Citi's $15 Bet Turns into $625K Treasury Triumph

Key Takeaway

Citi's Treasury options strategy yielded a 20-to-1 payout, turning a $15.625 bet into roughly $625,000 profit per 2,000 options.

The strategy capitalized on near-term gains in US Treasuries due to short-covering, month-end buying, and economic data.

This successful bet underscores the potential of strategic options trading amid market volatility and economic indicators.

Citi's Treasury options strategy yielded a 20-to-1 payout, turning a $15.625 bet into roughly $625,000 profit per 2,000 options.

The strategy capitalized on near-term gains in US Treasuries due to short-covering, month-end buying, and economic data.

This successful bet underscores the potential of strategic options trading amid market volatility and economic indicators.

Citi's Ingenious Bet on Treasury Bonds Pays Off Handsomely

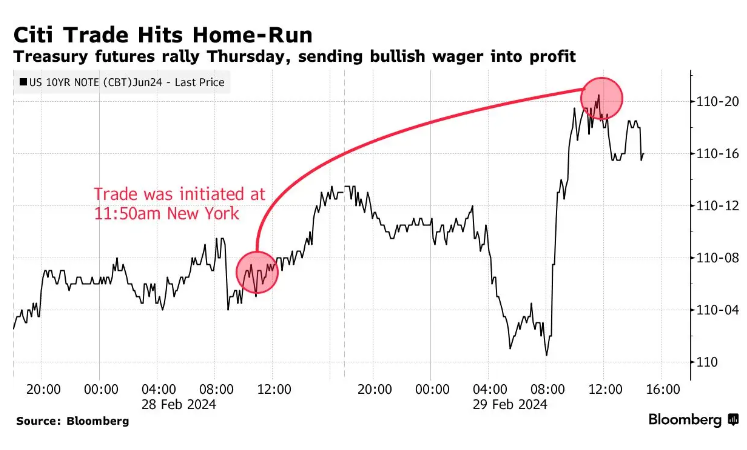

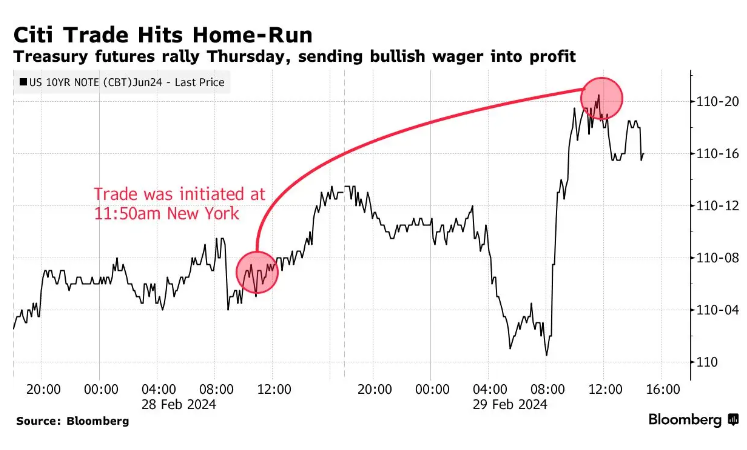

In a masterstroke of financial strategy, Citi's team unveiled a recommendation that caught the eyes of investors and market analysts alike. Dubbed the "quiet bull structure," this approach to Treasury 10-year weekly options was set forth on Wednesday, with an eye towards leveraging the anticipated upswing in US government bonds. The timing was impeccable, aligning with a confluence of market conditions ripe for a Treasury rally. These included a mix of short-covering, month-end buying, and the looming release of pivotal economic data points covering inflation, jobs, and manufacturing sectors.

The entry cost for investors was notably low, pegged at a mere one tick, or $15.625, a figure that represents the minimal investment required to secure an options contract. This modest outlay was quickly overshadowed by the strategy's success; by Thursday afternoon, as Treasury bonds gained ground, the value of this strategic play had ballooned to an impressive 20 ticks. This remarkable ascent translated into a staggering 20-to-1 payout, netting a profit in the vicinity of $625,000 from an initial 2,000 option-size bet.

A Convergence of Factors Fuels Treasury Rally

The rally in the bond market was no fluke but the result of a carefully aligned set of dynamics. Key among these was the unwinding of bearish positions, a move complemented by the anticipation surrounding the monthly bond index rebalancing. Jabaz Mathai, a strategist at Citigroup, provided insights into the market's momentum, suggesting a waning in the rates selloff. This observation hinted at a promising trajectory for Treasury prices, poised for an uptick.

Moreover, the end-of-month rebalancing was poised to trigger a shift in investment from equities to bonds, adding another layer of support to Treasury prices. This scenario painted a bullish picture for government bonds, setting the stage for Citi's recommended options strategy to flourish.

The strategic foresight displayed by Citi's team underscores a deep understanding of market dynamics and the ability to harness such insights for substantial gains. This episode not only highlights the potential for well-timed, strategic bets in the financial markets but also serves as a testament to the intricate dance between economic indicators and market movements. As investors and analysts alike dissect the outcomes of this strategy, the "quiet bull structure" may well become a case study in leveraging market conditions for high returns. $Citigroup(C.US$

In a masterstroke of financial strategy, Citi's team unveiled a recommendation that caught the eyes of investors and market analysts alike. Dubbed the "quiet bull structure," this approach to Treasury 10-year weekly options was set forth on Wednesday, with an eye towards leveraging the anticipated upswing in US government bonds. The timing was impeccable, aligning with a confluence of market conditions ripe for a Treasury rally. These included a mix of short-covering, month-end buying, and the looming release of pivotal economic data points covering inflation, jobs, and manufacturing sectors.

The entry cost for investors was notably low, pegged at a mere one tick, or $15.625, a figure that represents the minimal investment required to secure an options contract. This modest outlay was quickly overshadowed by the strategy's success; by Thursday afternoon, as Treasury bonds gained ground, the value of this strategic play had ballooned to an impressive 20 ticks. This remarkable ascent translated into a staggering 20-to-1 payout, netting a profit in the vicinity of $625,000 from an initial 2,000 option-size bet.

A Convergence of Factors Fuels Treasury Rally

The rally in the bond market was no fluke but the result of a carefully aligned set of dynamics. Key among these was the unwinding of bearish positions, a move complemented by the anticipation surrounding the monthly bond index rebalancing. Jabaz Mathai, a strategist at Citigroup, provided insights into the market's momentum, suggesting a waning in the rates selloff. This observation hinted at a promising trajectory for Treasury prices, poised for an uptick.

Moreover, the end-of-month rebalancing was poised to trigger a shift in investment from equities to bonds, adding another layer of support to Treasury prices. This scenario painted a bullish picture for government bonds, setting the stage for Citi's recommended options strategy to flourish.

The strategic foresight displayed by Citi's team underscores a deep understanding of market dynamics and the ability to harness such insights for substantial gains. This episode not only highlights the potential for well-timed, strategic bets in the financial markets but also serves as a testament to the intricate dance between economic indicators and market movements. As investors and analysts alike dissect the outcomes of this strategy, the "quiet bull structure" may well become a case study in leveraging market conditions for high returns. $Citigroup(C.US$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment