:

1. Emphasize Return on Equity (ROE) over Earnings Per Share (EPS).

In his 1987 letter to shareholders, Buffett stated that a good investment should meet the following two criteria: first, an average ROE over the past ten years higher than 20%, and second, an ROE that has not fallen below 15% in any of the past ten years. Buffett places great importance on the ROE metric.

ROE (equal to Net Income / Shareholders' Equity) reflects the efficiency with which a company generates profits from the capital invested by shareholders, i.e., how much net income is generated for every dollar of shareholders' equity. Compared to Earnings Per Share (EPS), ROE takes into account the company's overall asset structure and capital efficiency, rather than just the profit allocated per share. Meanwhile, EPS focuses only on the profit per share without reflecting the capital structure that the company relies on to obtain those profits. ROE also reveals whether the company is reliant on high leverage (debt financing) to boost earnings; a high ROE, if built on a high level of debt, may hide significant financial risks.

2. Value Gross Margin

Buffett has mentioned the importance of gross margin in public on numerous occasions. In the long-term holdings of Berkshire Hathaway, the gross margin (gross profit / sales revenue) is generally above 30%. A high profit margin reflects both the capabilities of the company's management and its cost control abilities. Buffett looks for companies with competitive advantages and "economic goodwill," those that can maintain high profit margins over the long term, which typically means they possess some form of competitive advantage or barrier that allows them to generate excess profits consistently.

3. Attractive Pricing

In his 1977 letter to shareholders, Buffett summarized his four principles for stock selection: businesses that are understandable, with good long-term prospects, managed by able and trustworthy managers, and available at attractive prices. These four basic principles are consistent with the criteria mentioned above regarding business, market, and management aspects. Whether a stock is attractively priced can be judged by valuation metrics.

Regarding valuation, we can refer to Buffett's mentor, Benjamin Graham, known as the "father of value investing," who authored two classic works, "Security Analysis" and "The Intelligent Investor," which have influenced many investors. In his later years, Graham summarized "ten criteria" for stock selection, one of which related to valuation was that "the stock's price-to-earnings ratio should be less than 40% of its highest price-to-earnings ratio over the past five years."

4. Shareholder Returns

In addition, the strategy of high dividend yields has also attracted attention from many investors recently. In markets with significant volatility or unclear trends, known as "choppy markets," stocks with high dividend yields, typically from companies with robust operations, strong profitability, and ample cash flows, can provide relatively stable cash inflows. This reduces the volatility of an investment portfolio and can, to some extent, hedge against market risks.

Graham's standard regarding dividends was that the dividend payout ratio of a stock should be greater than two-thirds of the yield of AAA-rated U.S. bonds. To simplify, we can also compare the company's dividend yield to the risk-free rate of return (the yield on 10-year U.S. Treasury bonds). The risk-free rate affects the opportunity cost for investors; if a company's dividend yield exceeds the risk-free rate, it may be considered more attractive to invest in that company's stock compared to holding risk-free assets.

Based on the stock selection principles of Buffett and Graham, how do we implement them into our preliminary stock picking process? We have quantified and adjusted some of the criteria:

(1) ROE > 20%

(2) Gross Margin > 30%

(3) Price-to-Earnings Ratio (P/E): This metric is usually compared with historical levels and industry averages. Of course, you can also set this specific value according to your own judgment.

(4) Shareholder Returns: With the current 10-year Treasury yield at 4.67%, we set a criterion for the dividend yield to be > 4.67%.

Within the Moomoo platform, how should we specifically operate?

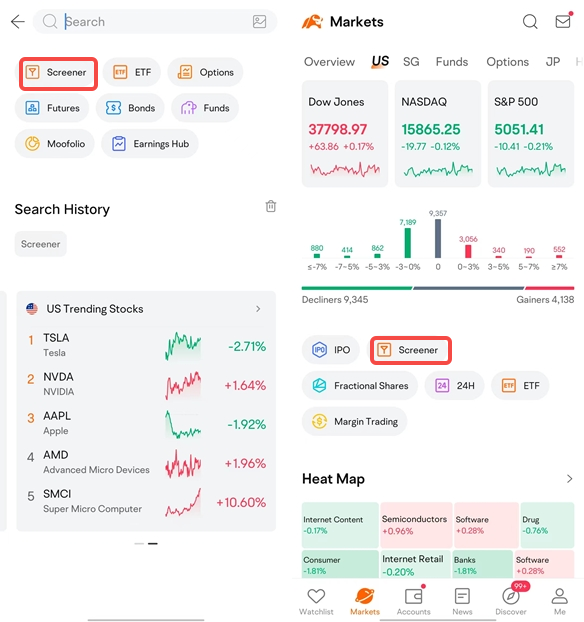

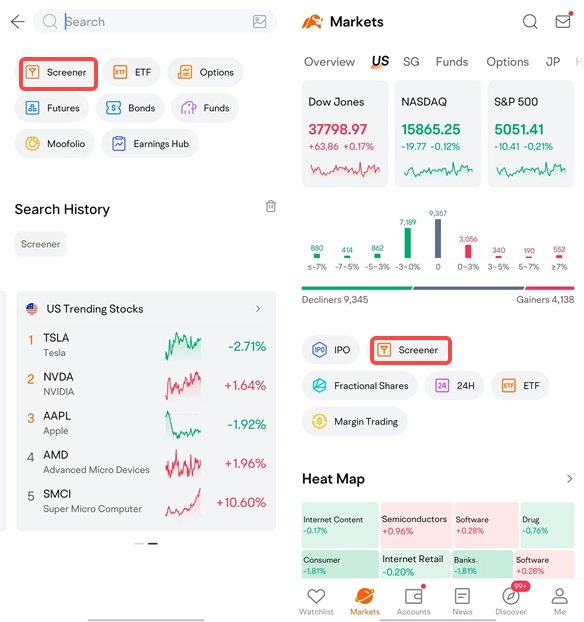

1. First, we need to find the entrance to the stock screener feature within the Moomoo app:

Entrance 1: Search page - Screener

Entrance 2: Market - U.S. Stocks - Screener

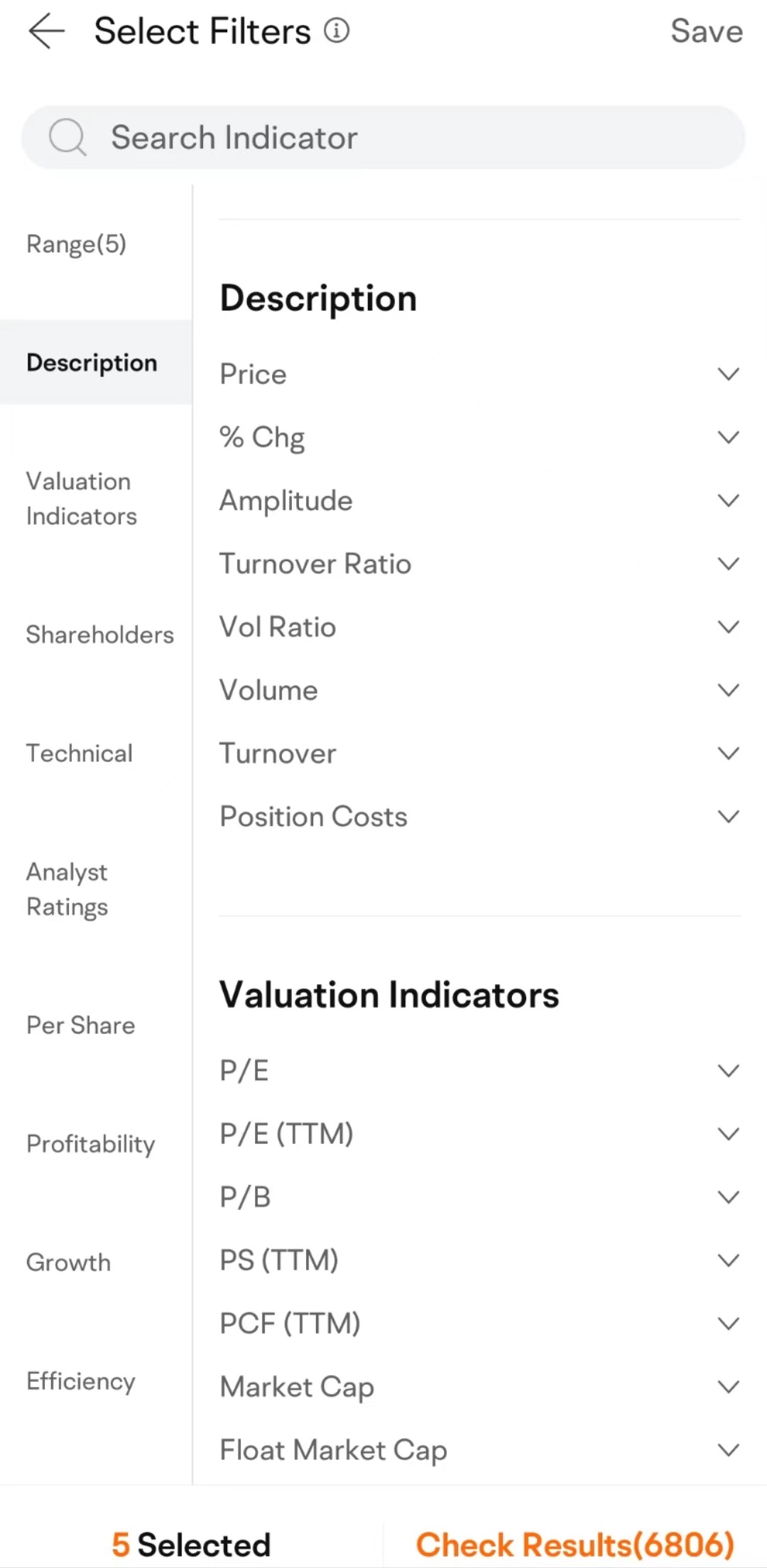

2. Next, select the stock screener indicators supported by the app according to your needs

Currently, the Moomoo app's stock screener supports four main categories of indicators: Market, Market Indicators, Technical Indicators, and Financial Indicators. Among them:

(1) Range indicators support the selection of regions, sectors, and scopes.

(2) Description indicators include choices such as a stock's market capitalization, price, and percentage change.

(3) Technical indicators support investors in selecting periods (candlestick selection), MA, EMA, and other such metrics.

(4) Financial indicators include basic financial metrics, profitability, debt-clearing ability, operational efficiency, growth potential, cash flow, and market performance.

Furthermore, if you're interested in brokerage positions and other stock-related conditions, you can also filter and compare them in the stock screener.

3. Once the stock selection is complete, the stock screening strategy can be saved in the cloud.

During the process of setting stock screening indicators, users can click "View Results" to see the outcomes of the stock selection. Once the setup of stock indicators is complete, users can click "Save" in the top right corner to save the screener. The strategy will then be saved in the cloud.

Lastly, after setting the filtering criteria, the stock screener will automatically list the stocks that meet the conditions and support sorting by related indicators. Investors can quickly compare the data of each candidate stock to identify those that stand out in specific dimensions, making the process of finding promising stocks very straightforward.

II. Delving into the Supply Chain: Understanding Industry Logic and Linkage Effects

In addition to the stock screener function mentioned above, the Moomoo app also offers users the ability to select stocks based on the supply chain, which helps investors understand the upstream and downstream relationships between industries from a macro perspective.

The term "supply chain" describes the upstream, midstream, and downstream segments of an industry and the related companies involved. By researching and selecting stocks through the supply chain, investors can grasp the various industry cycles and prosperity levels, locate strategic segments, and leading companies, and better capture the dividends of different supply chains.

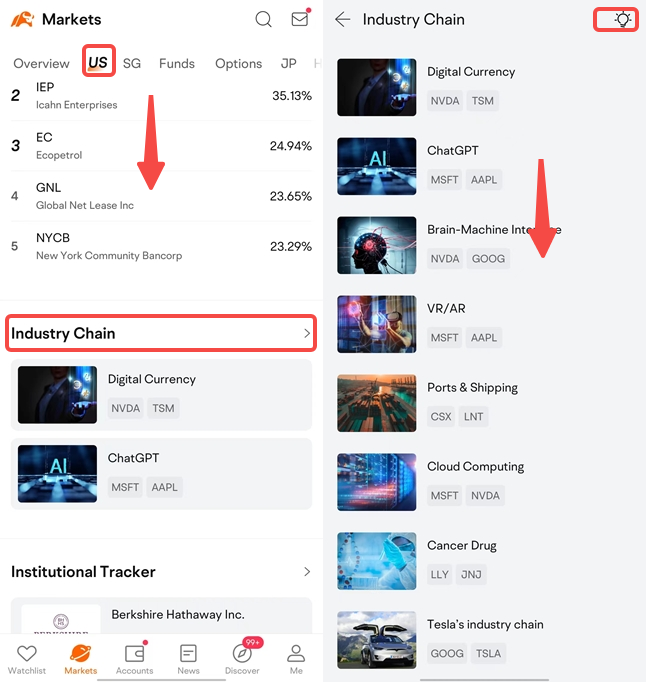

Next, let's introduce investors to how to find supply chain-related stocks within the platform.

First, we locate the entrance to the supply chain:

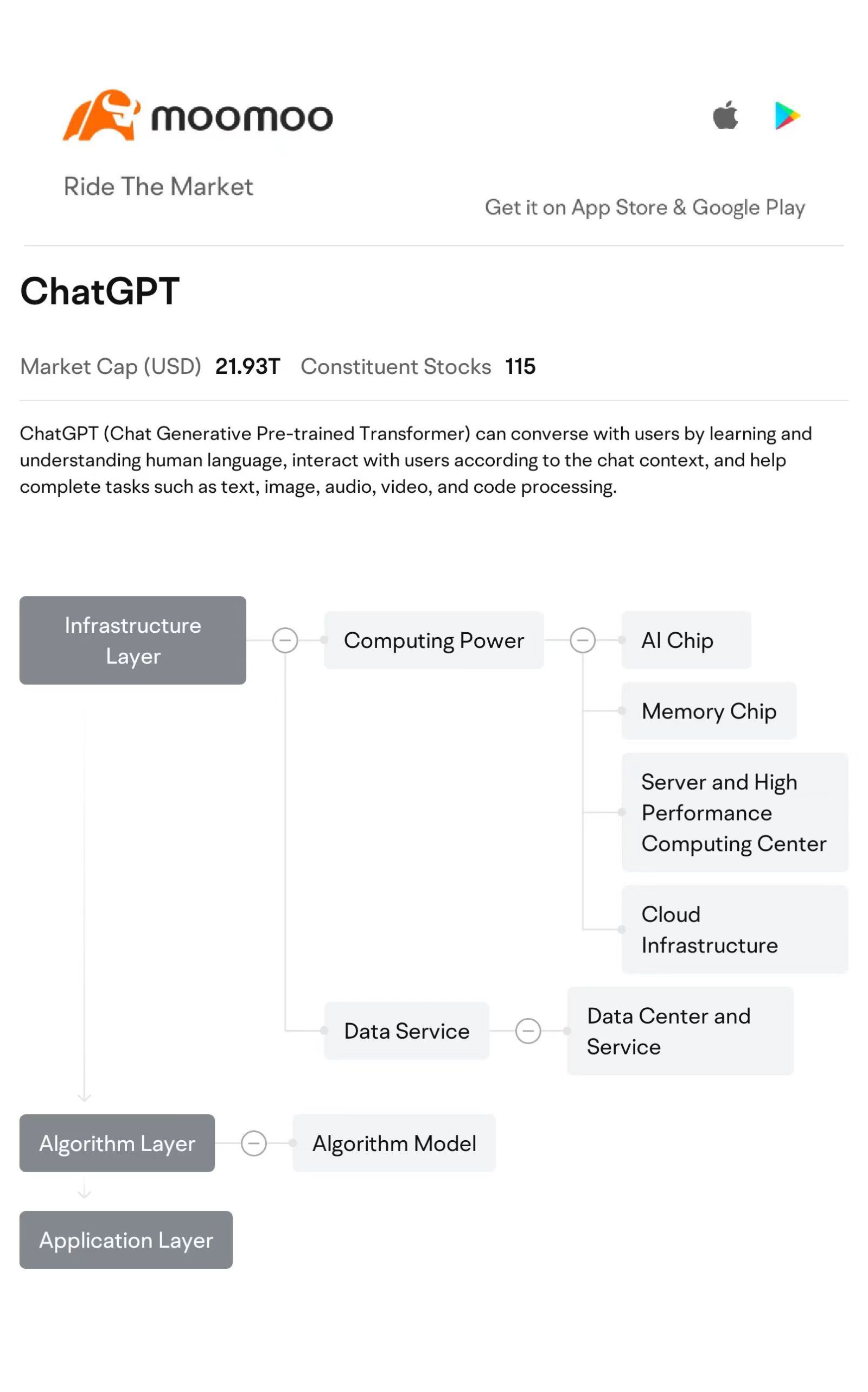

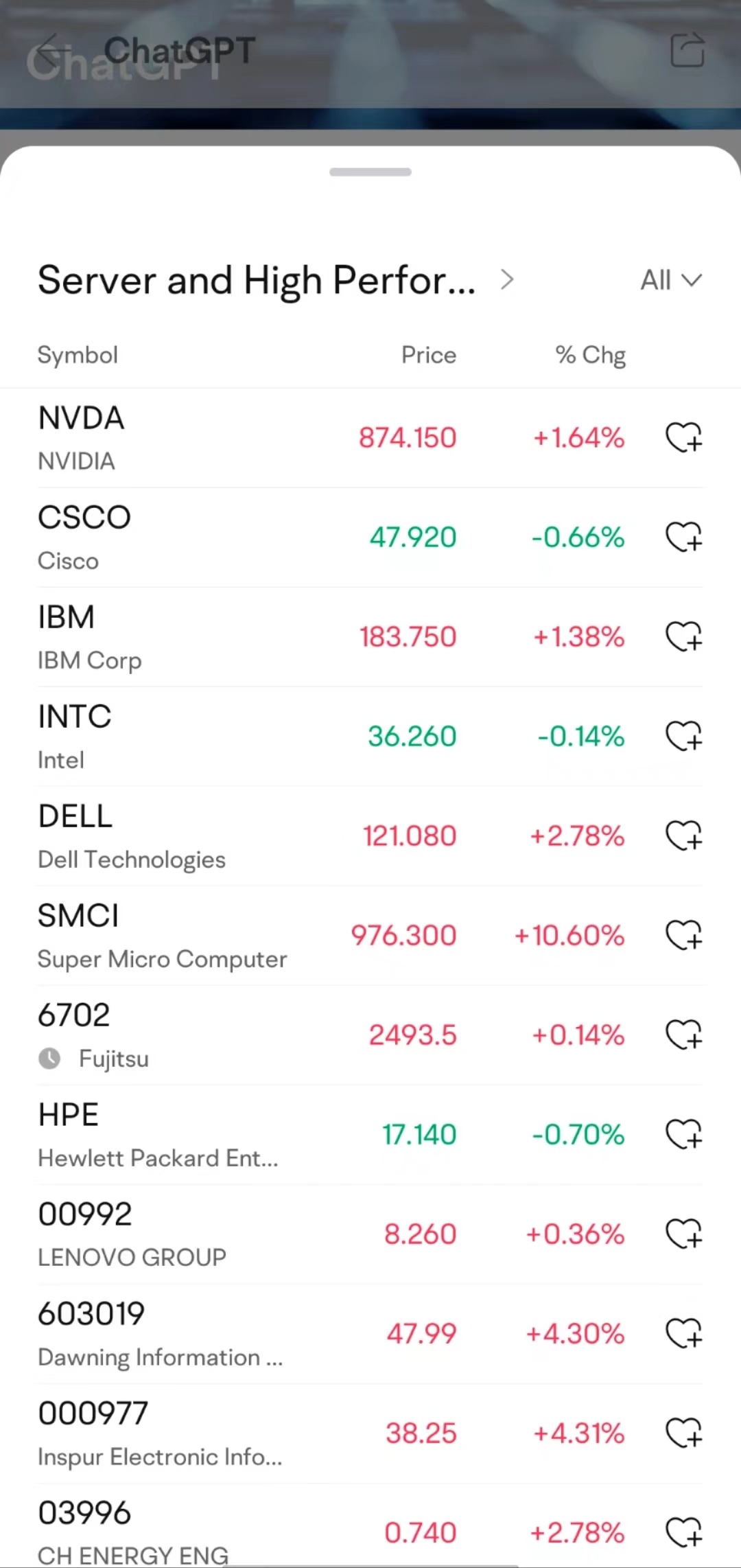

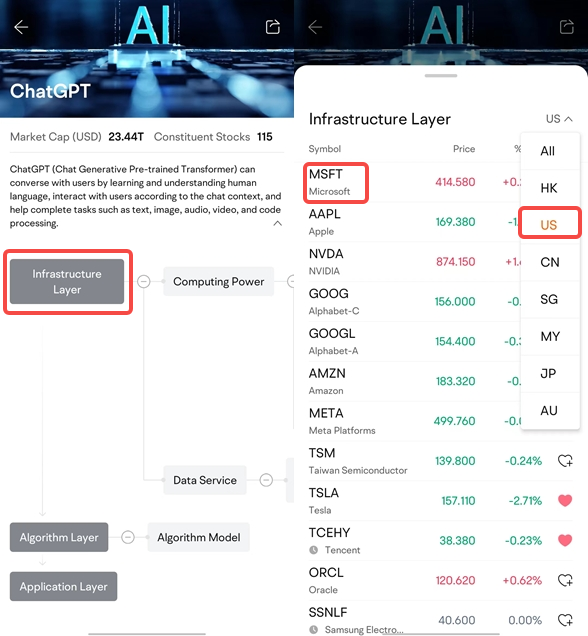

Click on Markets > "US" > "Industry Chain," where over 20+ supply chains are provided, including ChatGPT, semiconductors, digital currencies, etc.

Taking the ChatGPT supply chain as an example, by clicking into the ChatGPT supply chain, you can see the market capitalization of the industry, related stocks, and an industry introduction. You can also clearly view a visual map of all the companies in the upstream, midstream, and downstream sectors of the industry.

Subsequently, users can click on the "+" or "-" sign to expand or collapse any layer of the supply chain branch. By exploring the chain relationships, users can unearth potential stocks within hot industries.

How can the supply chain help us with stock selection? For example:

- AI chips are one of the core components of the entire supply chain, especially chips that are optimized for deep learning and natural language processing tasks, which benefit the most directly. Here we can uncover companies like NVIDIA and AMD. As well as memory chips, companies like Micron Technology.

- Looking upstream in the supply chain, servers constitute the foundation of the large-scale distributed computing clusters that run and support ChatGPT. We can uncover this year's soaring stocks such as Advanced Micro Devices (AMD) and Dell Technologies.

During the process of discovering investment opportunities through the supply chain, users can filter the stock market by clicking on "All." If they find a stock they are interested in, they can also click the "heart" to add it to their favorites.

III. Keeping Up with Concept Themes: Tracking Market Trends and Thematic Investments

Concept sectors are investment collections classified based on specific themes, hot events, policy orientations, etc., that are associated with the stocks. Stocks within a concept sector may come from different industries, but they share business attributes, development prospects, policy orientations, etc., closely related to that concept.

Moomoo's concept sector feature is continuously updated in real time to ensure the timeliness and accuracy of the concept sectors. Currently, the APP's concept sectors cover many popular areas such as digital currency, new energy vehicles, Trump-related concepts, AI, ChatGPT, and more.

Taking the digital currency concept sector as an example, this sector includes stocks of public companies that are closely related to digital currencies. These companies may be directly involved in the mining, circulation, trading, storage, etc., of digital currencies, or provide necessary hardware and software infrastructure, technical services, solutions, etc., for the digital currency ecosystem.

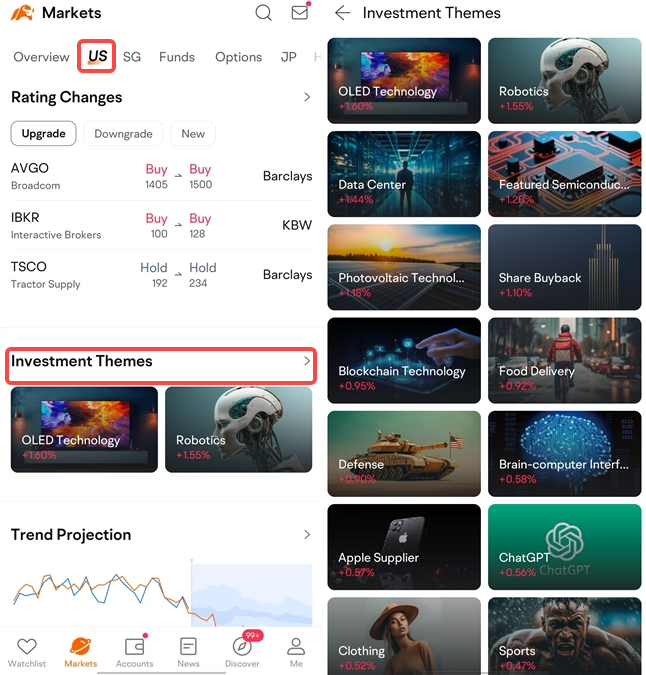

First, let's find the entrance to the concept sectors:

Taking U.S. stock concept themes as an example, click on Market > [US] > [Investment Themes] and you will see Themes like "Robotics". Concept Themes for other markets can be accessed by clicking on the respective markets.

Next, by clicking into the digital currency sector, you can view the sector's chart, including candlestick charts, stock tickers, prices, price changes, comments, and news about the sector. By referring to the price change of the constituent stocks within the sector and the overall trend of the sector, investors can discover suitable investment opportunities.

IV. Conclusion

Moomoo's stock screener, supply chain analysis, and concept sectors are three features that allow investors to build a three-dimensional stock selection system, covering micro-level screening, mid-level supply chain analysis, and macro-level thematic grasp. The stock screener helps investors refine their search and intelligently sort stocks, enabling them to identify potential top-performing stocks among a vast array. Supply chain analysis allows investors to understand the dynamics and value chain rules of different industries and to quickly pinpoint core companies within the supply chain. The concept sectors serve as a guide to hot investment spots in the market, allowing investors to stay on top of popular themes and seize opportunities.

Mastering these stock selection tools not only enhances our efficiency in selecting stocks but also enables us to discern market trends and accurately capture explosive growth stocks in the complex and volatile stock market.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73573891 bob : I wish had a account already opened I love learn ing and playing with such important things to do with money growth and loss