DeBLASEing the Trail | 2Q23 Earnings Season In Pictures

All but one end market posted Y/Y organic growth, but most verticals are also seeing growth decelerate sequentially We spend a lot of time gathering organic growth data by geography and end market for the entire MI/EE & Machinery space (not just the names we cover), and note that 17/18 end markets posted Y/Y organic growth in 2Q (consistent with 1Q), up 9% at the median. These included: Truck OEMs +23%, Construction Equipment +21%, Autos +19%, Ag Equipment +18%, A&D +16%, Automation +14%, Flow Control +13%, Truck Suppliers +12%, Electrical Products +11%, Power +7%, Fire & Security +6%, HVAC/R +6%, Welding +5%, Healthcare +5%, Renewables +4%, Food Equipment +4%, and General Industrial +4%. Only Tools declined, falling 5% Y/Y. That said, Y/Y growth accelerated Q/Q for only 4/18 end markets (vs. 5/18 last quarter) and both A&D and HVAC/R were stable Q/Q; we saw the biggest improvements within Autos (+7ppts Q/Q), Construction Equipment (+4ppts Q/Q), and Truck Suppliers (+3ppts Q/Q). In contrast, we observed the greatest Q/Q deceleration within Food Equipment (-12ppts Q/Q), Power (-11ppts Q/Q), and Automation (-9ppts Q/Q). By geography, we observed a Q/Q step-up in organic growth for APAC (+9.3% vs. +8.5% in 1Q23), EMEA (+9% vs. +8% in 1Q23), and China (-4% vs. -7.5% in 1Q23). The remaining two regions saw meaningful deceleration: US (+2.9% vs. +11% in 1Q23), and LatAm (+10.4% vs. +16.7% in 1Q23).

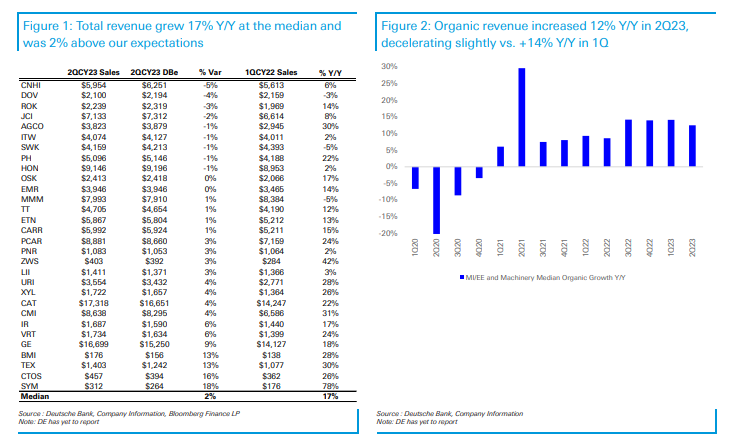

As expected, the majority of companies we cover beat DBe/consensus EPS forecasts At the median, EPS increased 21% Y/Y (decelerating from +26% growth in 1Q23), and beat DBe by 9%. CMI, DOV, ROK, JCI, and HON were the only companies in our coverage universe to miss headline DBe EPS estimates (note that when compared to consensus, JCI results were in-line and HON beat). This quarter, the median Machinery EPS percentage beat was 11% vs. an 8% beat for the MI/EE group (last quarter it was Machinery +26% vs. MI/EE +11%). For the total coverage universe, revenue came in 2% ahead of DBe and was up 17% Y/Y. Core operating income came in 9% above DBe and increased 30% Y/Y, with core operating margins expanding ~200bps Y/Y, ~80bps above DBe.

Most companies raised their full year guidance, given greater visibility into 2H results via elevated backlogs and 2Q beats

Most companies raised their full year guidance, given we are now halfway through the year, backlogs generally remain elevated, and 2Q results came ahead of expectations. At the median, MI/EE and Machinery companies are now baking in 8-10% Y/Y organic growth (up from +7-9% Y/Y as of last quarter) and 13-17% Y/Y EPS growth (up from 8-12% Y/Y as of last quarter). The modestly stronger EPS growth forecasts vs. organic sales suggests that companies are assuming stronger operating leverage in their outlooks. For the most part, we view current guidance ranges as achievable, but macro risk looms into 2024.

We saw an upward bias to share price performance on earnings day, but this generally faded post-earnings

As per usual, we saw a wide range of share price reactions to earnings prints this quarter. We observed an upward bias, with only 9 companies we cover trading down on earnings day and a median increase of 3% for the group. We highlight drivers of the top three and bottom three performers: 1) SYM, top performer: Delivered a material adj. EBITDA beat driven by a material revenue beat. Once again this quarter, the company accelerated its system deployments. 2) VRT, second best performer: Great results on every metric; adj. operating profit, strong organic growth and better incrementals drove segment margins up over 800bps Y/Y. The company also boosted guidance significantly. 3) OSK, third-best performer: The company beat 2Q consensus expectations, delivering strong upside to core consensus segment income forecasts as supply chain constraints eased. Management also raised its FY adj. EPS guidance by 33% at the midpoint. 4) JCI, worst performer: 4Q guidance was relatively weak due to a ~4ppts revenue headwind related to resi HVAC/fire & security channel inventory destocking. 5) ROK, second-worst performer: High investor expectations were met with a 3Q miss, primarily driven by an unexpected distribution center transition in May/June that pushed out $50-100m of revenue from 3Q into 4Q. 6) CMI, third-worst performer: The stock moved up materially in the weeks leading up to earnings season and investor expectations for truck-driven earnings escalated on the back of material beats by global OEMs. Against this backdrop, an EPS miss and unchanged FY guidance was punished by the market.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment