Escalating Conflict in the Red Sea: What Are the Potential Impacts?

Geopolitical tensions in the Red Sea have escalated significantly. Following last week's announcement by four major shipping companies that they would suspend operations along the Red Sea route, oil giant BP also confirmed on Monday that it will suspend transportation through the region.

Given the vital significance of the Suez Canal for international trade, analysts have warned that ongoing conflicts and waterway obstructions are posing fresh challenges to global supply chain security, causing disruptions across various industries including shipping and energy. The situation may even heighten the upward risk of inflation in some regions.

In early December, the Houthis declared a ban on sailing in the Red Sea and Arabian Sea for any ship heading to Israel - regardless of its nationality. Subsequently, there have been numerous incidents of ship attacks in the Red Sea.

For safety reasons, major shipping companies including Mediterranean Shipping Company (MSC), Maersk, Hapag-Lloyd, CMA-CGM, Yang Ming Marine Lines, and Evergreen Marine Line have recently declared the suspension of Red Sea shipping or the alteration of ship routes. Orient Overseas Container Line (OOCL), a subsidiary of the Chinese-owned COSCO Shipping Group, has halted acceptance of Israeli cargo due to operational concerns. Furthermore, oil giant BP and Norwegian oil and gas giant Equinor have also joined the ranks of suspending Red Sea shipping on Monday.

According to analysis, if the conflict continues to escalate, there is a possibility that the shipping hub Suez Canal may be forced to close, potentially disrupting the global supply chain.

The Red Sea is a crucial link between the Mediterranean Sea through the Suez Canal and the Gulf of Aden through the Bab el-Mandeb Strait, thereby connecting the Atlantic and Indian Oceans. Given that it represents one of the most direct sea routes between Eurasia and Africa, the Red Sea is of paramount importance to global shipping and ranks as one of the busiest maritime trade corridors in the world. Available data shows that around 12% of global trade, including approximately 30% of global container traffic, as well as 10% of crude oil and 12% of refined oil shipments, traverse the Suez Canal and pass through the Red Sea and Bab el-Mandeb Strait.

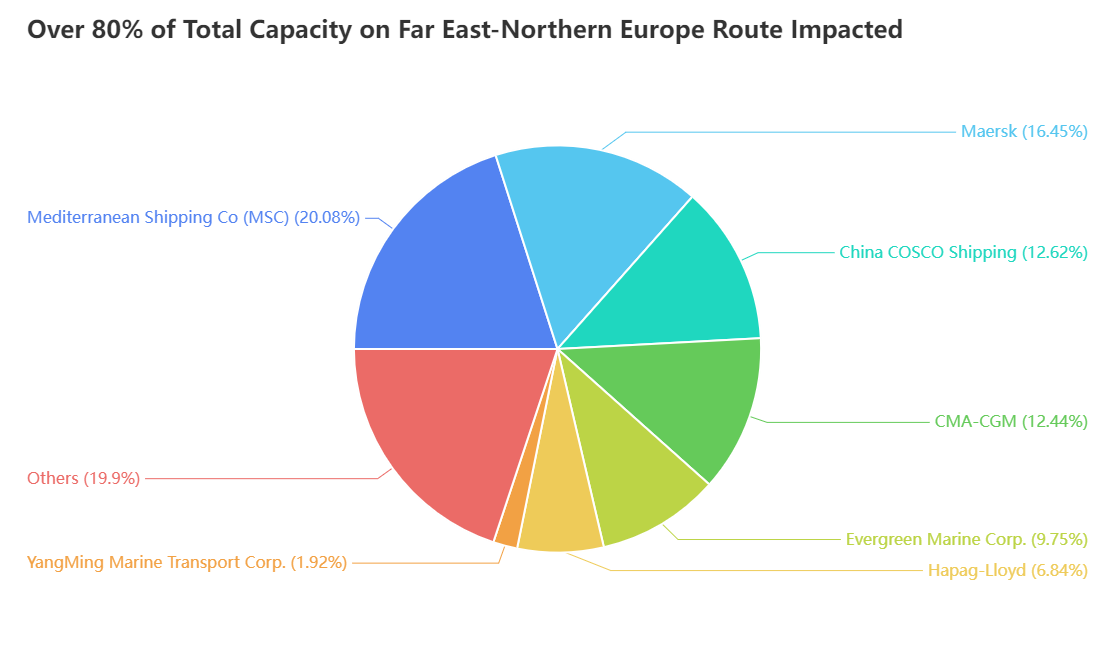

Currently, some major global shipping companies have announced plans to bypass the Suez Canal and are considering diverting to the Cape of Good Hope in Africa to avoid dangerous areas. A rough calculation shows that this will affect 80% of the total capacity operated on the Far East-Northern Europe route.

Rerouting of ships will significantly increase voyage distance and voyage duration, leading to upward pressure on freight rates.

1. The substantial 40% surge in voyage distance will inevitably trigger considerable cost escalation, encompassing fuel consumption, labor expenses, insurance premiums, and various other charges - consequently, propelling the overall costs for shipping companies.

2. Furthermore, diverting via the Cape of Good Hope in Africa will add around 10 extra days to the journey,substantially lowering ship turnover efficiency, absorbing effective transport capacity within the market, and stimulating short-term freight rate increases.

The spot market freight rates updated in the past two days show that many European and Mediterranean routes have doubled in price for early January next year.

The renewed shipping capacity constraints and the risk of short-term surges in freight rates have driven a significant increase in the stock prices of shipping companies.

On Monday, the global shipping giant $A.P. Moller - Maersk A/S Unsponsored ADR(AMKBY.US$ surged by 3.73%, marking an increase of over 20% from its December 12th low. Meanwhile, German shipping firm Hapag-Lloyd and Israeli international shipping company $ZIM Integrated Shipping(ZIM.US$ recorded a rise of 7.95% and 1.35%, respectively, regaining more than 30% from last week's troughs.

As for tanker stocks, Norwegian tankers Hafnia and Frontline maintained their upward momentum on Monday, escalating by 5.39% and 2.49%, correspondingly, with weekly cumulative gains ranging from 11% to 15%.

The announcement of Red Sea shipping suspension by oil heavyweights $BP PLC(BP.US$ and $Equinor(EQNR.US$ triggered concerns about oil supply disruptions and increasing geopolitical risk premiums, ultimately driving up oil prices. The $Crude Oil Futures(JUN4)(CLmain.US$ prices surged by 4% during Monday's trading session, surpassing $74 per barrel, which marked a two-week peak.Meanwhile, the $Brent Last Day Financial Futures(JUL4)(BZmain.US$ concluded that day with an increase of 1.46%, closing at $78.01 per barrel.

Moving forward, some analysts opine that the transportation challenges brought about by the Red Sea conflict and heightened geopolitical risk premiums may only serve as short-term disturbances to oil prices.

Tamas Kumar, an oil broker from PVM, stated that despite the recovery, Brent and U.S. crude remain in contango (immediate delivery oil trades at a lower price than crude for later delivery), indicating that the physical market remains adequately supplied.

The redirection or re-routing of ships, which can lead to increased worldwide trade expenses and delays, has heightened anxieties surrounding the stability of the global supply chain in the aftermath of the Suez Canal blockage. This is particularly concerning given the ongoing navigation challenges caused by drought in another crucial shipping route, the Panama Canal.

As the year-end Christmas peak season for transportation approaches, shipping companies have implemented four rounds of price increases since November. If the blockage in the Suez Canal persists, it could further drive up shipping prices, fuel costs, labor expenses, insurance premiums, and various other costs associated with finding alternative routes. Ultimately, consumers may end up bearing the burden of these rising costs. This situation is similar to the story we witnessed during the COVID-19 pandemic, where supply chain disruptions and increased orders from people staying at home led to a surge in consumer prices.

In the short term, this situation could lead to a resurgence of inflation risks that had previously subsided.

According to Marco Forgione, the Director-General at the Institute of Export & International Trade, “This impacts every link in the supply chain, from producer right down to end user, and will only increase the chances of critical products not making their destinations in time for Christmas.”

Stuart Stawpert, a member of the shipping chamber, stated that he foresees potential price hikes for consumers in the short term, but much depends on the duration of the security threat's persistence.

Many people have compared the recent Evergrande crisis to the 2021 Suez Canal blockage caused by the grounding of the Ever Given, which lasted only six days. According to a report by German insurer Allianz at the time, the disruption in shipping due to the Suez Canal blockage resulted in global trade losses of approximately $6-10 billion per week.

However, analysts point out that considering the uncertainty of geopolitical risks, this crisis may be even more severe. Nevertheless, the situation remains to be observed.

John Kartsonas, Managing Partner of Breakwave Advisors said, "A number of shipping companies are diverting ships away from the Red Sea region due to the risk. That can change at any given time if military forces get involved, so again difficult to assess."

Source: CNBC, Bloomberg, Clarksons, moomoo, Financial Times

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpyderCall : Good info here

104548195 : Ok