Japanese stock market bullish trend persists:Consider these ETFs for exposure.

Introduction

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the first time in history that it has ended a trading session above the 40,000-point threshold.

Why has the Japanese market continued to rise?

Warren Buffett's perspective on the long-term pricing logic of the stock market can be encapsulated in his famous analogy: "In the short run, the stock market is a voting machine; in the long run, it is a weighing machine."

Evidently, Japan is currently experiencing resonance between its 'voting machine' and 'weighing machine'.

1. The Short-Term Voting Machine

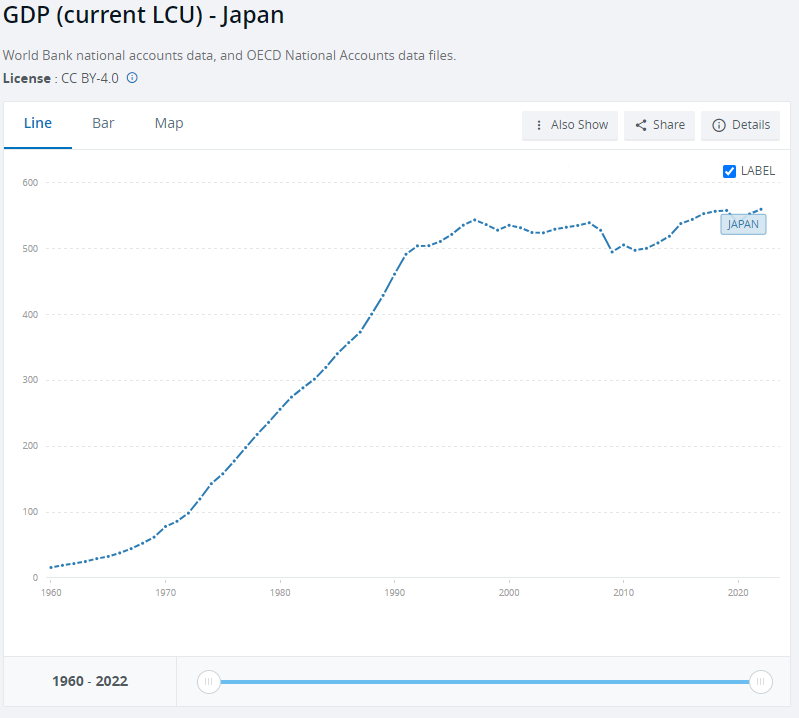

Currently, the Japanese economy is benefiting from a resurgence in consumer spending driven by wage growth and moderate inflation. Corporate earnings are consistently improving, generating stable cash flows. In terms of yen-denominated GDP per capita, there has been an increase (although when considering the depreciation against the US dollar, this growth is negated).

Chart: Yen-denominated Japanese Per Capita GDP

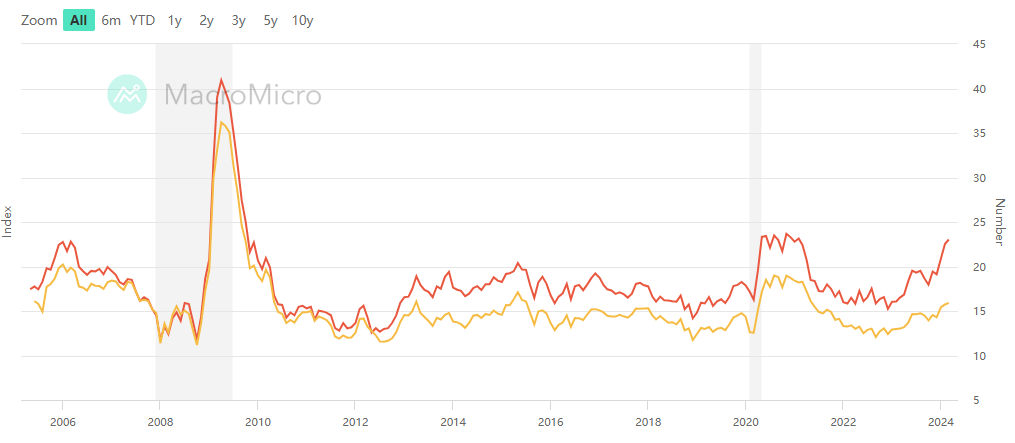

Moreover, the potential for foreign capital inflows is substantial, currently standing at only one quarter of its historical peak. Analysis reveals that the current P/E ratio of the Japanese stock market is estimated to be around 15 to 16 times, which is significantly lower than the 60 times it reached during the burst of Japan's economic bubble in the 1990s.

Chart: Estimated P/E Ratio for Japanese Stocks (Red: Estimated Nikkei 225 Index/Yellow: Estimated TOPIX Index)

2. The Long-Term Weighing Machine

Global investors have not only taken note of the long-term shareholding increases by international giants such as Berkshire Hathaway in major Japanese trading companies but also closely observed a proactive shift among Japanese listed companies towards enhancing shareholder value: In 2023, Japanese listed corporations demonstrated unprecedented strength in share buybacks, with the cumulative total for the year soaring to a new record high of approximately 9.6 trillion yen, marking two consecutive years of record-breaking activity.

Consequently, disregarding the effects of yen depreciation, the Japanese stock market has embarked on an impressively robust bull run. Furthermore, there is a plethora of instruments available to engage in this market, with ETFs serving as a convenient investment tool that provides investors with a simple and efficient way to participate in the performance of the Japanese stock market. Both domestic and overseas markets offer a variety of ETF options. Next, we will introduce several representative Japanese equity ETF products.

I. Japanese Equity ETFs in the Hong Kong Market:

To invest in the Japanese stock market through the Hong Kong Exchange, there are currently three options available.

(1) $ChinaAMC MSCI Japan Hedged to USD ETF(03160.HK$: Tracks the MSCI Japan Equity Index (100% USD hedged) with an annual management fee of 0.5%.

(2) $Global X Japan Global Leaders ETF(03150.HK$: Tracks the FactSet Japan Global Leaders Index, allowing investors to invest in the top 20 Japanese global leaders across diverse industries such as consumer electronics, computers, automobiles, semiconductors, and medical devices. The ongoing charge over a year is 0.68%.

(3) $CSOP Nikkei 225 Index ETF(03153.HK$: Launched by CSOP in late January 2024 in Hong Kong, this is the first ETF in Hong Kong to track the Nikkei 225 Index. The ETF was listed with an initial offering price of HK$78 per unit, a minimum trading unit of 10 shares, and an annual management fee equivalent to 0.99% of the net asset value.

II. In the U.S. stock market, the following ETFs are available for investing in Japanese equities:

(1) $iShares MSCI Japan ETF(EWJ.US$: Offers exposure to the Japanese stock market and tracks the MSCI Japan Index.

(2) $WisdomTree Japan Hedged Equity ETF(DXJ.US$: This ETF not only invests in Japanese stocks but also hedges against yen currency risk, aiming to minimize the impact of exchange rate fluctuations. It is particularly appealing for investors looking to participate in the Japanese equity market while mitigating concerns over potential currency depreciation.

(3) $Ishares Jpx-Nikkei 400 Etf(JPXN.US$: Invests in high-quality Japanese companies that are part of the JPX-Nikkei 400 Index, covering a wide range of industries.

(4) $JPMorgan BetaBuilders Japan ETF(BBJP.US$: Tracks the Morningstar Japan Target Market Exposure Index, providing broad exposure to the Japanese equity market.

(5) $Vanguard FTSE Pacific ETF(VPL.US$: Although not exclusively focused on Japan, this ETF tracks the FTSE Japan Index, including a variety of companies listed on the Japanese exchanges as part of its broader exposure to the Asia-Pacific region.

III. The major uncertainty in investing in Japanese ETFs currently lies in currency risk.

The economic development levels, market sizes, political stability, and regulatory environments of different countries and regions can significantly impact the performance of overseas and cross-border ETFs. Therefore, conducting thorough research on the target's macroeconomic conditions, monetary policies, trade relations, and potential risks is essential before investing.

For Japanese equity ETFs, one of the most prominent risks that can lead to losses is currency exchange rate risk.

Taking the example of $CSOP Nikkei 225 Index ETF(03153.HK$, its underlying assets are denominated in Japanese yen, which means the fund invests in Japanese company stocks priced in yen. However, when investors either add to their investment (through cash subscriptions) or exit their investment (by redeeming shares) in the primary market, these transactions occur via conversion from US dollars to Japanese yen.

Moreover, any dividends distributed by the fund to investors (if applicable) are paid out in Hong Kong dollars. This implies that the net asset value of the fund is subject to fluctuations due to changes in the USD/JPY exchange rate: If the dollar appreciates or depreciates against the yen, the value of the fund’s assets could rise or fall accordingly.

In the secondary market, specifically on the Hong Kong Stock Exchange, investors buy and sell units of this ETF using Hong Kong dollars. Hence, for investors trading this fund on the HKEX, they must not only monitor the fund's performance itself but also be mindful of the exchange rate fluctuations between the Hong Kong dollar and the Japanese yen. Such currency volatility can lead to additional costs or losses during the buying and selling process, even if the fund's performance remains stable, potentially impacting the overall investment return due to currency factors.

Therefore, when investing in Japanese stock ETFs, to address the risk associated with currency fluctuations, our research suggests that the simplest approach would be to directly choose a currency-hedged ETF. This can mitigate depreciation risk; however, as with any coin, there are two sides to consider. On the other hand, if the yen experiences sustained appreciation, it may also result in a decrease in potential returns.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment