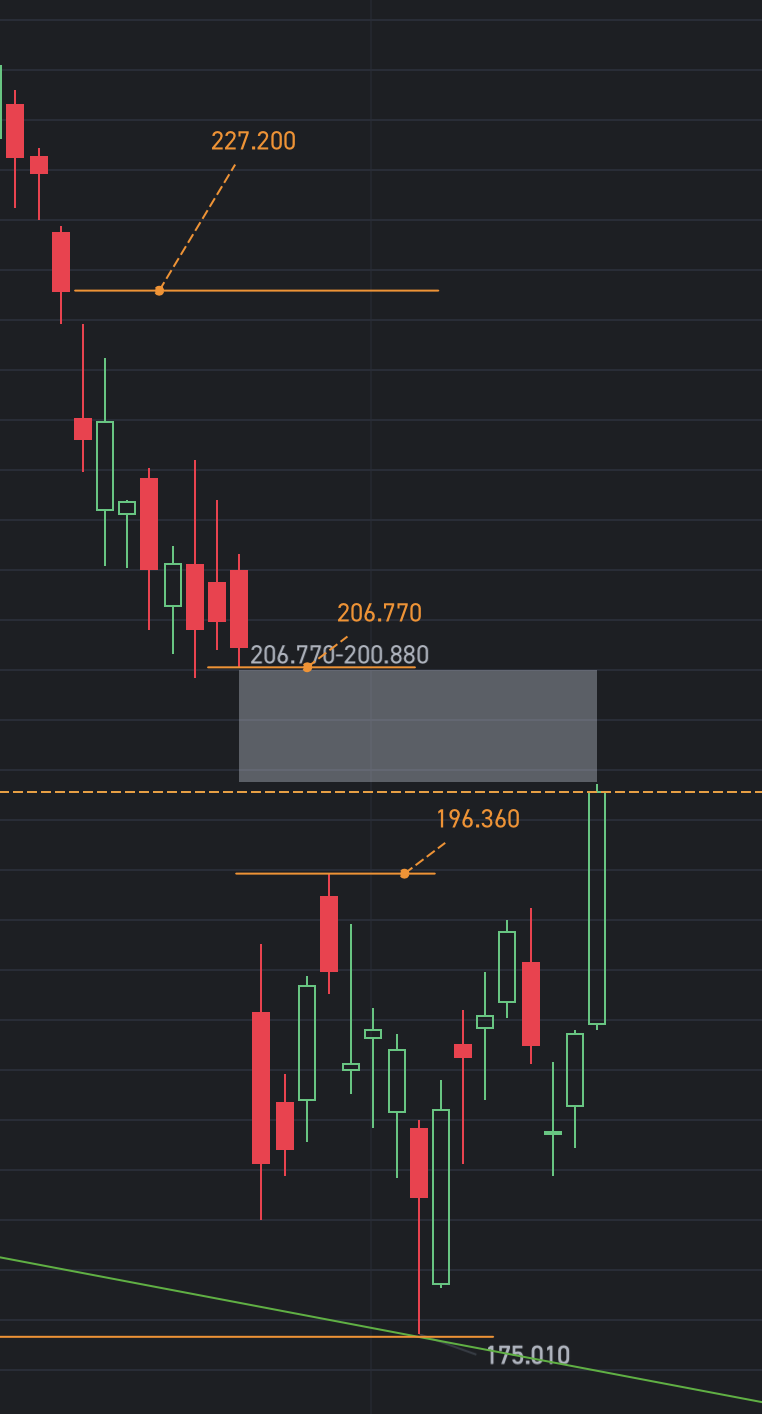

If the bears refuse to surrender and resist to the end, they will lose completely: 196.36 and 206.77

Have you heard and know that gap wins? The retaliatory rebound in Tesla's stock price exceeded JC's original expectations and expectations. Just as Tesla continued to plummet beyond the ordinary, beyond JC's expectations. Therefore, we must fear God and fear the unfathomable principles of the financial market. The role of any technical analysis is very limited in the long course of history. US stocks should have been a long-term value investment.

As long as there are profit prospects, Wall Street will never be stingy; on the contrary, it will give extremely high valuations.

Tesla's stock price has returned to the atmosphere and regained its upward trend. It is the general trend, the aspiration of the people, and the expectations of the public.

If taken down and effectively trampled on 196.36 (The Empty Gates of Hell has already been achieved.) and 206.77 (the one used to tighten the noose for the bears, in progress...), then even if the door to hell for the bears opens.

A ferocious retaliatory backlash is underway,...

Tesla definitely has a bright future. Electric vehicles are not only a means of transportation that has changed energy power, but also an important platform and carrier for the future survival of humans. By implementing artificial intelligence on the platform, they can complete many tasks: point-to-point autonomous driving, mobile internet, mobile Internet of Things, mobile office, mobile living, etc. Tesla is not an ordinary car company, but a real high-tech, rapidly growing US NASDAQ biggest bullish stock. Tesla's complete AI (artificial intelligence) and corresponding profit financial reporting will take some time.

Like a ferocious alligator, it bites the bottom and bottom characteristic signals unwavering, and also continuously corrects the accuracy and trajectory of surgery-type relatively accurate framed discontinuous discrete random variable bottom trading in gradients and batches until it hits the lowest value at the bottom of one dynamic group. People who truly fear God must choose God's life just like Abraham between God's promises and God. Because with God, we have promises; without God, all promises are in vain. What can really support you is a wealth of knowledge — theoretical physics and applied mathematics, modeling, quantitative analysis, functions, nonlinearity; sufficient economic foundation — decent clothing, food, lodging, and travel; continuous emotional stability — trusting God, having an eternal future, not following the world; a controlled pace of life — lifelong learning and progress, optimism and cheerfulness; and your unbeatable self — use your courage and wisdom to lock in one (one is enough) US stocks, flexible positions, and long-term dynamic positions worth owning forever.

There was a time before dawn when it was very dark, there were no stars, and no moon, but you must know that it's already past 4 a.m.

It's really not easy to make large sums of money all at once. It's even harder in the stock market. You must have a clear understanding of the US and American society, and have more than ordinary people's cognition, patience, perseverance, and reserve capital resources. Wealth Jinshan is guarded by evil beasts. As long as they are not cleaned up by evil beasts, they can return home with a full load. The more critical the moment, the crazier the beast. This kind of complexity is simply unintelligible to the public.

Judging from historical big data: bearish and short selling, sharp and mean, there is no place in Wall Street's forest of success.

Speculative competition is the most fascinating intellectual game in the world. But stupid people can't play, people who are too lazy to use their brains can't play, people with poor emotional balance can't play, people who are too confident to face objective reality can't play, let alone fantasy adventurers who want to get rich overnight. Do you know why?

There are four stages in the life of an ordinary shareholder: ignorance, joy and obsession, feeling ashamed and suffering, unrequited anger and disappointment, honest ordinary consumption, and decadent hobbies. What step have you reached?

Now I've learned to eat as much as I can, take a bath, and go to bed early when I'm in pain. It's not that I'm living without heart or lungs, but I know that the pain won't go away on its own; it will stick around in front of me for a long time, and I have to keep up my energy to the end!

For the bulls, the hardest time is over. If you don't have the ability to discern, you will be fooled by the appearance of the market. Empty, lost and found out.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

天津小丸子 : i no sell just buy