Crypto Invest: From 3 Long/Short ETFs to 4 Standout Stocks

Key Takeaway

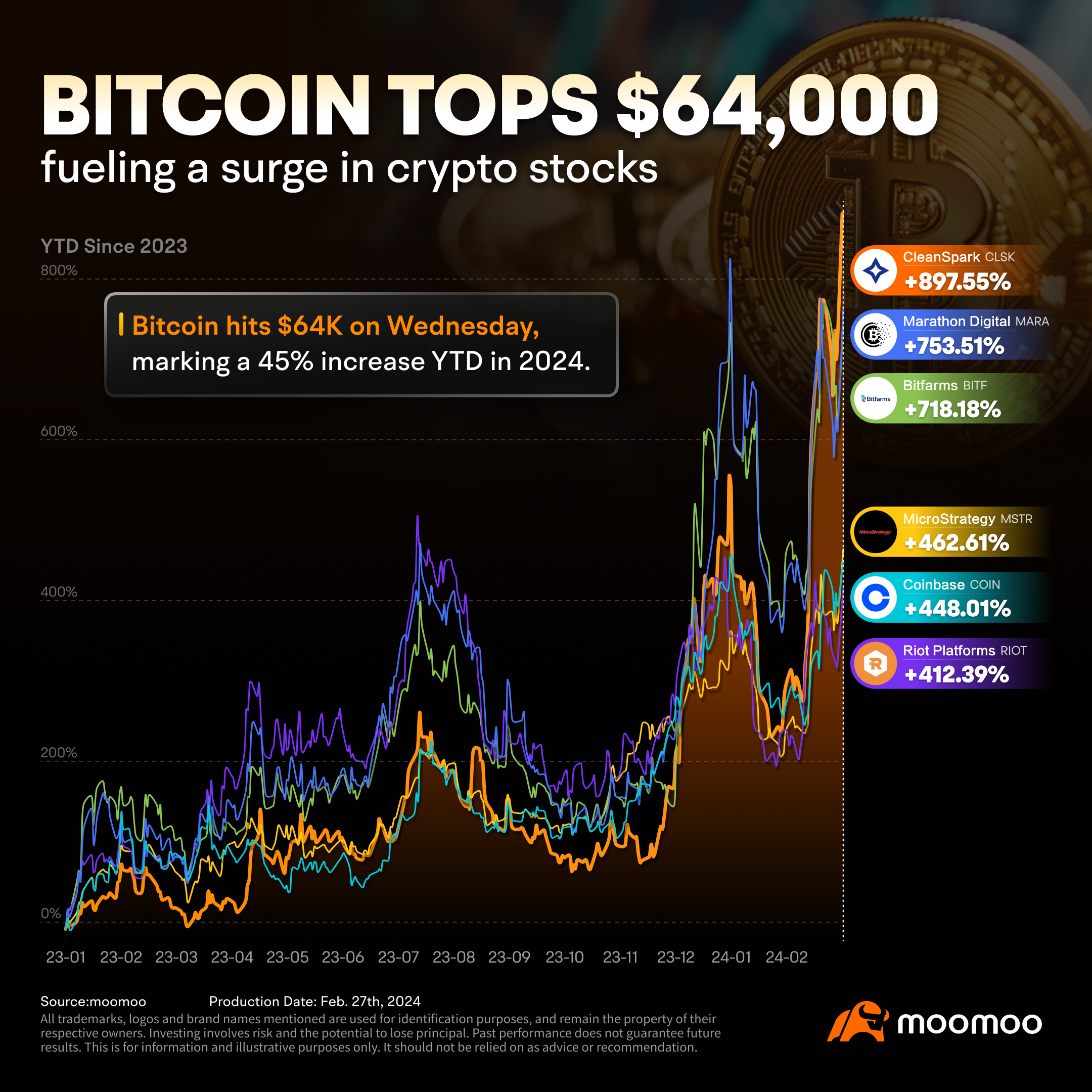

Bitcoin Set for Biggest Monthly Surge Since 2020, Fueling Related Stock Rally

Bitcoin topped $64,000 in the Australian early Wednesday morning, marking a peak since November 2021 and recording the biggest monthly surge since 2020. Despite the rally, Bitcoin experienced a dramatic plunge from intraday highs of over $64,000, dropping $5,000 within minutes and narrowing its gains from a peak of 13% to just under 6%. This volatility led to significant losses for many investors, with data from Coinglass showing over 180,000 individuals liquidated in the past 24 hours, totaling $741 million in liquidations.

The cryptocurrency sector is not just about the digital currencies themselves. Related concept stocks have witnessed a staggering surge since last year. CleanSpark has skyrocketed nearly 900% since last year, with Marathon Digital and Bitfarms also soaring well over 700%.

Bernstein Analyst expressed a bullish stance on Bitcoin, predicting that it may reach a new all-time high later this year. They anticipate a FOMO rally driven by the ETF-led Bitcoin market, stating, "We think the best days of bitcoin are ahead."JP Morgan Analyst identified three key upcoming events that could excite retail investors and further drive the FOMO sentiment in the cryptocurrency space. These events include the Bitcoin halving, the Ethereum network upgrade, and the SEC's decision regarding the Ethereum spot ETF application.

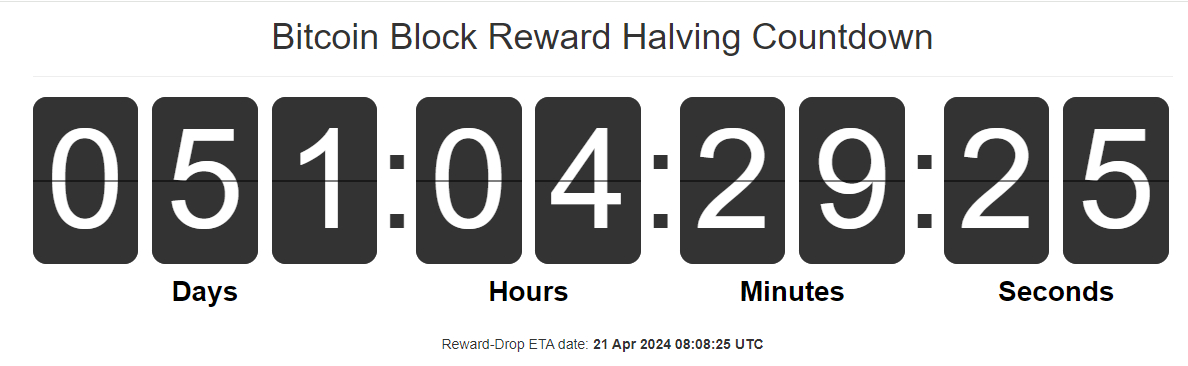

The upcoming Bitcoin halving: The impending Bitcoin halving has injected a wave of optimism into the market. Occurring every 210,000 blocks, the fourth Bitcoin halving is anticipated to take place in mid to late April of this year. Current data from Bitcoin Block Half shows that approximately 51 days remain until this event, expected to occur on April 21, 2024. When it happens, the reward for each block will decrease from 6.25 to 3.125 Bitcoins, an adjustment that historically precedes a significant price increase due to the reduced supply of new Bitcoins entering the market.

The Ethereum network upgrade and the approval of Ethereum spot ETF application are expected to deliver a substantial boon to the crypto industry, much like the considerable market effect that followed the approval of the Bitcoin ETF. The initiative, led by ETF giant BlackRock, has paved the way for mainstream investment in Bitcoin, opening the doors for substantial capital inflows from institutional investors. The ETF has brought in incremental funds that have driven up the price of Bitcoin. BlackRock's IBIT saw a volume of $1.357 billion, breaking the record of $1.3 billion set on Monday, which is more than double the average volume since it began trading in January.

Long/Short ETFs

Long ETF: $Grayscale Bitcoin Trust(GBTC.US$ is one of the first spot Bitcoin ETFs in the US. A spot Bitcoin ETF is solely and passively invested in Bitcoin that enables investors to gain exposure to BTC in the form of a security while avoiding the challenges of buying, storing, and safekeeping BTC, directly.

Leveraged Long ETF: $2x Bitcoin Strategy ETF(BITX.US$ seeks daily investment results, before fees and expenses, that correspond to two times (2x) the daily performance of S&P CME Bitcoin Futures Index through bitcoin futures contracts. It can provide investors with leveraged long positions in

Bitcoin Short ETF: $PROSHARES SHORT BITCOIN STRATEGY ETF(BITI.US$ is the first short-bitcoin ETF. The Fund seeks daily investment results, before fees and expenses, that correspond to inverse (-1x) the daily performance of S&P CME Bitcoin Futures Index through bitcoin futures contracts. Investors can use it to hedge bitcoin and cryptocurrency exposure.

4 Standout Stocks

The crypto ecosystem can be divided into 4 segments: mining equipment, mining operations, trading platforms, and payment systems.

Mining Equipment

Mining equipment refers to the hardware used to mine cryptocurrencies like Bitcoin and Ethereum. These are specialized computers known as miners or mining rigs that are built to perform complex mathematical computations required to validate transactions and secure the blockchain network.

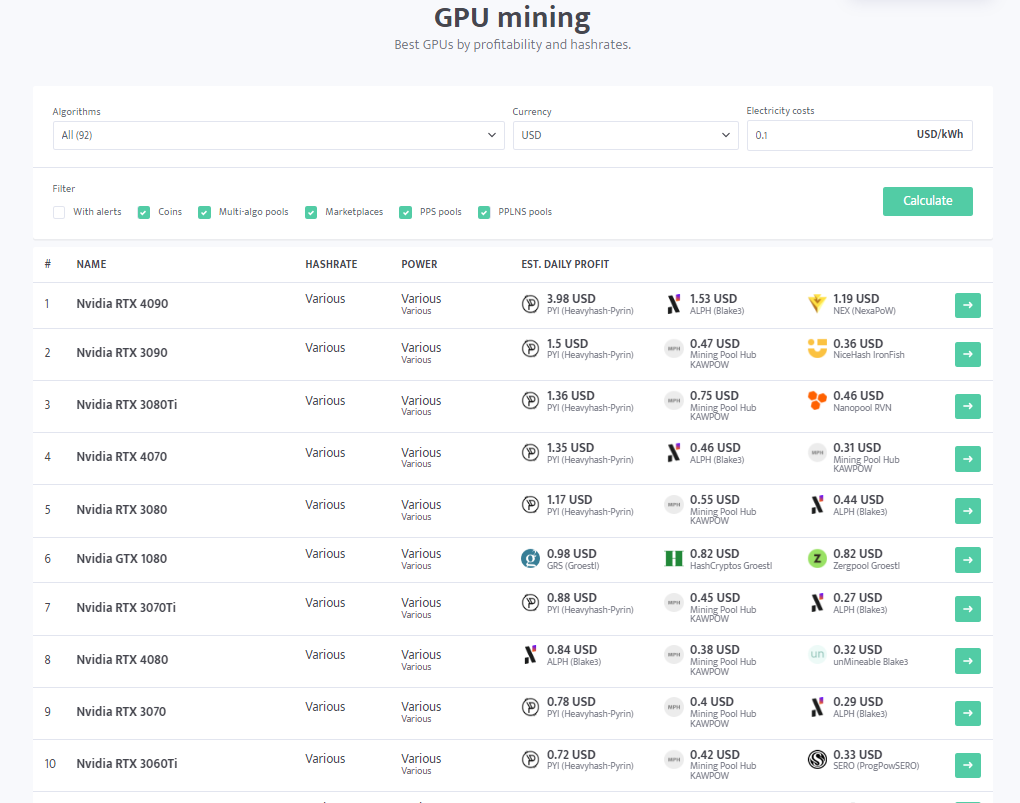

$NVIDIA(NVDA.US$, renowned for its powerful graphics processing units (GPUs), has also become a significant name in cryptocurrency mining. While NVIDIA's GPUs were initially designed for gaming and professional graphics rendering, their high computational capabilities made them ideal for mining cryptocurrencies. According to data from minerstat, the current top 10 list of the best mining GPUs is comprised entirely of NVIDIA's products.

Mining operations

Mining is the process by which new cryptocurrency coins or tokens are created and transactions are verified and added to the blockchain public ledger.

$Marathon Digital(MARA.US$ is a leading crypto mining company that focuses on the blockchain ecosystem and the generation of digital assets. As of January 31, the Company holds a total of 15,741 unrestricted BTC, with a total value exceeding 900 million USD. These companies' performance is closely tied to the fortunes of the cryptocurrency market, and specifically to the price of Bitcoin, as this affects the value of the rewards they earn from mining.

Trading Platforms

The exchange and trading of cryptocurrencies are central to the liquidity and accessibility of the market. $Coinbase(COIN.US$ is at the forefront of this sector, operating as a secure platform that allows users to buy, sell, and manage cryptocurrencies. This week, Coinbase surpassed a market capitalization of 50 billion USD, exceeding both the Hong Kong Stock Exchange and the German Stock Exchange, and has risen to become the fourth largest listed exchange in the world. The company's revenue is largely derived from transaction fees, meaning its growth is closely correlated with the overall activity and volume of the crypto market. Investing in Coinbase is akin to buying into the marketplace that sustains the cryptocurrency ecosystem.

Digital Payment

Digital payment using cryptocurrencies represents a method through which individuals and businesses can transact using digital currencies like Bitcoin, Ethereum, and other cryptos. This form of payment leverages the underlying blockchain technology of cryptocurrencies, which provides a decentralized, secure, and often transparent ledger of transactions.

The $Block(SQ.US$ $Block Inc(SQ2.AU$ , formerly known as Square, is a notable company in the digital payment and cryptocurrency space. It has simplified crypto transactions for users, effectively linking conventional financial systems with the rapidly expanding domain of digital currencies. In addition to providing a platform for digital payments, The Block has been actively involved in the development of the cryptocurrency ecosystem. The company has invested in Bitcoin and is engaged in initiatives to further promote and integrate cryptocurrency infrastructure and services, such as establishing Bitcoin mining operations and creating educational resources to foster greater adoption of digital currencies.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SurfingSam : btc to the moon

heiPando : $Marathon Digital (MARA.US)$ is going to $35, this is a beast