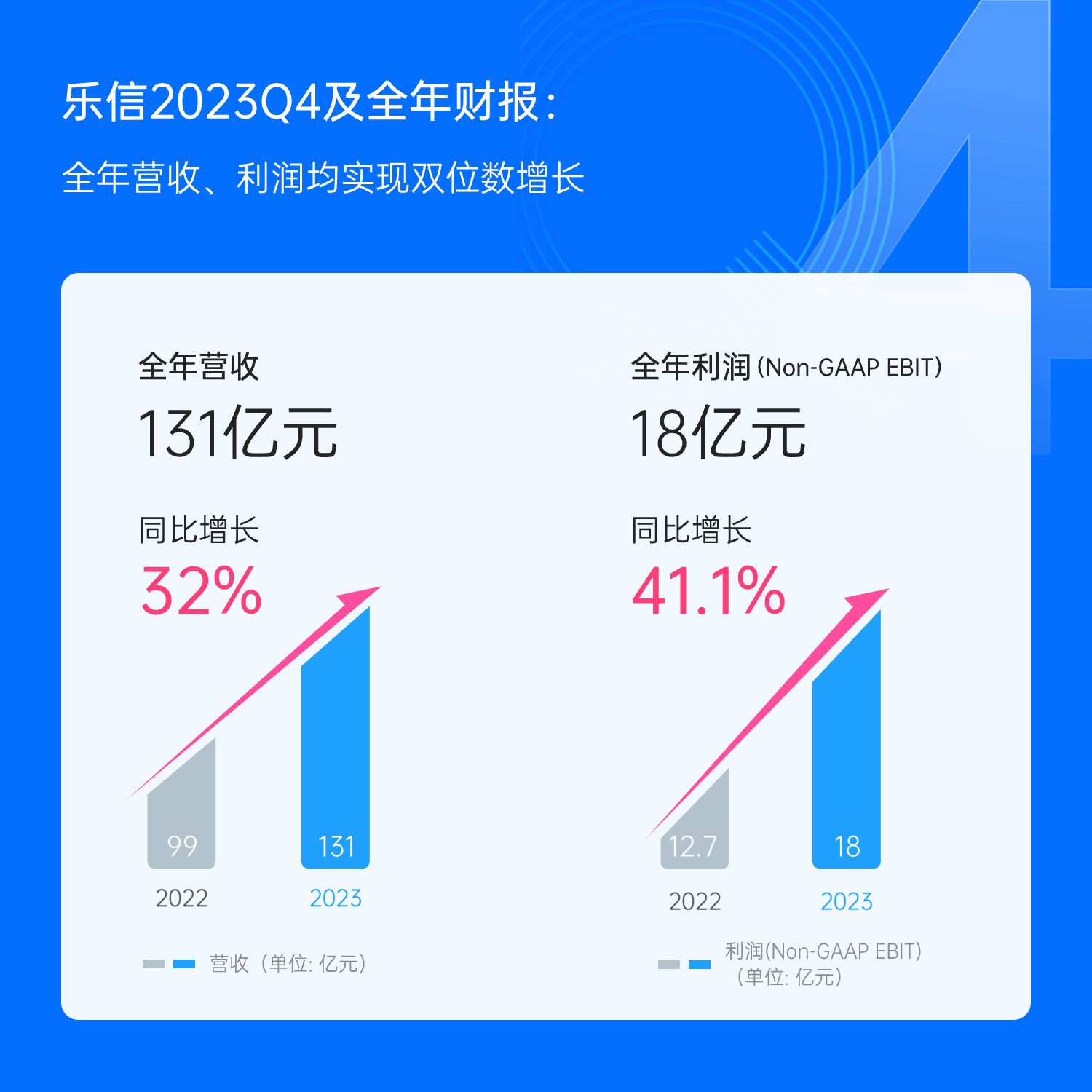

Lexin released 2023Q4 and full-year financial reports: annual transaction volume of RMB 249.5 billion, revenue of RMB 13.1 billion, an increase of 32% year-on-year

On March 21, Beijing time, Lexin, China's leading new consumer digital technology service provider $LexinFintech(LX.US$ Unaudited financial results for the fourth quarter and full year of 2023 were announced. In the current macroeconomic environment and industry environment, Lexin adheres to the two-wheel drive of risk and data, and achieves steady development: fourth quarter revenue of 3.5 billion yuan, up 15.1% year on year; annual revenue of 13.1 billion yuan, up 32% year on year; annual profit (non-GAAP EBIT) of 1.8 billion yuan, up 41.1% year on year. We achieved double-digit growth in both revenue and profit for the full year of 2023.

In terms of scale, the fourth quarter transaction volume was 61.2 billion yuan, up 9% year on year; annual transaction volume was 249.5 billion yuan, up 21.9% year on year; managed loan balance was 124 billion yuan, up 24.5% year on year; number of users was 210 million, up 10.9% year on year; new authorized users and new active users increased by 41% and 51.8% year on year respectively, and corresponding single customer acquisition costs decreased by 28% and 33.1% year on year, respectively.

In terms of financial cooperation, a number of high-quality financial institution partners were introduced during the quarter, and a steady capital structure composed of national joint stock banks, trillion-level urban commercial banks, and urban commercial banks and agricultural commercial banks spread all over the country was gradually formed. Capital costs fell by 20 BP from the third quarter to another record low.

In terms of risk management, Lexin further improved the risk framework and built a full-life cycle risk control system in the fourth quarter, and the quality of new assets improved markedly.

In order to increase shareholders' returns and show confidence in the company's long-term development, Lexin will continue its dividend policy twice a year. This time, cash dividends will be distributed at an amount of about 0.066 US dollars per ADS, about 20% of net profit for the second half of 2023. It is expected to be distributed on May 24, 2024, for shareholders registered on April 18.

Lexin CEO Xiao Wenjie said, “In the fourth quarter, we fully upgraded our risk team and invited Mr. Qiao Zhanwen to join and act as CRO. Zhan Wen has worked for more than 10 years on well-known fintech platforms in the industry. He has rich experience in credit risk control and managed trillions of assets. With his addition, the company's risk control will advance in the direction of more refinement and stability, and the level of risk control will be further improved.

“Looking ahead to 2024, the company will continue to uphold the principles of prudent management, adhere to risk priority, and make every effort to reduce risk and enhance profitability; be customer-oriented and operate in a matrix to provide users with more suitable products and offers; strengthen consumer rights protection and improve user satisfaction; improve diverse business ecosystems to create differentiated Lexin ecological advantages.”

New financial productivity is beginning to show results, and the two wheels of risk and data drive high-quality growth

Financial reports show that Lexin invested 136 million yuan in R&D in the fourth quarter, continuing to lead the industry.

Continued technological investment unleashes efficiency, especially the accelerated development of next-generation artificial intelligence represented by large models, and is becoming an important engine for the development of new types of productivity. The core of new financial productivity is digital finance. During the quarter, Lexin used data and big models to improve financial quality and efficiency by exploring new technologies such as AI and big models and applying them to the entire digital finance chain.

During the quarter, Lexin's self-developed large-scale model application accelerated implementation and played a role in the field of user image recognition. Through training, the big model can automatically analyze various data sources, identify information such as users' industries and repayment intentions, construct differentiated and personalized customer portraits and labeling systems, and realize data-driven refined management of customer groups. In addition, the variable attribution system, which was developed with the aid of a large model, was officially launched in the fourth quarter to monitor changes in business indicators in real time, automatically warn and attribute changes, and actively repair or provide repair solutions, which is equivalent to adding a “high-tech stabilizer” to business and risk to help digitize and intelligently make decisions.

In terms of risk drivers, Lexin rapidly increased the coverage of central bank credit reporting during the quarter, and jointly built the RTA model with ecological data vendors such as Byte. Traffic recognition capabilities were significantly improved, and model upgrades for multiple business lines were completed. The risk ranking index was increased by nearly 30%; the customer hierarchy logic was restructured to divide users into four categories of ultra-high-quality, high-quality, normal, and growth users. The entire process of attracting new, promoting, operating, and retaining customers matched a more complete risk strategy, further enhancing the competitiveness of leading customer group offers. Up 12% from the third quarter to the previous quarter, regular customers New risk decreased by more than 15% month-on-month.

Precisely based on Lexin's continuous exploration and application at the big model level, Lexin won the “Nanfang Daily” 2023 “New Quality, New Power, Industry Development and Innovation Award”.

Actively practice social responsibility: help inclusive finance, boost consumption, promote economic growth, and strengthen consumer insurance

Lexin takes active social responsibility as an important goal of the company and realizes integrated creation of commercial and social value through its different products and businesses.

In the past year, Lexin leveraged the advantages of offline customer acquisition and risk control through inclusive direct customer acquisition teams covering 30 provinces, municipalities, autonomous regions, and 336 cities, to serve small, small and micro enterprises and help the development of inclusive finance. Small and micro enterprises are an important pillar of the national economy, and they are also the source of urban fireworks. In October of last year, the Central Financial Work Conference proposed five major articles, including financial inclusion, to encourage diverse actors to promote the development of inclusive finance to a high quality stage. Lexin's inclusive business will begin penetrating into the industrial belt of low-tier cities in 2023, focusing on serving small and micro industries, individual businesses, and high-quality wage groups to help the local economy develop. Up to now, Lexin Inclusive has provided high-quality financial services to more than 4 million small, micro, and individual businesses, with a transaction volume of over 35 billion yuan.

Lexin's e-commerce business gives full play to the advantages of installments and scenarios, thoroughly explores the consumption potential of young consumers, drives consumption growth, and serves the development of the real economy. Over the past two years, the regulatory authorities have repeatedly proposed “reasonably increasing consumer credit” and “speeding up the development of consumer finance” in various documents, and the Installment Mall has responded positively to implementation. On the basis of maintaining the 3C advantage, the Instalment Mall focuses on creating trendy installment experiences in terms of merchant introduction and category operation, and continues to introduce luxury, sports and other categories that young people love. 452 new brands will be added throughout 2023.

The Instalment Mall is also creating a new consumption growth point for trendy domestic products by issuing coupons to drive consumption growth. At the end of December last year, Instalment Le Mall joined hands with the Shenzhen Nanshan District Government to issue 5 million yuan vouchers. The coupons focus on more than 500 domestic brands, including Huawei, DJI, Yunwhale, and Skyworth, and it is estimated that they will drive consumption to more than 50 million yuan.

In order to further optimize the consumer experience, Lexin recently launched the “Stay Warm Season” campaign to provide financial consumers with heart-warming consumer insurance services, starting with the four aspects of system construction, product functionality, user experience, and financial literacy, effectively strengthening consumer insurance efforts and protecting consumers' rights and interests.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment