Chipmakers' Disappointing Forecasts Signal Easy EV Sales Are Over

Confirmation of the slowdown in electric-vehicle and overall auto sales has been given by chip companies, leading to concerns among investors that this trend will continue into next year.

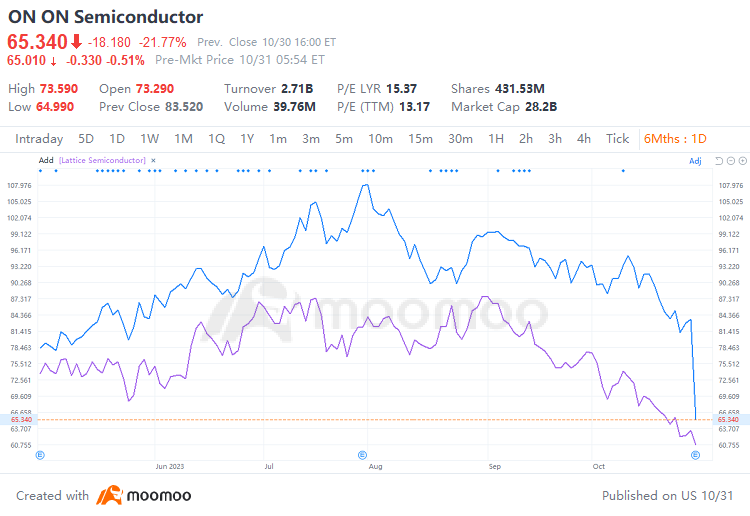

$ON Semiconductor(ON.US$ and $Lattice Semiconductor(LSCC.US$ both received less business than expected from automotive customers. On expeced to ship $200 million less this year of its silicon carbide chips used in EVs, and forecast revenue of $1.95 billion to $2.05 billion, below expectations of $2.18 billion. Investors were rattled and On's shares tumbled nearly 22%.

Lattice Semiconductor's fourth-quarter outlook was lower than expected, which led to disappointment on Wall Street. The company sells chips for advanced driver-assistance systems in cars and has fewer customers in Asia than anticipated. As a result, Lattice's shares dropped 13% during extended trading.

Easy EV sales are over

Semiconductor companies can be good indicators of end-product demand in industries, including automakers, which use many semiconductors. Unfortunately, those indicators are not looking good for autos in the short term. Companies such as $Tesla(TSLA.US$, $Ford Motor(F.US$, and $Rivian Automotive(RIVN.US$ have seen their shares decline recently.

Confidence on a strong demand for EVs has been shaken in recent days, with Ford executives saying last week that EV owners are unwilling to pay a premium for EVs over internal combustion-engine cars.

Here are some of the key takeaways from recent company earnings.

Losses continue to mount: "We also remain bullish on Model e and our EV future, but clearly, the market is a moving target … our EV start-up incurred US$1.3 billion of losses in the quarter, reflecting continued investment in our next-generation products and a more challenging market." – Ford CEO Jim Farley

EV demand falling short: "EV demand is not materialising quite as robustly as we were expecting this year. Pricing is a little bit down. Costs are going to be up with labor. So, I mean, you know, as you mentioned, EVs are going to become more challenging going forward." – BofA analyst John Murphy

Oversaturation: "You know, EVs are still in high demand. It's just, as you said, the pricing is much lower, and there's a lot of overcapacity in the middle of the market." – Ford CEO Jim Farley

Dialing down production: "Given the dynamic EV environment, we are being judicious about our production and adjusting future capacity to better match market demand." – Ford CFO John Lawler

Sluggish EV sales could continue

The slump in auto sales is expected to persist if inflation and high interest rates continue into next year.

We think it will carry through into the first part of next year, with most cycles running six to nine months,' said David Williams, an analyst at Benchmark.

However, the reduced consumer buying power and overall macro backdrop will likely keep buyers on the sidelines for the next couple of quarters."

Mooers, is this a peaking market, or just a speed bump?

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

RDK79 : But, Qualcomm auto chip business is increasing.