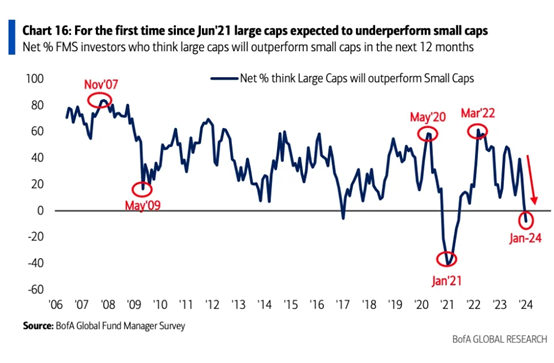

Investors Haven't Loved Small Caps So Much in Nearly 3 Years. But Could This Be Too Optimistic?

Small caps have been all the rage on Wall Street over the past two months.

In fact, according to Bank of America's latest fund managers survey, investors haven't been this bullish on small caps in almost three years.

The survey conducted from Jan.5-11 showed investors see large-cap companies underperforming small-cap companies in the next 12 months for the first time since June 2021.

Source: Bank of America

Wall Street strategists believe the group of stocks - which investors often track by proxy using the Russell 2000 Index- has become increasingly attractive as the prospect of lower interest rates in the year ahead grows.

It took just 48 days between late October and mid-December for the Russell 2000 to rise from a 52-week low to a new 52-week high, marking the fastest turnaround for the index ever, According to Bespoke Investment Group.

Source: Bloomberg

However, with the index up over 16% since its October lows, the key question for investors is whether the index has already priced in the future benefits of lower interest rates, limiting the upside in buying small caps.

Meanwhile, Wall Street's bullish calls on small caps are based on the low current valuations and a healthy economic outlook. Thus, a key caveat to this call could be if "investor expectations for economic growth deteriorate."

Lori Calvasina at RBC Capital Markets has also been recommending small-cap stocks for months, much of Calvasina's case for why small caps could outperform remains intact. But a key part of Calvasina's call, that small caps had been oversold, has flipped amid the recent market rally.

In late October of last year, the Russell 2000's RSI dropped to 30, showing it was oversold, but by mid-December, it had jumped above 80, tipping into the overbought zone.

Source: MooMoo

Notes: RSI1, RSI2, and RSI3 correspond to the 6th, 12th, and 24th respectively.

This has Calvasina "concerned" about how popular small caps have become.

"In December it felt like everyone we met with (including the many varieties of investors who are not focused on Small Cap investing) wanted to talk about Small Caps and was constructive on them," Calvasina wrote in a note.

She added, "We can't remember the last time this happened."

Source: Bank of America, Yahoo Finance, MooMoo, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment