Eli Lilly & Co:Raising Estimates on Higher Obesity Sales Potential – Now Forecasting $100bn+ GLP-1 Category

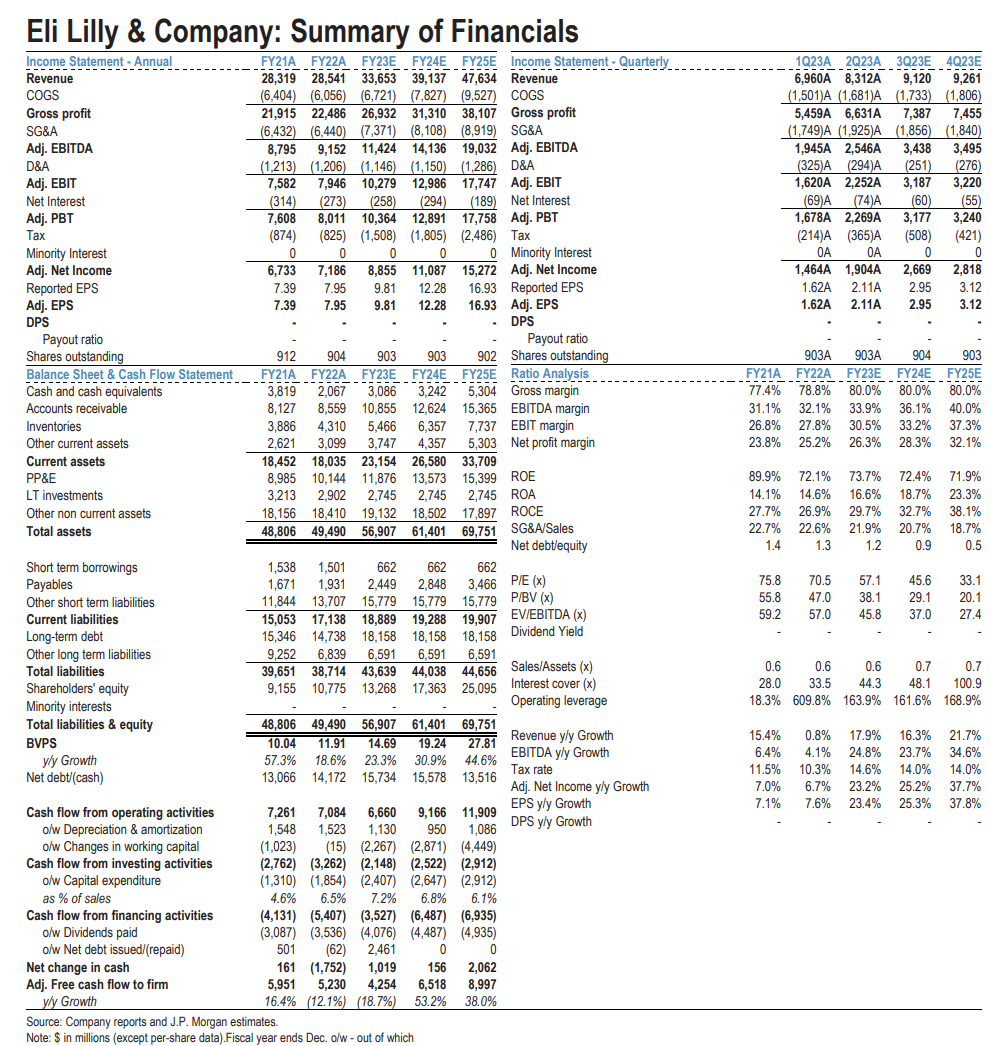

It is expected that GLP-1 category will reach well over $100bn in annual sales over time. This is driven fairly equally by diabetes/obesity usage and we would not be surprised to see further upside to our numbers in both indications over time. And with LLY/ Novo expected to continue to roughly split the market, it is expected that LLY’s GLP-1 sales increasing from ~$8bn in 2022 to ~$23bn in 2025, ~$34bn in 2027, and ~$50bn in 2030. This remains ahead of cons forecasts in both the near- and long-term.

On obesity, the US market approaching ~$50bn in sales by 2030. This would represent one of the largest markets in the US driven by 1) a high prevalence of obesity (~35-40% of adults in the US) coupled with 2) an expected paradigm shift to treating weight to address the range of co-morbidities associated with obesity (as supported by SELECT) and 3) a step up on reimbursement for the class over time . Our $50bn forecast assumes ~15mm obese patients will be on incretins by the end of the decade (translating to low- to mid-teens penetration) with use split between patients on these drugs chronically and those using them intermittently once their weight loss plateaus.

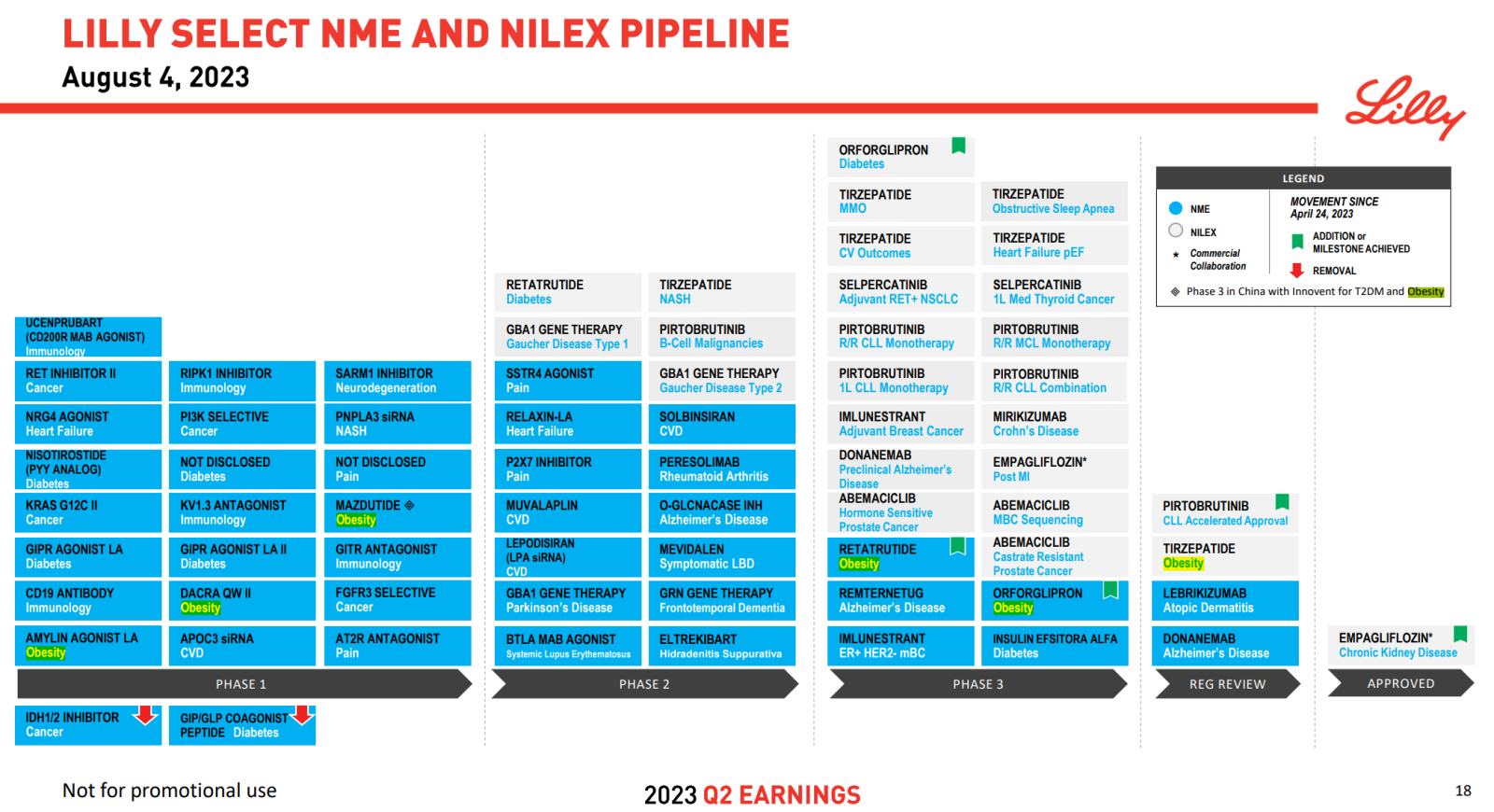

From a market share perspective, the incretin market largely remaining a duopoly between LLY and Novo. LLY has two promising next-gen assets in Retatrutide (LLY’s next-gen 1x weekly SubQ product) and Orforglipron (LLY’s oral GLP-1). For Retatrutide (GGG), we would not be surprised to see peak weight loss in the upper 20% range for the product with Ph2 data showing ~24% weight loss at 48 weeks with no sign of plateau. This is significantly higher than Mounjaro and also compares favorably to Novo’s Cagrisema, where weight loss of ~25%. Meanwhile, there is a significant role for LLY’s oral GLP-1, which has shown weight loss of ~15% in Ph2 (in-line with Wegovy) and will be far easier to manufacture than LLY’s injectable products (ultimately, an easy-to-use oral GLP-1 will help resolve the capacity constraints facing the class).

The diabetes opportunity for the GLP-1s is underappreciated and see sales in this setting also reaching $50bn+ over time. GLP-1 usage increasing from a low-teens % of T2D patients in the US today to 35%+ by 2030 and further increasing from there. With ~65% of T2D patients also overweight and the treatment paradigm shifting towards managing weight as well as HbA1c, GLP-1s continuing to move up in the T2D treatment paradigm.

There remain a number of positive catalysts to watch from here for LLY in the GLP-1 space. These include 1) Full SELECT data in Nov. ‘23, 2) Continued capacity expansion from the newly online NC facility for LLY, 3) an obesity approval late this year for Mounjaro and 4) outcomes data for Mounjaro in the sleep apnea and heart failure markets in 1H24. A positive risk/reward heading into each of these catalysts with full SELECT data further confirming the benefit of these drugs, a formal approval in obesity providing another leg of growth, and outcomes data for Mounjaro expected to show very impressive risk reduction in these markets.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment