FOMC Preview: Will Cooling Inflation Prompt the Fed to Discuss Rate Cut Details?

At 2 p.m. ET on January 31st, the Fed will announce its first interest rate decision of the year. While economists widely anticipate that the central bank will keep interest rates unchanged this month, market participants are eagerly awaiting any indications from Chairman Powell regarding the first rate cut of 2024, as well as any further information on the potential slowdown of the Fed's balance sheet reduction (QT).

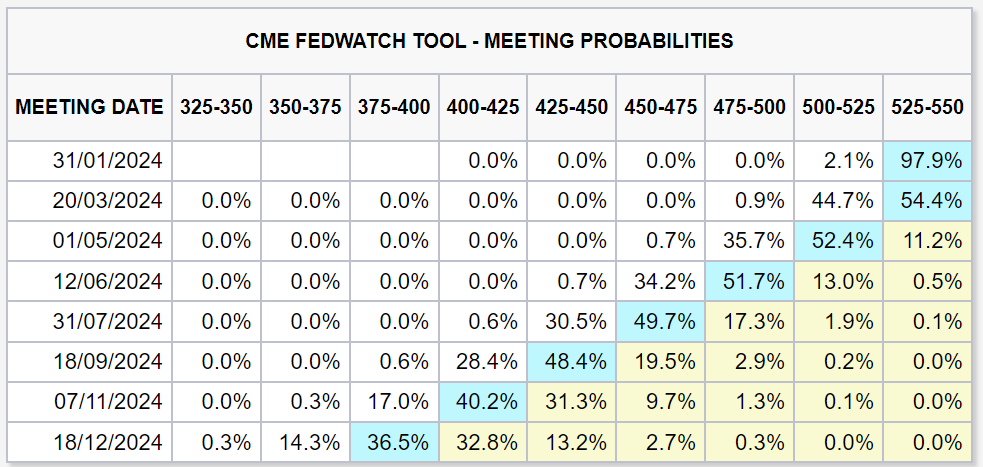

The market widely expects that the Federal Reserve will not cut interest rates for the first time in January. According to the CME FedWatch Tool, the market's expected timing for the first rate cut has fluctuated between March and May. Futures traders' latest estimates show that the likelihood of a rate cut in March is slightly less than 50%, while the probability of a cut in May is 88.8%.

Although the policy rate is likely to remain unchanged in January, the Fed may use this discussion to prepare for future monetary easing. Powell's comments on inflation, economic growth, and the path of interest rate cuts for the year are closely watched.

1.The Latest Economic Data: What Messages Are They Conveying to the Market and the Fed?

● Inflation Continues to Move Forward Towards the 2% Target

Since the December FOMC meeting, inflation data have continued to moderate. Despite the headline CPI rebounding from 0.1% MoM to 0.3% MoM in December, exceeding expectations, the core CPI remained unchanged at 0.3% MoM, which was in line with expectations.

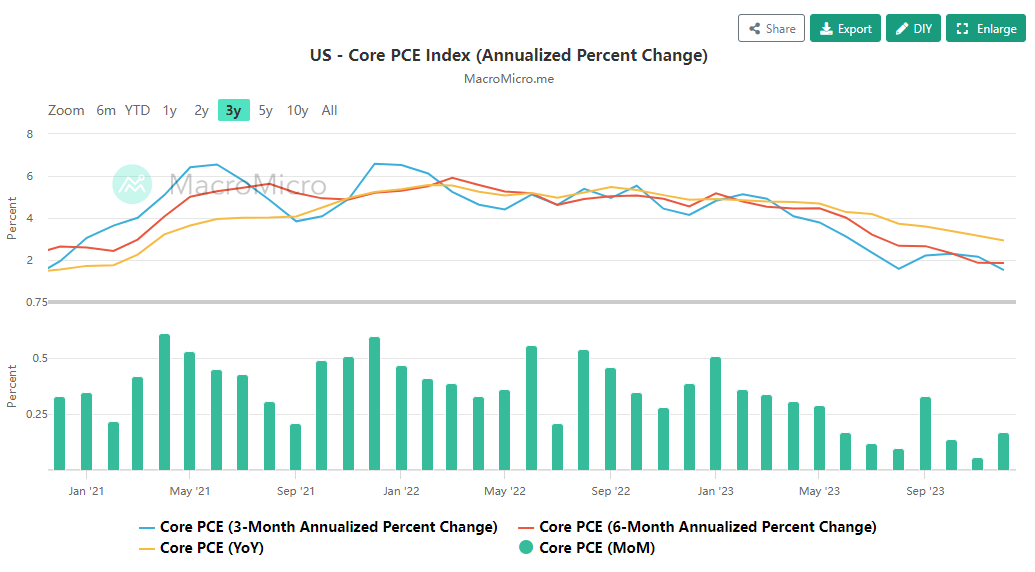

The Core Personal Consumption Expenditures Price Index (Core PCE), which is the Fed's preferred measure of inflation, grew by 2.9% YoY in December. This figure was lower than both the expected 3.0% and November's 3.2%, making it the slowest YoY increase since March 2021. Notably, on a six-month and three-month annualized basis, the Core PCE was only 1.9% and 1.5%, respectively, both below the Federal Reserve's target rate of 2%.

Additionally, inflation expectations have substantially eased, as demonstrated by both the NY Fed and University of Michigan consumer surveys. Previously, the market was concerned that sticky inflation may have an impact on the Fed's rate-cut process. However, it seems that the slowdown in inflation has been verified by data currently, the FOMC may have reasons to be confident that inflation is gradually trending towards a sustainable return to the 2% target.

● US Economy Continues to Grow Steadily, Enhancing Confidence in a Soft Landing

Recent data on consumption and GDP indicate that the US economy is still growing strongly. Specifically, driven by sales growth in several subsectors such as Clothing (+1.9% MoM), Nonstore Retailers (+1.64% MoM), and Motor Vehicle (+1.11% MoM), retail sales in December increased by 0.6% MoM, exceeding market expectations of 0.4% and November's 0.3%, marking the strongest growth rate in three months.

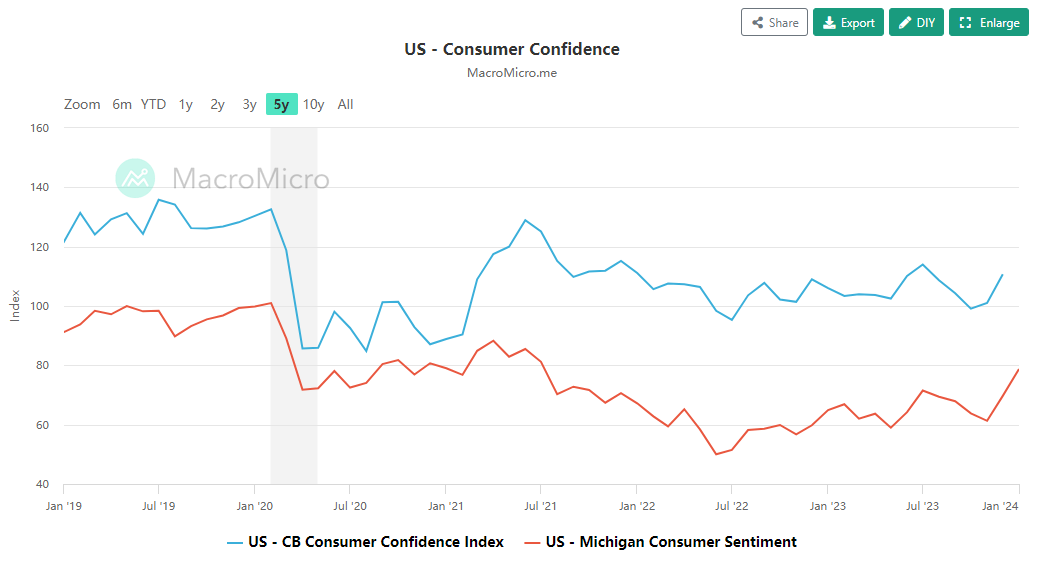

Meanwhile, as wage growth outpaces inflation, the University of Michigan's consumer confidence index rose 9.1 to 78.8 in January, reaching its highest level since July 2021. The index has soared 29% since November 2021, the largest two-month gain since 1991, further indicating that consumer sentiment is improving.

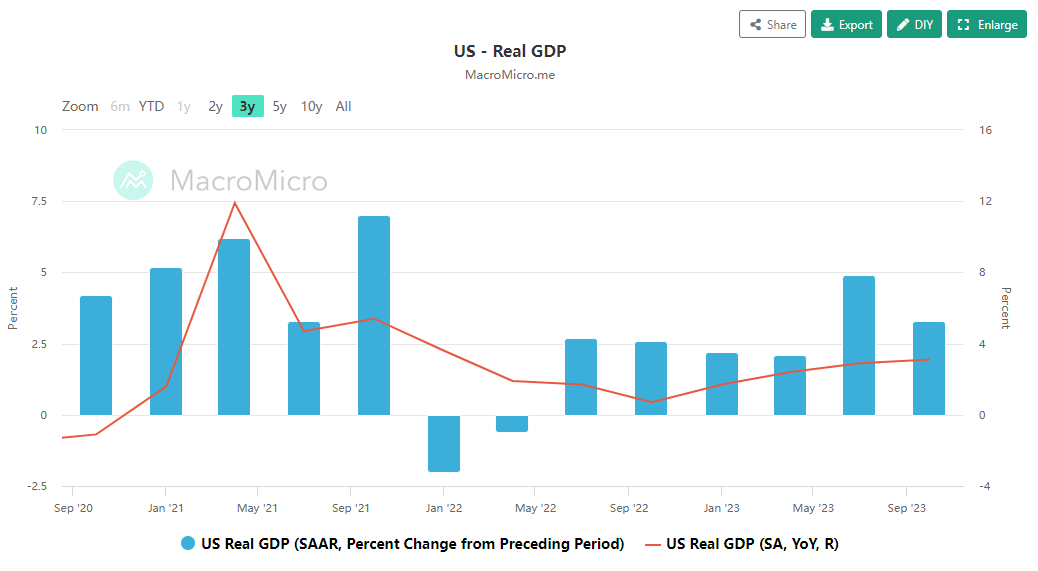

Strong consumer spending data also bolstered the better-than-expected US Q4 economic growth. According to data from the US Bureau of Economic Analysis, US real GDP increased at an annual rate of 3.3% in the Q4 of 2023, far exceeding the market's expected 2%. The full-year economic growth in 2023 is 2.5%, marking the fastest annual growth in the past two years.

● Labor Markets Remain Resilient

The US economy added 216,000 nonfarm jobs in December, a significant increase from the expected 170,000, with the unemployment rate remaining unchanged at 3.7%. Average hourly earnings saw a steady increase of 0.4% on a monthly basis and 4.1% on a yearly basis.

However, 10 out of the past 11 non-farm employment reports have seen significant downward revisions, with October and November being revised down by 45,000 and 26,000, respectively. JOLTS data also showed that job vacancies in November 2023 fell to their lowest level since April 2021, indicating a cooling in labor demand. Furthermore, the Institute for Supply Management (ISM) reported a sharp drop in the employment sub-index of its service sector index to 43.3 in December - hitting the lowest point since July 2020. This figure appears out of line with other survey data showing steady hiring.

These data points suggest that while the US labor market remains resilient, it is not necessarily overheating. Nick Timiraos, the chief economics correspondent for The Wall Street Journal, is often referred to as the "Fed whisperer" noted that:

" The December jobs report doesn't scream 'change your policy stance' for the Federal Reserve."

● Financial Conditions Continue to Ease

Both the Goldman Sachs Financial Conditions Index and The Chicago Fed's National Financial Conditions Index (NFCI) indicate that financial conditions in the US have continued to ease in recent weeks. Specifically, the NFCI ticked down to -0.57 in the week ending January 19th. This may lead Powell to be somewhat vague in his statements regarding interest rate cuts during his press conference, with a continued emphasis on selectivity and data.

A positive value for the NFCI indicates financial conditions that are tighter than average, while a negative value indicates financial conditions that are looser than average.

2. Will the Fed Discuss the Timing and Magnitude of Interest Rate Cuts During this Meeting?

Policymakers at the December meeting mentioned the likelihood of rate cuts in 2024 but did not delve into when and how fast they would occur. The market is eagerly anticipating further discussion on this topic during this week's meeting.

Before the release of the persistently cooling PCE data, analysts from Nomura believed that the Fed is likely to shed its hawkish stance during this meeting and keep options open for future policy easing. However, the meeting are unlikely to commit to a specific timeline or any signal of an imminent rate cut. This aligns with Waller's recent statements emphasizing that the Federal Reserve moves would need to be "carefully calibrated and not rushed."

"Fed is not behind the curve and will not feel any urgency to cut rapidly as long as growth and labor data remain positive."

But following the PCE data, Nick Timiraos, also known as the 'Fed whisperer', wrote that the modest US inflation pressure in December could allow the Fed to consider when and how much to cut interest rates. Timiraos further points out that the Fed officials are expected to maintain interest rates at the current level during the meeting, and may remove the previous hawkish tone. This is partly because officials are concerned that maintaining interest rates while inflation falls may cause inflation-adjusted real interest rates to rise to a level that unnecessarily suppresses economic activity.

Bloomberg Intelligence has shared similar views and also suggested that their base case scenario is for the Fed to cut rates at the March meeting:

"The faster-than-expected pace of disinflation recently gives policymakers room to support the maximum-employment side of their mandate. With survey data from Fed districts flagging faster deterioration than the hard data show, FOMC officials probably aren't as confident about a soft landing as the market is."

Since the December FOMC minutes indicated that several participants suggested initiating discussions on when to slow down quantitative tightening (QT) after considering decisive technical factors, Federal Reserve officials have recently issued frequent signals to slow the pace of balance sheet reduction. Wall Street is eager to determine when this quantitative tightening (QT) will come to an end.

According to Bloomberg Intelligence, the balance-sheet policy is independent of rate moves. Given the uncertainty surrounding what constitutes an appropriate level of bank reserves, the Fed will reduce QT in May, specifically before mid-year.

"We expect a more detailed announcement to be issued at the March meeting, and for the tapering of QT to commence in May."

UBS also stated in a recent report that the Fed will gradually slow down QT from the second quarter of this year and will end QT by mid-year.

Nomura believes that the FOMC is likely to discuss adjusting the pace of balance sheet reduction at this meeting. It suggests that the Federal Reserve may reveal that a slowdown in quantitative tightening (QT) is reasonable later this year, but given the abundance of reserves, the FOMC can afford to be patient about a potential adjustment at this time.

Source: Bloomberg, Nomura, Wall Street Journal, MacroMicro

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Short it Amyi: What kind of serious hair will it be

RAF Trader 108 : Thank you for this excellent overview on the up coming Feds report.