Markets react late in the week

Two big economic reports coming up this week could go a long way toward determining at least which way the central bank policymakers could lean — and how markets might react to a turn in monetary policy. The inflation numbers, which are trending towards the Fed’s 2% goal but aren’t there yet are the determing factor. But the change in sentiment that has occured is following data showing a stronger-than-expected .06% growth in consumer spending for December and initial jobless claims falling to their lowest weekly level since September 2022. A bull market is ahead.

Top stocks

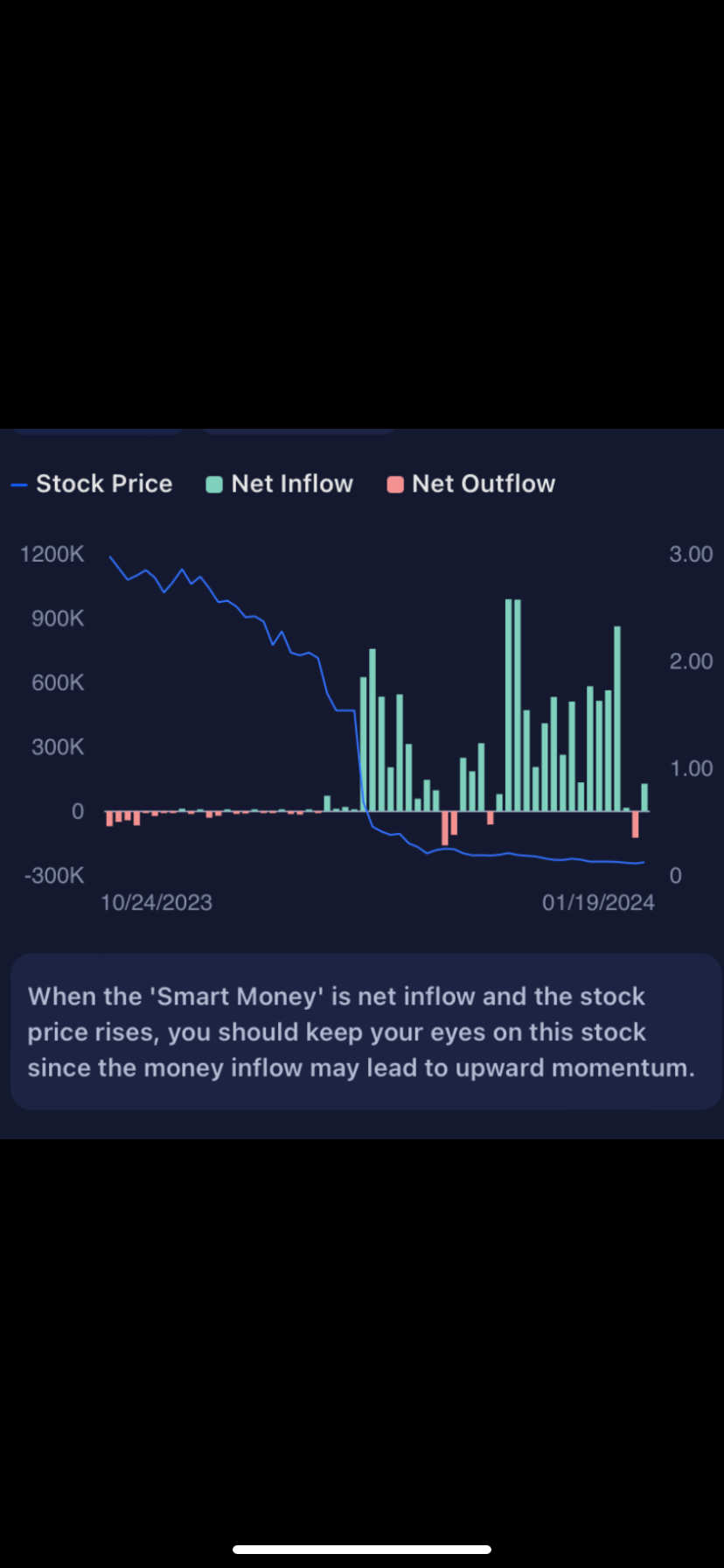

$U Power(UCAR.US$ A run to .66 is predicated. All this inflow and no price reaction has built up to a level that it cant be held down much longer.

$Northann(NCL.US$ Top trending stock. Picked up Friday at 1.33. Has to break 2.15 to run big.

Three stocks coming up on 1 year since IPO:

$QuantaSing Group(QSG.US$ Resistance is at 3.40 and 5.70.

$Cadrenal Therapeutics(CVKD.US$ It has no resistance. Monday is its big day. Can go as high as 3.00.

Closing its offering tomorrow:

$Transcode Therapeutics(RNAZ.US$ Has fallen from 5.00 to .74 since it opened. Looks to recover some of that starting tomorrow.

Watch:

$FOXO Technologies(FOXO.US$ Broke thru alot of resistance Friday. Small float and its trying to get back over 1.00. Has begun an uptrend. Resistance is at .54 and .60.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Salmon Klein : I sold UCAR last week on losses... Do you think it should be a runner soon? I am afraid it may keep dropping to below 0.1...doesn't seem it found its bottom yet ?

Mcsnacks H TupackOP Salmon Klein: I would buy $FOXO Technologies (FOXO.US)$ before this

Robert Smith31 : Since it held .12 thru early premarket i think that is a great sign that today she will hold and start to rise. I honestly believe the bottom was .105

indecisive Capybara : Do u think ncl can still break 1.9 for nhod ? Or the run is done ?

Biff : Well said!

Nidia_Girl : @Mcsnacks H Tupack i can see $Transcode Therapeutics (RNAZ.US)$ have a nice pop but then i just seen they have a prospectus:(

72840248 : do u think foxo will still rise , I was expecting it to hold up with the news

Mcsnacks H TupackOP 72840248: yea it is uptrending. The .54 resistance will decide it. Once it closes above that then it will climb to the 2.07 spot. I would give it until March 18th to reach 1.50 at least.

Mcsnacks H TupackOP Nidia_Girl: Yea sons of bitches. Won't see a run up until March 11th. So I hold until then.

Mcsnacks H TupackOP indecisive Capybara: Should have a run in the next week to 1.60 from .70. ER is going to decide on the 27th how high it will go.