Consumption was pretty hot, but the gain was mostly affected...

Consumption was pretty hot, but the gain was mostly affected by energy prices rising. PCE inflation reflected the unexpected acceleration from yesterday. Yields may pull back today, but I'm not sure we'll see that turn into a sustained move.

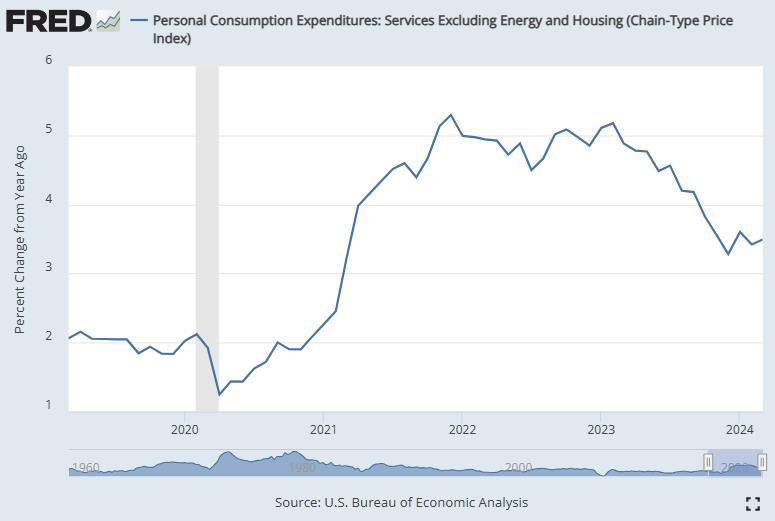

Pricing in 1 rate hike this year feels about right. A reminder, services inflation is still sticky. PCE services (ex-energy, housing) inflation ticked up in Mar to 3.5% YoY vs 3.4% YoY in Feb and has only been accelerating this year.

Bonus doomer data: PCE (ex-nrg, hou) annualized QoQ inflation in Q4 2023 was 2.0%, in Q1 2024 it was 5.7% (highest since Q4 2021).

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment