Insightful Analysis: Decoding the Implications of Fed's September Rate-Hike Pause

The Fed paused rate hikes in September and maintained its target range for the federal funds rate at 5.25%-5.50%. Despite this, the Fed reinforced its commitment to "higher for longer" interest rates and provided a more hawkish outlook on interest rates for 2024 compared to earlier forecasts.

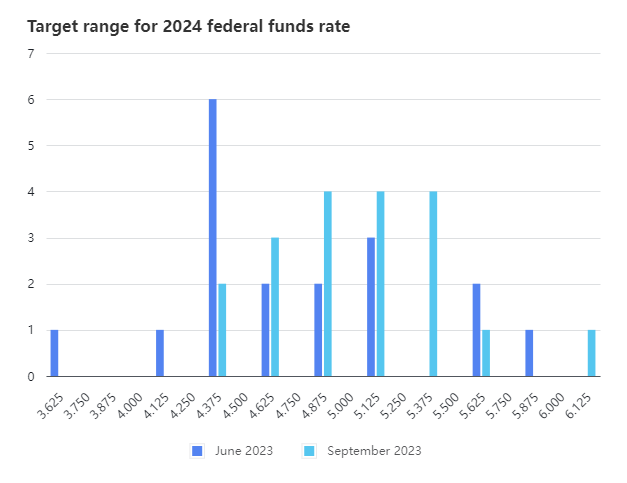

According to the September dot plot, a majority of officials projected the policy rate to be within the range of 4.875% to 5.375% in 2024, significantly higher than the June forecast of 4.375%. In light of the FOMC meeting, market participants have since anticipated a further delay in the first rate cut until the third quarter of 2024.

1. Forecasts of rate cuts in 2024 trimmed from 100bp to 50bp: The median forecast indicates that the policy rate will decrease to approximately 5.1% by the end of 2024, a decrease from 5.6% by the end of 2023. This suggests that only a modest cut of 50bp is likely to occur next year, down from the previously projected 100bp in June, which represents the biggest "hawkish" signal of the meeting.

2. A more confident economic outlook: The Fed has raised its forecast for US economic growth in 2023 from the previous 1% to 2.1%. Additionally, the Fed changed its description of the pace of economic activity from "moderate" in July to "solid".

3. Cooling inflation and a tight labor market are expected: The Fed has revised its forecast for core inflation in 2023 downward from 3.9% to 3.7%, indicating an expectation of further cooling. However, the labor market is projected to tighten, with a revision from 4.1% to 3.8% for the same period.

U.S. Treasury:

As the Federal Reserve is committed to keeping interest rates high for an extended period of time, U.S.Treasury yieldshave surpassed their previous highs, with the 10-year rate reaching 4.41%.

U.S. Stocks:

The surge in U.S. Treasury yields has put pressure on U.S. equity markets, leading to a decline in stock performance.

U.S. Dollar:

High-interest rates and robust US economic fundamentals have supported the dollar's strength.

Source: Federal Reserve, Bloomberg, Zerohedge, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

FearGreed : Nice summary! To be honest it was all as expected but the market is acting as if it were surprised. It’s a theatre!

OceansWave : Unfortunately, the reports and analyst at the FOMC painted the situation differently and positioned it very negatively.