Did the Fed's Dovish Pivot Spark Early Santa Claus Rally?

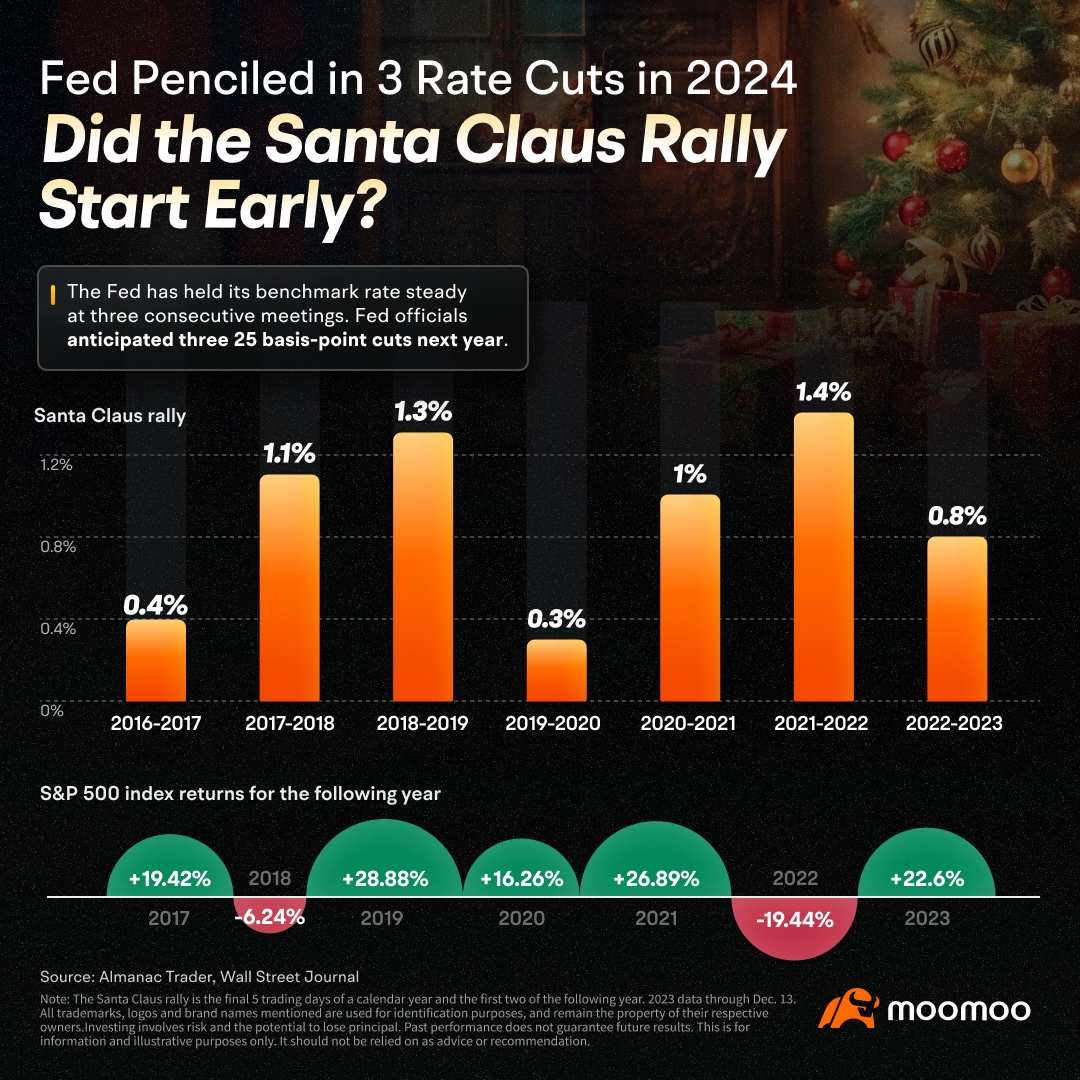

Stock investors are getting early Christmas presents: The Fed has held its benchmark rate steady at three consecutive meetings and Fed officials anticipated three 25 basis-point cuts next year, igniting a rally on Wall Street.

Did the Fed’s dovish pivot spark early Santa Claus rally?

The Santa Claus rally is the final five trading days of the year and first two trading days of the following year, coined by Yale Hirsch, founder of the Stock Trader’s Almanac. Historically, there has been a trend of positive returns during these seven days, with the seven-day combo being higher 79.2% of the time and an average return of 1.33% from 1950 to 2022, according to LPL Research.

While there is no definitive explanation for this trend, there are several theories as to why it occurs. One popular theory is that investors become more optimistic during the holiday season, leading them to buy more stocks. Another theory is that many investors take time off work during this period, which can lead to lower trading volumes and less volatility.

This, in turn, may make it easier for stock prices to rise. However, it's worth noting that the Santa Claus Rally is not a guaranteed event and there are years when it doesn't occur. In addition, some analysts warn that investors should not rely solely on historical trends to make investment decisions.

Source: LPL Research, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

RIPPER : God I hate when the term “Santa Rally” gets thrown around …..makes me think I shouldn’t be so bullish

Paul A Meza : my s&p got cut down more than I expected it's funny because most of the percentages go to Internet and crypto base but never in me the direct owners hands ...the family of s&p (comon Paul get s) has been mistreated for years not receiving one penny.

Peanny : Reset on its way.

Paul A Meza : I'll be hitting a reset soon as well let's see what Santa has in mind

OceansWave : This is what these analyst want.. retail investors to keep buying and they quickly offload… whenever analyst say shit like this… always take it with a pinch of salt… because they would not want to say things that don’t benefit them..