Jan. CPI Preview: How Low Can Inflation Go?

The US January CPI data, due to be released by the Bureau of Labor Statistics at 8:30 ET on Feb. 13th, may not reach the high levels observed in December, but it requires more factors to support further alleviation.

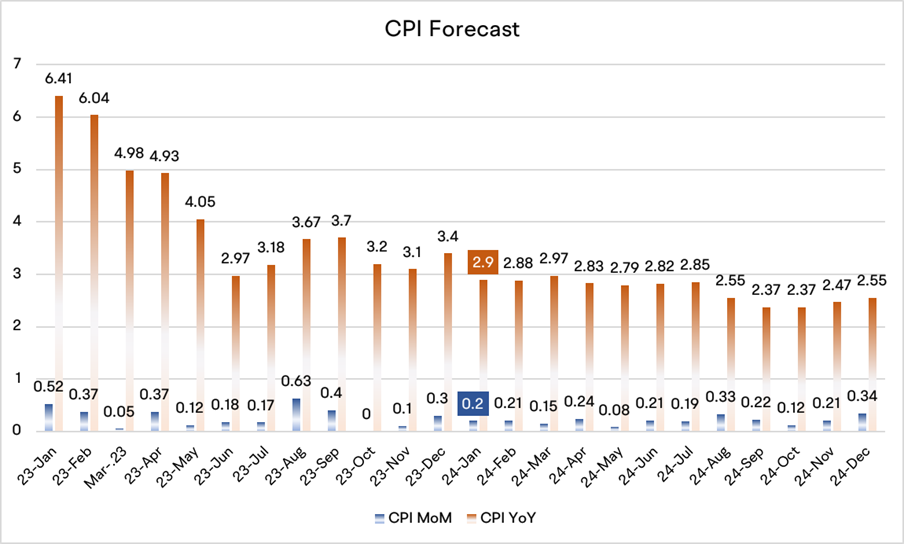

Economists polled by Bloomberg estimate that CPI in January increased by 2.9% year-on-year (vs. the previous value of 3.4%). Core CPI is expected to increase by 3.7% (vs. the previous value of 3.9%).

■ Energy prices rebound modestly in January

WTI crude price climbed as investors continued to weigh the risk of supply disruptions in the Middle East. Still, oil prices have fallen by about 7% since late January amid reports of progress in ceasefire negotiations between Israel and Hamas. Fading expectations of immediate interest rate cuts from the US Federal Reserve also weighed on the global demand outlook.

■ Food price pressure eased

The FAO (Food and Agriculture Organization of the UN) Food Price Index stood at 118.0 points in January 2024, down 1.2 points (1.0 percent) from its revised December level, as decreases in the price indices for cereals and meat more than offset an increase in the sugar price index. The index stood 13.7 points (10.4 percent) below its corresponding value one year ago.

■ Wholesale used car prices decrease in January

Wholesale used-vehicle prices (on a seasonally adjusted basis) decreased 1.0% from December in the first 15 days of January, according to Cox Automotive. The midmonth Manheim Used Vehicle Value Index dropped to 201.9, which was down 10.2% from the full month of January 2023.

■ The rental market slowdown is gradually showing up in inflation numbers

Apartment List's latest monthly report shows that the rental market kicked off the new year with a sixth straight month of negative rent growth, as the nationwide median rent fell by 0.3 percent to $1,373. On a year-over-year basis, rents have seen a 1 percent decrease. The annual growth rate of rents fell into negative figures last June for the first time since the initial phase of the pandemic, marking a trend that has continued for eight straight months.

From the market's supply perspective, the national vacancy index is currently at 6.5 percent, which is marginally above the average seen before the pandemic. On a regional level, January saw a decrease in rents across 73 of the country's 100 largest cities, with year-over-year prices dropping in 53 of these cities.

■ Where is the bottom of this round of deflation?

Although inflation is expected to fall in January, Bloomberg economist Stuart Paul warned that with the end of the destocking process, the drag created by deflation in core goods over the last six months will dissipate. Looking ahead to the next six months, he sees monthly core CPI averaging 0.23% - corresponding to an annualized rate of 2.8%.

In addition, the surprising nonfarm payroll data in January and the unexpected wage growth have exacerbated concerns about inflation in the service industry. In January, average hourly earnings for all employees on private nonfarm payrolls rose by 19 cents, or 0.6 percent, to $34.55. Over the past 12 months, average hourly earnings have increased by 4.5 percent.

The rise in wages, on the one hand, will increase the purchasing power of residents, but it can also lead to higher costs in the transportation, food service, and hotel industries, making inflation more persistent. Therefore, further reduction in inflation requires the support of multiple factors, including a further cooling of the labor market and the gradual stabilization of the situation in the Middle East.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment