Following the general trend, anti-technology, anti-humanity.

【Core Hint:In the US, historical big data has proven that speculators can never beat investors. Delivering charcoal in the snow is far more clever and meaningful than the icing on the cake.]

1. In a society where there are many ignorant people, it is easy to see Galeries Lafayette and Boxers.

2. Half of the people use repeated informs to lie, and the other half use nationalism to lie.

3. Efforts that seem silly are shortcuts to success.

3. The furthest distance in the world is the distance between “thinking” and “getting,” because there is a gap between “doing”, and there are thousands of mountains and waters.

4. People often only look at the immediate purpose and forget about the crisis behind them.

3. The furthest distance in the world is the distance between “thinking” and “getting,” because there is a gap between “doing”, and there are thousands of mountains and waters.

4. People often only look at the immediate purpose and forget about the crisis behind them.

Classic K-line pattern when the main force draws money -- multiple Xiaoyang plus single middle yin

The entry of the main players into the market changes the long and short power of an individual stock, and the stock price will slowly rise unwittingly, driven by active buying by the main players. However, the main force's position opening is generally controlled within a price range in a planned manner. After the stock price rises, the main force usually uses a small amount of chips to quickly suppress the stock price at the right time (when the market falls or the end of the market). This period of rapid suppression is commonly called a quick fall in order to continue opening positions again at a lower price. This repetition forms a wave or wave of negative N-shaped K-line patterns on the K-line chart.

The entry of the main players into the market changes the long and short power of an individual stock, and the stock price will slowly rise unwittingly, driven by active buying by the main players. However, the main force's position opening is generally controlled within a price range in a planned manner. After the stock price rises, the main force usually uses a small amount of chips to quickly suppress the stock price at the right time (when the market falls or the end of the market). This period of rapid suppression is commonly called a quick fall in order to continue opening positions again at a lower price. This repetition forms a wave or wave of negative N-shaped K-line patterns on the K-line chart.

Be patient. Choosing the right time and point is very critical. In particular, choosing the timing is even more critical. It accounts for 70% of the criticality. The factors that determine success or failure in life are wins and losses at critical moments and wins and losses at key events. The factors that determine the success or failure of life in the stock market are wins and losses during periods of major fluctuations in the stock market; winning or losing at critical moments depends not only on a person's professional experience, but also on a person's overall quality, as well as a moderate mindset and detailed rhythm of handling. When the stock market index plummeted and plummeted, when the graphics and indicators were at their ugliest, it was enough to act as if the strong were never going back. It was enough to resolutely establish positions in BOLL's LOWER position in batches when the stock market index plummeted and plummeted; the rest is up to you. When I watch TV or online news, I hear that the stock market is full of blood and sorrow, and it's completely over, then go against the current, be a raging star, and do the opposite -- buy it! Buy it! Buy it! That's right.)

People in the mix tend to get worse and more pessimistic.

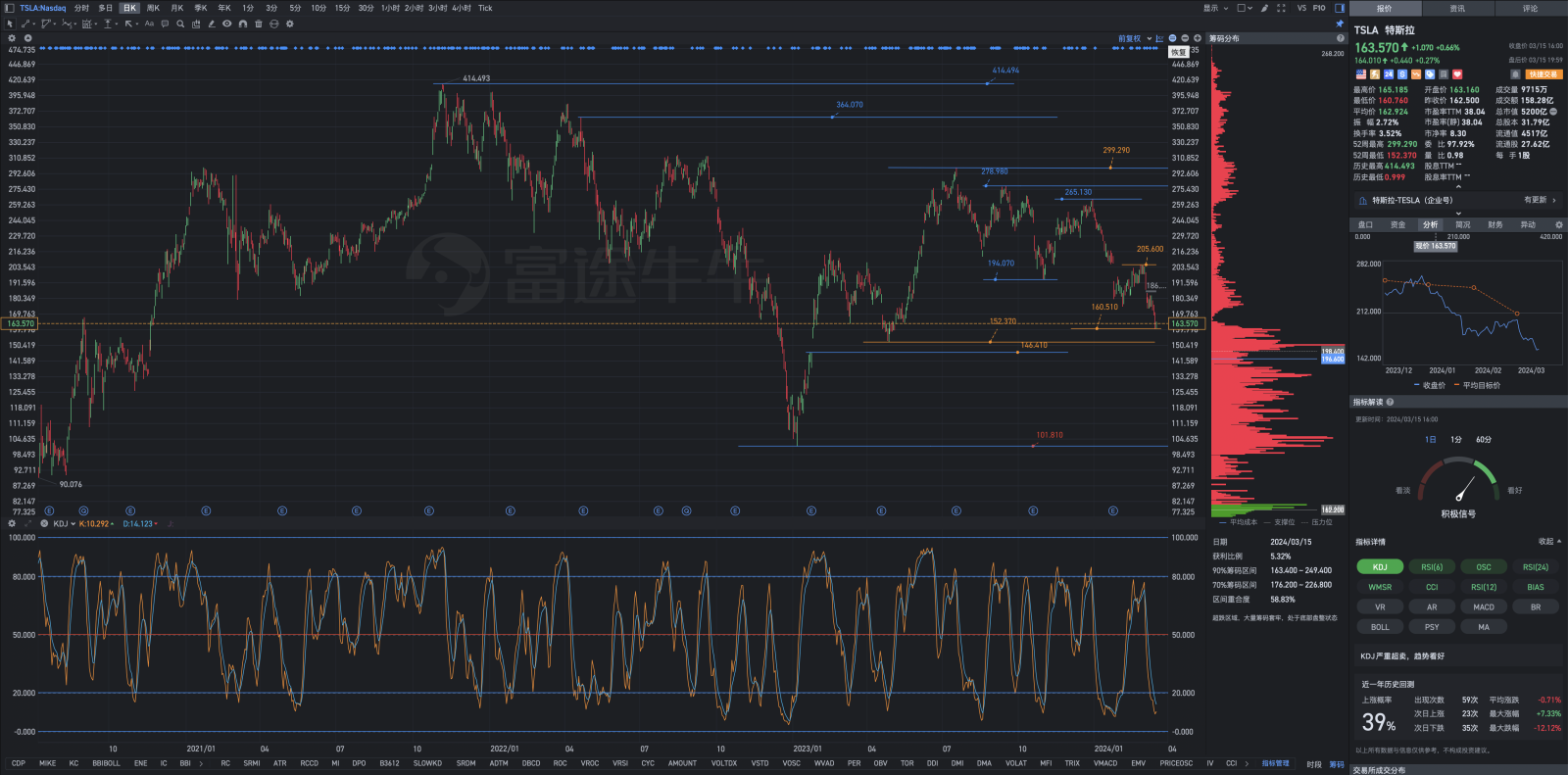

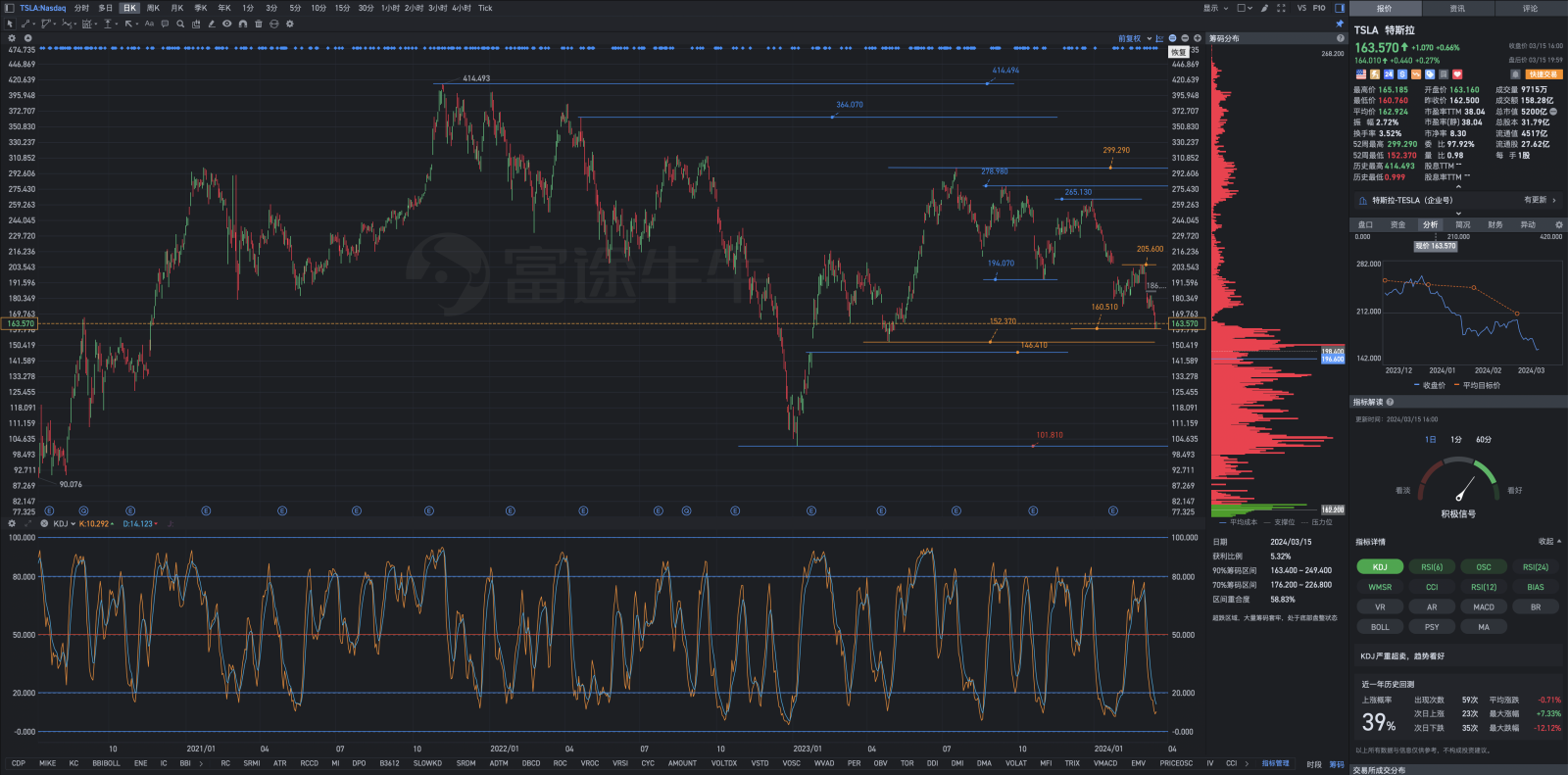

Expanding the stock price flood zone 162.900-152.370-146.410-101.810? Others claim that the stock price will reach 23.370 points, so there will be no bubble, which is compatible with the PE it should have.

Yes, Jerome will increase capital and expand shares.

Jerome advised you to be optimistic and cheerful, avoid being harsh and mean, which is of no benefit to others or yourself. The body is equipped with a personal protective pistol and plenty of magazines, leaving room for talking and doing things. There are many interesting and meaningful things to do in this world, far more than just speculative arbitrage. In the US, historical big data has proven that speculators can never beat investors. Delivering charcoal in the snow is far more ingenious and meaningful than icing on the cake.

Keep the following in mind: In 2010, Tesla lost money for a long time, was unprofitable, and the stock price remained low for a long time, and more than 90% of market participants sold cheap Tesla shares with a sense of depression and extreme frustration (I don't know how many times stronger Tesla and Elon Musk are now than they were back then). At almost the same time, Stephen A. Schwarzman (Stephen A. Schwarzman), a Jewish-American superrich philanthropist worth over $10.8 billion and one of the founders of BlackRock, said to his family, from adults and children to young grandchildren, that every week they save a little money every month from other places, even if they can only buy one Tesla stock, and keep it there like a bank. On August 26, 2018, or about 8 years later, Tesla's stock price finally climbed from 1.13 to 371. This is almost a 33,000% increase.

You can do whatever you originally do. Those without professional trading skills are encouraged to hold on a long-term basis. There are dividends and dividends. Once you make a profit from the sale, don't forget to pay taxes. Paying taxes is a good thing, and it's good for yourself. It's a good thing, an honor!

Reiterate:In the US, historical big data has proven that speculators can never beat investors. Delivering charcoal in the snow is far more clever and meaningful than icing on the cake.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

WilliamZheng : It is better to listen to your voice than to read ten years of books

Elias ChenOP WilliamZheng: Thank you for your generosity,my pleasure,my pleasure.(感谢你的慷慨,我的荣幸。)