Japan: Where more regulation leads to higher stock prices

After decades of languishing stock prices, Japan Exchange Group had had enough

The top of the capital markets pecking order includes not just banks and asset managers, but stock-exchange companies. Quiet and unassuming compared with the traditional masters of the universe, they are no less powerful. Nowhere is this more apparent than Japan.

First off, stock-exchange companies operate many of the indexes that increasingly drive global capital flows. London Stock Exchange Group Plc, for instance, owns and manages the UK’s FTSE gauges alongside a suite of other benchmarks under the Russell brand. While the Japanese exchange’s best-known index is owned by local newspaper group Nikkei Inc, it has the more useful market cap-weighted Topix, which is tracked by over ¥83 trillion of assets ($750 billion).

Second, there’s clearing. Regulation designed to create more transparency and reduce systemic risk has routed trading activity away from opaque over-the-counter markets managed by banks and into clearinghouses, most of which are owned by stock exchange companies. Japan’s primary clearinghouse – Japan Securities Clearing Corporation (JSCC) – is a subsidiary of Japan Exchange Group Inc, operator of the Tokyo Stock Exchange. It currently clears around 70% of yen interest-rate swaps globally and, as yen-based activity ramps up with changes to monetary policy imminent, JSCC’s role in global markets is sure to be enhanced.

Now, their influence is penetrating deeper inside boardrooms. While exchanges have always driven corporate governance policy through companies listed on their venues, they’re increasingly flexing their muscles — particularly in Japan and Korea.

As early as 1869, the New York Stock Exchange formed a special committee to evaluate applications to list securities. The committee was concerned with the character of prospective issuers. Over time, the exchange layered in specific mandates: a requirement to distribute an annual report, to report quarterly earnings, to undertake independent audits. Eventually, Congress folded many of these rules into the Securities Exchange Act of 1934, but the NYSE kept pushing. It required companies to seek shareholder approval for large acquisitions, to have at least two outside directors on boards and to establish an audit committee of independent directors.

Throughout, though, exchanges didn’t get involved in whether shares rose or fell. As long as the stock price remained above US$1 — a strict NYSE requirement — companies were left alone to manage their business.

Not so in Japan. After decades of languishing stock prices, Japan Exchange Group had had enough. In 2022, it reorganized its market segments, calling on the top-tier companies to “commit to sustainable growth and improvement of medium- to long-term corporate value, putting constructive dialogue with investors at the centre.” It then turned on companies whose stocks trade at a discount to book value, encouraging them to consider such factors such as cost of capital and return on equity.

In March last year, it demanded that companies take “action to implement management that is conscious of the cost of capital and stock price” and, exploiting the allure of indexation, launched an index – the JPX Prime 150 – of “leading Japanese companies that are estimated to create value.” In January, it began publishing lists of companies that disclose information in accordance with its request.

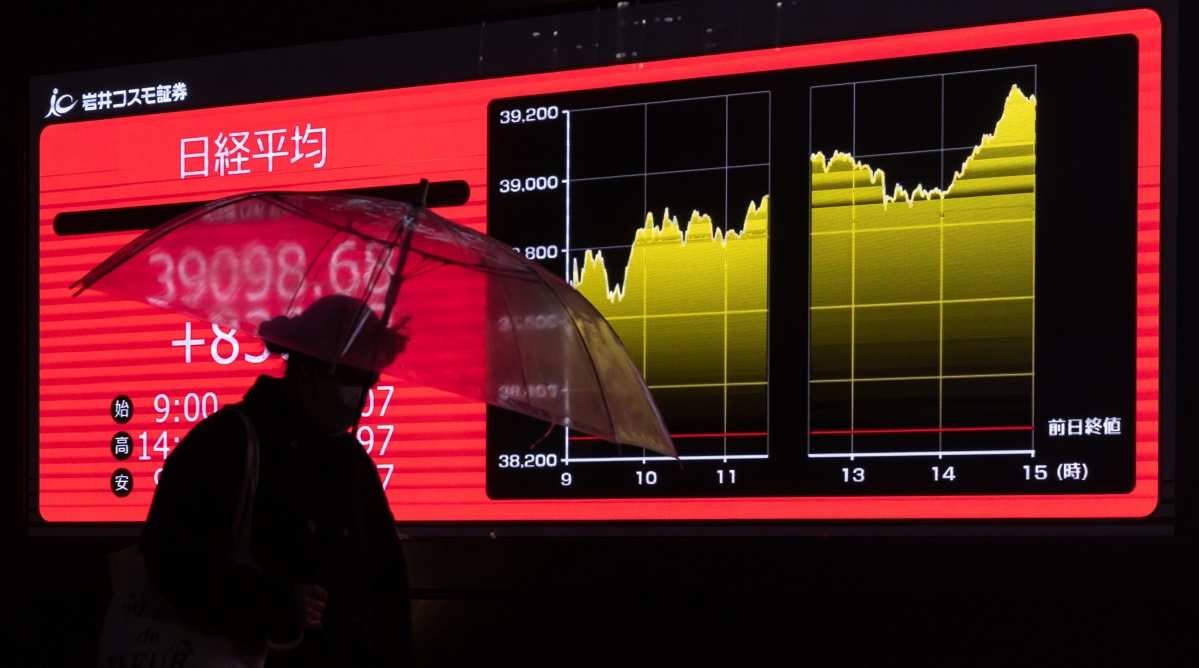

The results have been positive. The number of Japanese companies that trade below book value has shrunk and stocks have rallied. Since the beginning of 2023, the overall market is up 42%.

For Japan Exchange Group, it hasn’t been all bad either. “If corporate executives properly recognize the public attention towards their corporate governance and can continually boost their stock prices, we can anticipate a correlating increase in our revenues as a business entity,” said Iwanaga Moriyuki, president and chief executive officer of the Tokyo Stock Exchange in July 2023. “This might sound simplistic, but that’s the principle.”

Now, Korea is looking to do the same. Like in Japan, many of its stocks trade at a discount to book value. As at the end of January, 64% of constituents of the benchmark Kospi index generated a return on equity below 8%, versus 51% in the Topix (and 23% in the S&P 500), according to Goldman Sachs Group research. In February, authorities announced a “Corporate Value-up Program,” with more details due to be released in May. A “Korea Value-up Index” will be introduced, composed of companies that have proven records of profitability or those anticipated to boost corporate value, and penalties could be imposed on companies that don’t meet standards.

A difference in Korea is that financial supervisory authorities are leading reforms rather than the exchange directly. But that reflects another reason exchanges are top dog: Unlike banks, whose market position has been eroded by onerous regulation over the past 10 years, exchanges benefit from regulation and even help draft it. Alongside their lock on indexation and clearing, their power now also derives from steering corporate strategy. - Bloomberg Opinion:

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment