Market Optimistic Amid Uncertainty Over Rate Cut Decision

We saw yesterday’s trading session maintaining a positive tone from start to finish, gaining momentum in the afternoon.

The Dow Jones Industrial Average saw an increase of 0.9%, while the S&P 500 also rose by 0.9%. The Nasdaq Composite experienced a more significant boost, climbing 1.5%, and the Russell 2000 outperformed with a 1.8% increase.

We have Coinbase and Block releasing their earnings after hours and they lead the earnings surprises, this has helped to boost the Tech Stocks. We saw the S&P 500 Consumer Discretionary and Information Technology sector perform above 1.5%.

Market Optimistic Sentiment From Fed No Further Rate Hikes Comment

The reason why we saw yesterday market optimistic sentiment is because of the Fed Chair Powell's remarks indicating that further rate hikes are unlikely.

However there is no clarity as to when rates might be lowered, this has added uncertainty surrounding the rate cut timeline. With the April Employment report due tomorrow at 8:30 ET, this uncertainty would continue to linger, and this might influence future Fed policy decisions.

So as investors, I think we should continue to stay focused on how the market moves with the data, and the rally ahead of jobs report might be a short-lived one.

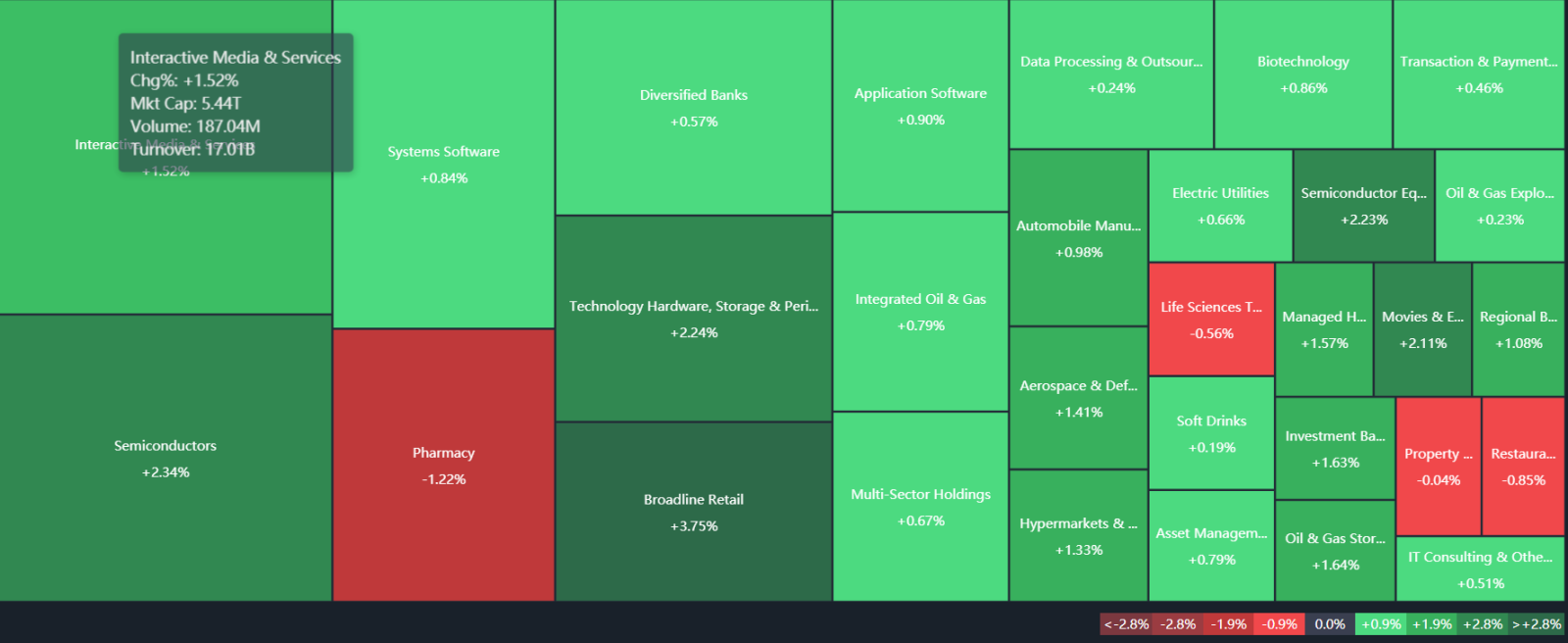

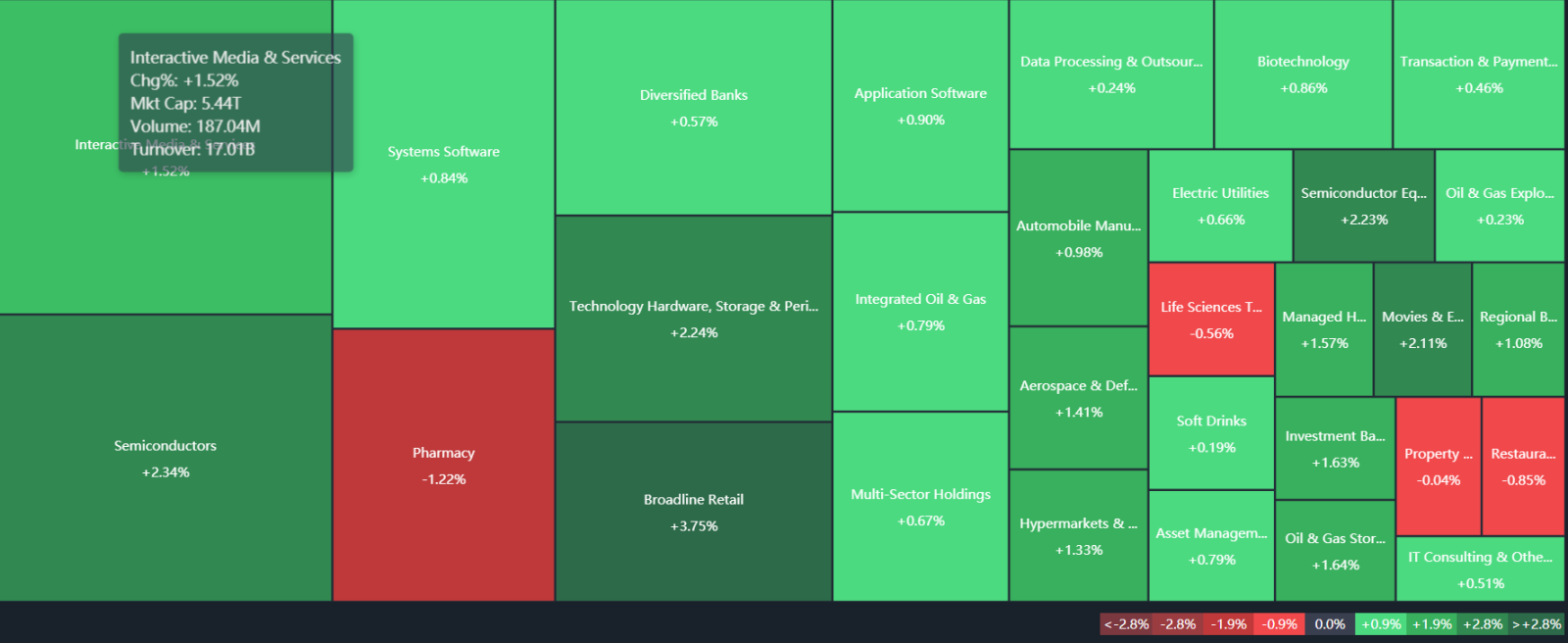

Sector Performance and Highlights

Major gains were noted in specific sectors and stocks. We could see that the semiconductor and broadline retail have more than 2% gains.

The Vanguard Mega Cap Growth ETF (MGK) advanced by 1.2%, and the PHLX Semiconductor Index (SOX,) saw a significant rise of 2.2%, partly fueled by Qualcomm impressive earnings-related surge of 9.7%.

Treasury Yields and Sector Movements

We saw a decrease in Treasury yields in late afternoon, with the 10-year note dropping by two basis points to 4.57% and the 2-year note decreasing by six basis points to 4.88%.

Within the S&P 500, the information technology and consumer discretionary sectors led gains, each up by 1.5%. Conversely, the materials and health care sectors experienced declines, closing down by 0.5% and 0.1%, respectively.

Stock To Watch Today (03 May 2024)

Coinbase reported a robust Q1 with GAAP EPS of $4.40, surpassing expectations by $3.33, and revenue reaching $1.64 billion, a significant 112.3% increase year-over-year. The impressive performance was largely driven by a 36% quarter-over-quarter increase in subscription and services revenue, which benefited from heightened crypto asset prices and an expanded USDC market capitalization.

If we looked at how COIN have been trading for the past 2 weeks, it is actually in sideway, but we could see that MACD is converging and we might see a crossover today (03 May).

Investors interest and sentiment should be coming back as the KDJ did show that buying strength is still present. This would be a good time to look at COIN if you have missed the previous dip.

Block also exceeded Q1 forecasts, posting Non-GAAP EPS of $0.85, which beat estimates by $0.12, and a revenue of $5.96 billion, marking a 19.4% rise year-over-year. The company highlighted a 23% increase in subscription and services-based revenue and processed $54.43 billion in GPV, up 6% from the previous year.

If you look at how Block have been trading, this is a very nice declining wedge, I would think many would avoid this stock, but if you looked at it from a reversal, you would find that from MACD, it is actually doing a converging, and KDJ is also showing signs of buying sentiment.

So with the stellar earnings result, I believe we could be seeing a MACD crossover and KDJ to present a bullish reversal. I think it is time to load up Block as the next quarter earnings should be better from the guidance they provided.

Amgen announced a Q1 Non-GAAP EPS of $3.96, slightly above expectations by $0.05, with revenue of $7.45 billion, aligning with forecasts. The company's performance was bolstered by a 22.1% year-over-year revenue increase.

If we looked at how this stock have been trading, it is basically in a sideway, and there is consistent buying interest and MACD is also flat, with the slight increase above expectations, this stock might not have much upside or Gap up.

Summary

Even though we saw market optimism pushing the indices and stocks to new gains, but do remember that uncertainty still remains. Unless we could see a rate cut in the next 2 months, then we might see some positivity staying in the market.

So I would still place my strategy as part defensive.

Appreciate if you could share your thoughts in the comment section whether you think market optimism would continue into today (03 May) trading?

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment