Earnings Volatility: Tesla's Earnings Under Pressure, Options Braces for Muted Volatility

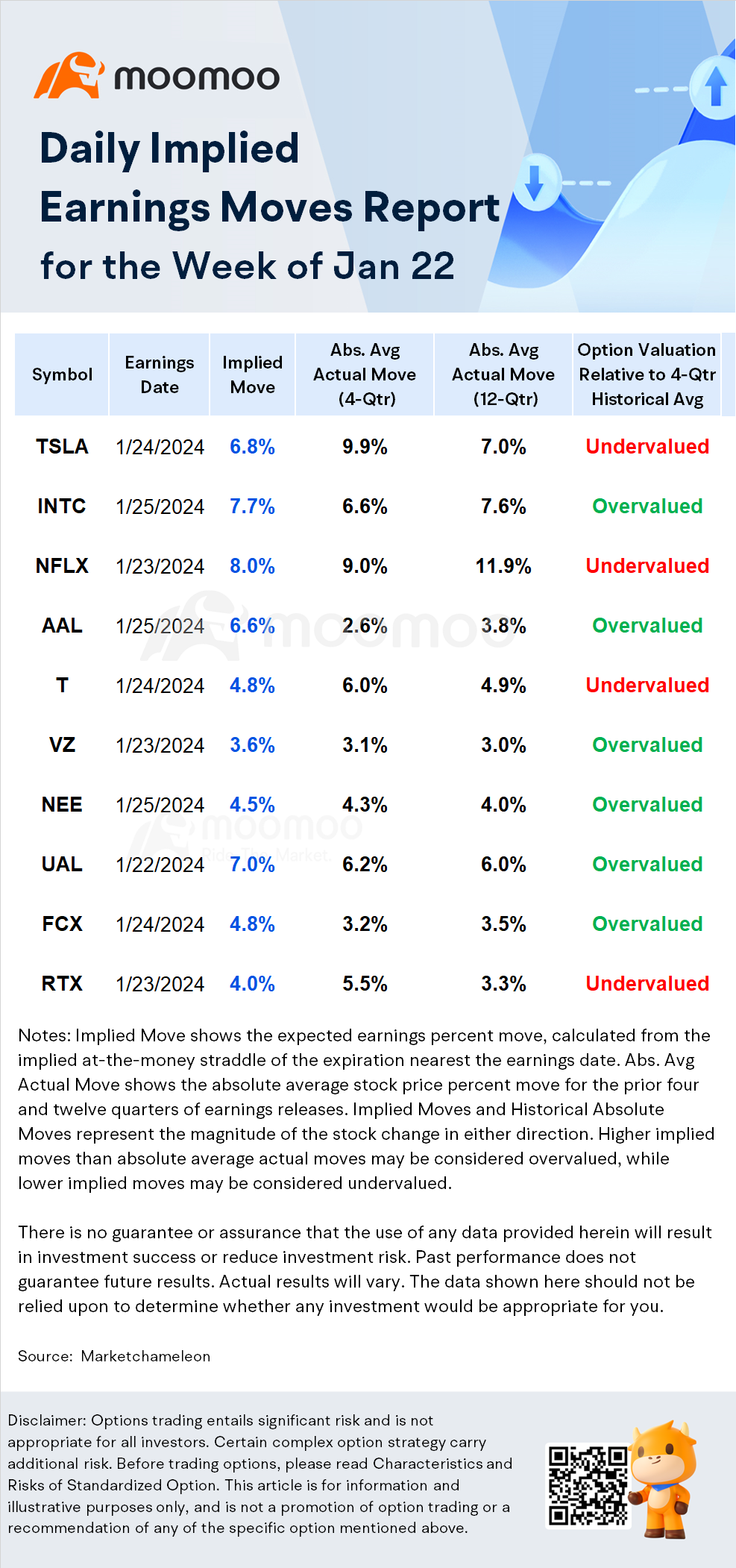

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings. Here are the top earnings and volatility for the week:

-Earnings Date: 1/22 After Market Close

-Implied Move: 6.8%

-Absolute Average Actual Move for the past 4 Quarters: 9.9%

-Absolute Average Actual Move for the past 12 Quarters: 7.0%

-Earnings Normalized Estimate: USD $0.619

-Revenue Estimate: USD 25.743 billion

According to recent data from Market Chameleon, options for Tesla are undervalued with the implied move of 6.8% lower than the average actual move for the past 4 quarters (9.9%) and its average actual move for the past 12 quarters(7.0%). The options market overestimated TSLA stocks earnings move 50% of the time in the last 12 quarters. The predicted move after earnings announcement was ±7.5% on average vs an average of the actual earnings moves of 7.0% (in absolute terms).

Earnings Catalyst

Deliveries

On January 2nd, Tesla revealed impressive fourth-quarter delivery numbers, surpassing the expectations set by Wall Street analysts. The leading electric vehicle manufacturer reported a record-setting delivery of 484,507 vehicles for the quarter.

Over the course of 2023, Tesla's total deliveries reached 1.81 million, which not only exceeded its own target of 1.8 million but also represented a significant milestone for the company. This performance underscores Tesla's growth and leadership in the EV market.

Tesla had been aiming to deliver 1.8 million vehicles in 2023. Ahead of Tesla's data release, Wall Street consensus had Tesla vehicle deliveries in 2023 totaling 1.797 million, just below that 1.8 million target, according to FactSet.

Cybertruck Event

On November 30th, Tesla made a notable delivery of 12 Cybertrucks at a special event held at its factory in Austin, Texas, showcasing the much-anticipated electric truck amidst a grand display. Tesla's CEO, Elon Musk, addressed the audience, highlighting the achievement of producing a vehicle that many experts had previously deemed impossible to manufacture.

Tesla's Cybertruck comes in three different trims to cater to various customer needs, with the entry-level rear-wheel drive version priced at $60,990 and offering a range of 250 miles on a single charge. According to Tesla's official website, this base model is slated for availability in 2025. This introduction of the Cybertruck marks a significant expansion of Tesla's product lineup and represents another step forward in the company's innovation within the electric vehicle sector.

However, this new model is yet to provide strong earnings boost to the company.

CEO Elon Musk said in October that he expects Tesla to be producing roughly 250,000 Cybertrucks a year by 2025. He warned at the same time that it could up to 18 months for the Cybertruck to become profitable, due to issues with scalability.

"We dug our own grave with Cybertruck," he said during Tesla's third-quarter earnings call. "The ramp is going to be extremely difficult. There's no way around that."

Growth Concerns

According to a report by the research firm Canalys, the global electric vehicle (EV) market is projected to experience a slowdown in its growth rate to 27.1% this year. This deceleration is attributed to a decrease in government subsidies, which have been instrumental in making EVs more affordable and attractive to consumers.

In 2023, the electric vehicle market witnessed an estimated growth of 29%, with sales reaching approximately 13.7 million units. This growth was significantly supported by state incentives that encouraged buyers to opt for EVs over traditional internal combustion engine vehicles. However, with the reduction of these subsidies, the market's expansion is expected to slow down as electric vehicles may become less financially viable for a portion of potential buyers.

"Despite a 20% drop in the ASP (average selling price) of EVs in 2023, insufficient product choices and inconvenient charging experience hampered demand, impacting the market growth of EVs," said Jason Low, principle analyst at Canalys.

Global Price Cutting Strategy

Tesla's profit margins took a hit in the previous third quarter, falling short of Wall Street's expectations. The company made strategic price cuts, averaging around 25% in the U.S. over the past year, to stay ahead in the competitive electric vehicle market. As a result, the focus shifted towards maintaining sales volume over profit maximization.

Despite the aggressive pricing strategy to boost sales, there are concerns about the sustainability of continuous price reductions. The third-quarter net profit margin for Tesla stood at 8%, which is comparable to that of legacy automakers, suggesting that Tesla might face limitations in further price cuts without affecting profitability.

Analysts are predicting that Tesla stock may have reached a near-term bottom, and they anticipate higher prices in the future. The optimism comes just ahead of the company's earnings report. Data from Yahoo Finance, shows that the average price target from 37 analysts is $228.65 per share. This represents a potential increase of 7.76% from the current stock price, suggesting a positive outlook.

Don't Get Crushed by Earnings. Here are things you should know before considering a trade.

Knowing the IV Crush

Before significant corporate events such as earnings announcements, product launches, or clinical trial results, implied volatility tends to increase. However, after the news has been released, the implied volatility can drop significantly due to the sudden clarity in the market and the stock price reaction to the news. This phenomenon is referred to as IV crush.

IV Crush And Option Prices

IV crush can lead to a decrease in option prices because the Implied volatility is lowered dramatically. This decrease in option prices due to IV crush can be a risk for options traders who have purchased options at a higher price with the expectation of making a profit from a significant move in the underlying stock price. Conversely, IV crush may not be as prevalent if the option is undervalued and the stock price moves drastically, which can pose a risk for option sellers. It's important for traders to be aware of IV crush and factor it into their trading strategy when considering options trades around significant corporate events.

Not all options are affected equally by an IV crush. IV crush affects short-term option prices more than long-term option prices.

Nonetheless, it's important to note that trading options always involve risks, and investors should consult with a financial advisor before making any trades.

Source: Dow Jones, Market Chameleon, Bloomberg

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

The data and information provided has been obtained from sources considered to be reliable, but Moomoo Financial and its affiliates do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment