Fuel Price Spike Shadows US Election, Inflation Woes

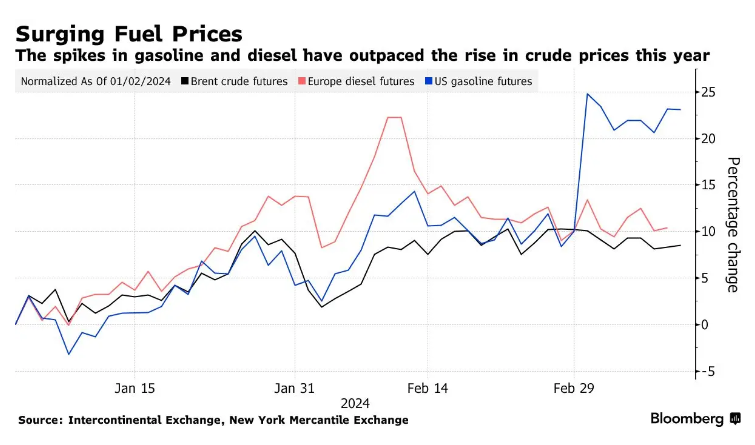

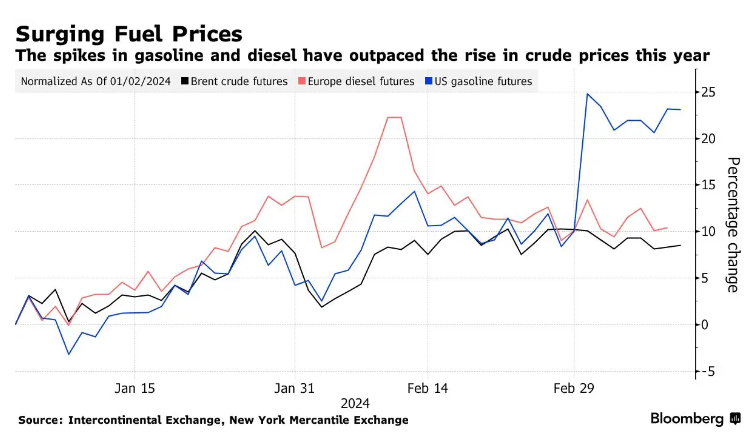

Surging gasoline prices pose inflation risks in US election year, with futures up over 20% amid global disruptions.

Fuel Price Surge Amid Global Disruptions

Global fuel prices are on the rise, significantly outpacing the increases in crude oil prices, primarily due to disruptions on major trade routes, refinery closures, and a resurgence in demand. In the US, gasoline futures have seen a sharp increase, now up by more than a fifth this year, while diesel prices in Europe have climbed by 10%. These developments come at a critical time ahead of a US presidential election where inflation is a central issue.

Scheduled maintenance, unplanned outages, and drone attacks on Russian facilities, along with higher shipping costs due to Houthi attacks in the Red Sea and drought at the Panama Canal, have contributed to the tightening of fuel supplies. The situation is further complicated by the delays in over a million barrels-a-day of new refining capacity set to come online this year.

Impact on US and Global Markets

The US is particularly feeling the pressure, with gasoline prices at the pump now 60% higher than at the start of November 2020. This price hike could influence American voters' perceptions of their economic well-being compared to when President Joe Biden was elected. US stockpiles of gasoline and diesel-type fuels are well below seasonal norms, offering less of a supply cushion than usual.

Globally, the demand for oil is expected to break another record this year, with refinery crude processing also forecasted to rise. However, the availability of octane-enhancing blending components for gasoline, especially with the US summer driving season approaching, remains a significant concern.

Refining Capacity and Market Outlook

Despite the challenges, new refining capacities, such as Nigeria’s Dangote refinery and Petroleos Mexicanos’s Dos Bocas plant in Mexico, have started to export fuel. However, questions linger over when these facilities will reach full capacity and how quickly specific units will come online.

Goldman Sachs and other analysts expect refined product margins to remain elevated and volatile, with strong demand growth for refined products roughly in line with net gains in refining capacity. However, disruptions to the supply of crude and feedstocks, sanctions on Russian oil, and changes to global trade flows are influencing decisions on fuel production. $Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$ $S&P 500 Index(.SPX.US$ $Occidental Petroleum(OXY.US$ $Chevron(CVX.US$

Global fuel prices are on the rise, significantly outpacing the increases in crude oil prices, primarily due to disruptions on major trade routes, refinery closures, and a resurgence in demand. In the US, gasoline futures have seen a sharp increase, now up by more than a fifth this year, while diesel prices in Europe have climbed by 10%. These developments come at a critical time ahead of a US presidential election where inflation is a central issue.

Scheduled maintenance, unplanned outages, and drone attacks on Russian facilities, along with higher shipping costs due to Houthi attacks in the Red Sea and drought at the Panama Canal, have contributed to the tightening of fuel supplies. The situation is further complicated by the delays in over a million barrels-a-day of new refining capacity set to come online this year.

Impact on US and Global Markets

The US is particularly feeling the pressure, with gasoline prices at the pump now 60% higher than at the start of November 2020. This price hike could influence American voters' perceptions of their economic well-being compared to when President Joe Biden was elected. US stockpiles of gasoline and diesel-type fuels are well below seasonal norms, offering less of a supply cushion than usual.

Globally, the demand for oil is expected to break another record this year, with refinery crude processing also forecasted to rise. However, the availability of octane-enhancing blending components for gasoline, especially with the US summer driving season approaching, remains a significant concern.

Refining Capacity and Market Outlook

Despite the challenges, new refining capacities, such as Nigeria’s Dangote refinery and Petroleos Mexicanos’s Dos Bocas plant in Mexico, have started to export fuel. However, questions linger over when these facilities will reach full capacity and how quickly specific units will come online.

Goldman Sachs and other analysts expect refined product margins to remain elevated and volatile, with strong demand growth for refined products roughly in line with net gains in refining capacity. However, disruptions to the supply of crude and feedstocks, sanctions on Russian oil, and changes to global trade flows are influencing decisions on fuel production. $Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$ $S&P 500 Index(.SPX.US$ $Occidental Petroleum(OXY.US$ $Chevron(CVX.US$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Kody Lehman6 : good job now its time to gev back to the peple...