Is Nvidia's Valuation Too Wild? Nvidia's Surging Growth May Still Disappoint Some Investors

Last week Nvidia’s market cap passed the $1.8trillion mark, leapfrogging Alphabet to become the third most valuable US company after Microsoft and Apple. Moreover, Nvidia options have gone wild, the rolling five-day average notional value of options tied to Nvidia has surpassed Tesla, soaring above $100 billion this year.

However, a scorching rally in Nvidia's shares came to a halt on Tuesday, fell more than 4% as investors worried if the high-flying chip designer's quarterly results would justify its towering valuation.

Is Nvidia's valuation getting too crazy?

Goldman Sachs analyst Toshiya Hari still sees more room for growth

Goldman analysts increased their fiscal 2025 and 2026 estimates for Nvidia's non-GAAP earnings per share by 22% on average to reflect “recent industry data points indicative of robust AI server demand and improving GPU supply.”

"We no longer assume a drop off in Data Center revenue in H2 2024 and instead model consistent growth through H1 2025 driven by continued spending on Generative AI infrastructure by the large cloud service providers, a broadening customer profile, and multiple new product cycles," the analysts wrote.

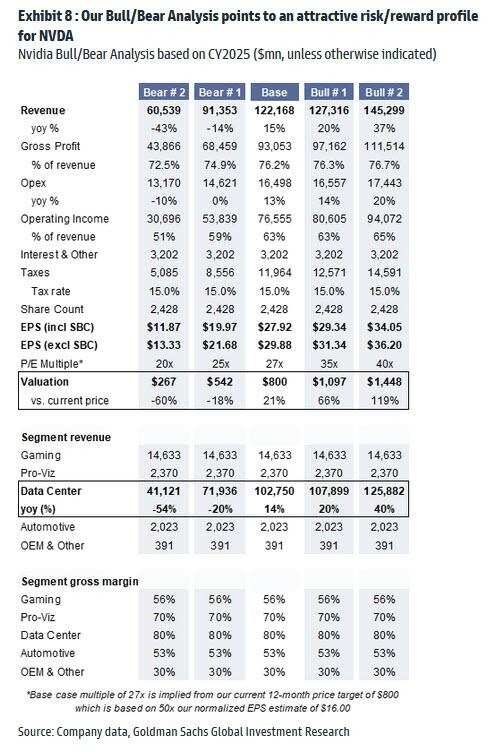

“We reiterate our Buy rating on NVDA with our updated 12-month price target of $800, pointing to 21% potential upside from current levels and our bull/bear analysis indicating an attractive risk/reward profile,” according to Goldman Sachs.

Revenue Projections

The base case for Nvidia's revenue in CY2025 is projected at 122,168 million, with a year-over-year growth of 15%.

Data Center Projections

The base case for Nvidia's data center revenue in CY2025 is projected at 102,750 million, with a year-over-year growth of 14%.

Under base case, Goldman Sachs still sees room for growth with a target price of $800 and a P/E multiple of 27 times.

However, Chameleon Capital analyst has poured cold water on Nvidia's towering valuation

Chameleon Capital analyst Toby Clothier used a simple discounted cash flow model and plugged in Nvidia’s numbers. To get to a $740 share price simply requires that the company maintain a monopolist-like operating profit margin of 55 per cent for the next decade, while also growing sales tenfold, from $60 billion a year to more than $600 billion.

Over the past decade Nvidia did admittedly achieve a similar level of growth: in 2014 its sales were a mere $4 billion. However, Clothier points out that Nvidia’s unusual profitability is a recent phenomenon related to the very high prices pushed through in response to overwhelming demand:

“The EBIT Margins were all over the place from 2014-2023 (range of 12-37 per cent) and certainly nowhere near a steady 55 per cent.”

So Nvidia shareholders are making a bet that the law of large numbers does not apply, and that competition, innovation, and pricing pressure will not come to bear until at least the mid-2030s.

So Mooers, do you think Nvidia's valuation is too crazy? Where will Nvidia go after the earnings report is released?

Source: Financial Times, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment