Iron Ore and A-share Market Weekly Report and Global Capital Market Weekly Report 20240415

Overall

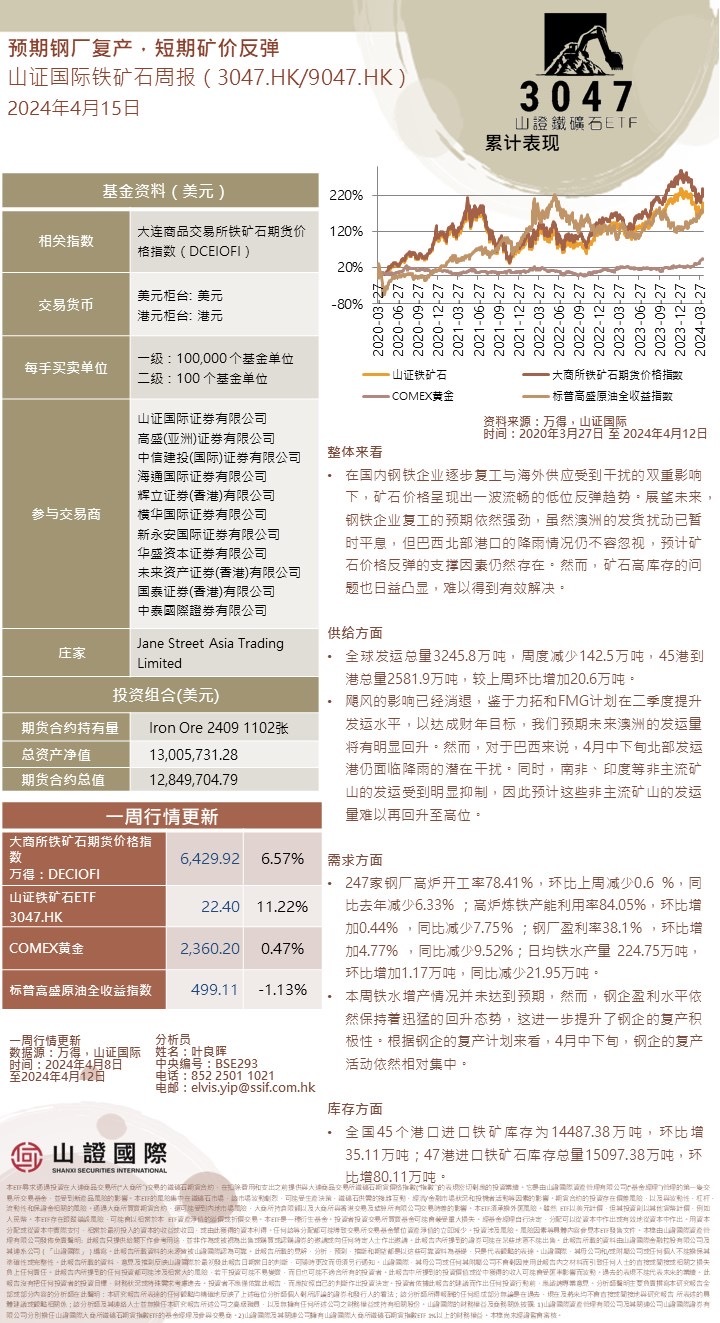

• Under the dual influence of the gradual resumption of work by domestic steel companies and disruptions in overseas supply, ore prices showed a smooth rebound trend at a low level. Looking ahead, expectations for steel companies to resume work are still strong. Although Australia's shipping disruptions have temporarily subsided, the rainfall situation in Brazil's northern ports cannot be ignored, and it is expected that the supporting factors for the rebound in ore prices will still exist. However, the problem of high ore stocks is also becoming more and more prominent, and it is difficult to effectively solve it. $SSIF DCE Iron Ore Futures Index ETF(03047.HK$

On the supply side

• Total global shipments were 32.458 million tons, a weekly decrease of 1,425 million tons, and a total of 258.19 million tons arriving at 45 ports, an increase of 206,000 tons over the previous week.

• The impact of the hurricane has subsided. As Rio Tinto and FMG plan to increase shipping levels in the second quarter to meet fiscal year targets, we expect a marked recovery in Australian shipments in the future. However, for Brazil, the northern shipping port still faces potential disruptions from rainfall in mid-late April. At the same time, shipments from non-mainstream mines such as South Africa and India have been clearly curtailed, so it is expected that it will be difficult for the shipment volume of these non-mainstream mines to rise again to a high level.

Demand side

• The operating rate of blast furnaces in 247 steel mills was 78.41%, down 0.6% from last week, down 6.33% from last year; blast furnace iron production capacity utilization rate was 84.05%, up 0.44% month on month, down 7.75% year on year; steel mill profit ratio was 38.1%, up 4.77% month on month, down 9.52% year on year; average daily iron and water production was 2.247,500 tons, a year-on-year decrease of 219,500 tons.

• The increase in iron and water production this week did not meet expectations. However, the profit level of steel companies maintained a rapid upward trend, which further boosted the enthusiasm of steel companies to resume production. According to steel companies' plans to resume production, in mid-late April, steel companies' activities to resume production were still relatively concentrated.

In terms of inventory

• Imported iron ore stocks in 45 ports across the country were 144.8838 million tons, an increase of 351,100 tons over the previous month; the total stocks of imported iron ore at 47 ports were 1509.738 million tons, an increase of 801,100 tons over the previous month.

This week's A-share weekly report:

The key measures of the “Nine Rules of the New Country” are “emphasizing dividends+strengthening delisting”, which is expected to reshape the A-share ecosystem and consolidate the strong foundation of the index. The quality and effectiveness of dividend factors are expected to continue to improve, which is beneficial to central state-owned enterprise dividend stocks with strong performance release and dividend capacity.

The short-term recovery in demand has strengthened secondary inflationary trading, leading to a volatile market in resource products. Our pricing model shows that copper prices showed signs of slightly surging this week (but pricing has yet to bubble), and the deviation in international gold prices from theoretical fair value is even more significant.

During the performance determination period, grasp the quarterly report and the positive direction of the economy — first-level industries with high performance expectations in the quarterly report and improving month-on-month: communications, automobiles, machinery, beauty, and military. Secondary industries: sports, construction machinery, commercial vehicles, biological products, cosmetics, gas, auto parts, communication equipment, and white electricity.

The molecular side is expected to welcome a “decision”. Until the molecular denominator forms an upward synergy, don't rush to wait patiently for a while; the tactical level suggests focusing on the return of balance in the transaction structure and performance pricing, and finding cost-effective assets with low congestion and improved profit expectations, which will be the decisive player in the next phase.

Industry allocation suggestions: (1) manufacturing going overseas+ performance expectations improvement: construction machinery, commercial vehicles, communication equipment; (2) independent business cycle: pig breeding, oil transport/shipping; (3) in the medium term, stabilizing dividend assets is still the best choice for bottom warehouse allocation. $Value Gold ETF(03081.HK$

Global Capital Markets Weekly Report:

Retail sales were higher than expected, and retail sales were revised upward in January and February. This increased our actual consumption tracking for the first quarter from 2.5% to 3.0% and GDP from 2.4% to 2.7%.

Despite strong retail sales performance, it's unclear if the growth is broadly based, as non-stores bring together all online spending categories — e-commerce is controlling 75% of retail sales growth this month. $Amazon(AMZN.US$

• Under the dual influence of the gradual resumption of work by domestic steel companies and disruptions in overseas supply, ore prices showed a smooth rebound trend at a low level. Looking ahead, expectations for steel companies to resume work are still strong. Although Australia's shipping disruptions have temporarily subsided, the rainfall situation in Brazil's northern ports cannot be ignored, and it is expected that the supporting factors for the rebound in ore prices will still exist. However, the problem of high ore stocks is also becoming more and more prominent, and it is difficult to effectively solve it. $SSIF DCE Iron Ore Futures Index ETF(03047.HK$

On the supply side

• Total global shipments were 32.458 million tons, a weekly decrease of 1,425 million tons, and a total of 258.19 million tons arriving at 45 ports, an increase of 206,000 tons over the previous week.

• The impact of the hurricane has subsided. As Rio Tinto and FMG plan to increase shipping levels in the second quarter to meet fiscal year targets, we expect a marked recovery in Australian shipments in the future. However, for Brazil, the northern shipping port still faces potential disruptions from rainfall in mid-late April. At the same time, shipments from non-mainstream mines such as South Africa and India have been clearly curtailed, so it is expected that it will be difficult for the shipment volume of these non-mainstream mines to rise again to a high level.

Demand side

• The operating rate of blast furnaces in 247 steel mills was 78.41%, down 0.6% from last week, down 6.33% from last year; blast furnace iron production capacity utilization rate was 84.05%, up 0.44% month on month, down 7.75% year on year; steel mill profit ratio was 38.1%, up 4.77% month on month, down 9.52% year on year; average daily iron and water production was 2.247,500 tons, a year-on-year decrease of 219,500 tons.

• The increase in iron and water production this week did not meet expectations. However, the profit level of steel companies maintained a rapid upward trend, which further boosted the enthusiasm of steel companies to resume production. According to steel companies' plans to resume production, in mid-late April, steel companies' activities to resume production were still relatively concentrated.

In terms of inventory

• Imported iron ore stocks in 45 ports across the country were 144.8838 million tons, an increase of 351,100 tons over the previous month; the total stocks of imported iron ore at 47 ports were 1509.738 million tons, an increase of 801,100 tons over the previous month.

This week's A-share weekly report:

The key measures of the “Nine Rules of the New Country” are “emphasizing dividends+strengthening delisting”, which is expected to reshape the A-share ecosystem and consolidate the strong foundation of the index. The quality and effectiveness of dividend factors are expected to continue to improve, which is beneficial to central state-owned enterprise dividend stocks with strong performance release and dividend capacity.

The short-term recovery in demand has strengthened secondary inflationary trading, leading to a volatile market in resource products. Our pricing model shows that copper prices showed signs of slightly surging this week (but pricing has yet to bubble), and the deviation in international gold prices from theoretical fair value is even more significant.

During the performance determination period, grasp the quarterly report and the positive direction of the economy — first-level industries with high performance expectations in the quarterly report and improving month-on-month: communications, automobiles, machinery, beauty, and military. Secondary industries: sports, construction machinery, commercial vehicles, biological products, cosmetics, gas, auto parts, communication equipment, and white electricity.

The molecular side is expected to welcome a “decision”. Until the molecular denominator forms an upward synergy, don't rush to wait patiently for a while; the tactical level suggests focusing on the return of balance in the transaction structure and performance pricing, and finding cost-effective assets with low congestion and improved profit expectations, which will be the decisive player in the next phase.

Industry allocation suggestions: (1) manufacturing going overseas+ performance expectations improvement: construction machinery, commercial vehicles, communication equipment; (2) independent business cycle: pig breeding, oil transport/shipping; (3) in the medium term, stabilizing dividend assets is still the best choice for bottom warehouse allocation. $Value Gold ETF(03081.HK$

Global Capital Markets Weekly Report:

Retail sales were higher than expected, and retail sales were revised upward in January and February. This increased our actual consumption tracking for the first quarter from 2.5% to 3.0% and GDP from 2.4% to 2.7%.

Despite strong retail sales performance, it's unclear if the growth is broadly based, as non-stores bring together all online spending categories — e-commerce is controlling 75% of retail sales growth this month. $Amazon(AMZN.US$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment