Buffett's Lucrative Bet on Japan: What Investors Can Learn from His Success

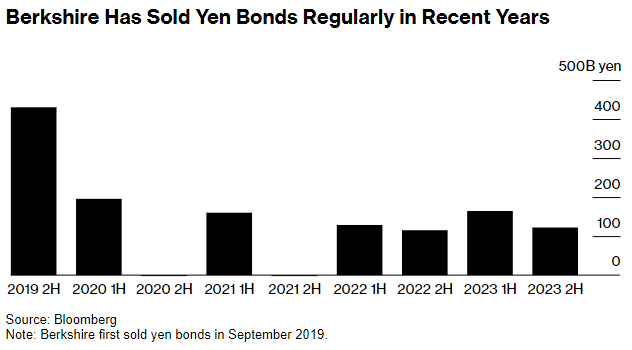

On April 9th, Berkshire Hathaway signaled its intent to issue yen-denominated bonds for the first time following the Bank of Japan's rate hike, with Daiwa Securities strategist Atsuko Ishitoya suggesting that this could lead to further investments in Japanese trading firms.

Nomura Securities analyst Kazuma Ogino noted that Berkshire's consistent bond issuances, surpassing 100 billion yen, demonstrate its broad appeal to investors. This trend persisted as the announcement of the new bonds coincided with a boost in share prices for the five trading houses favored by Buffett—namely Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo.

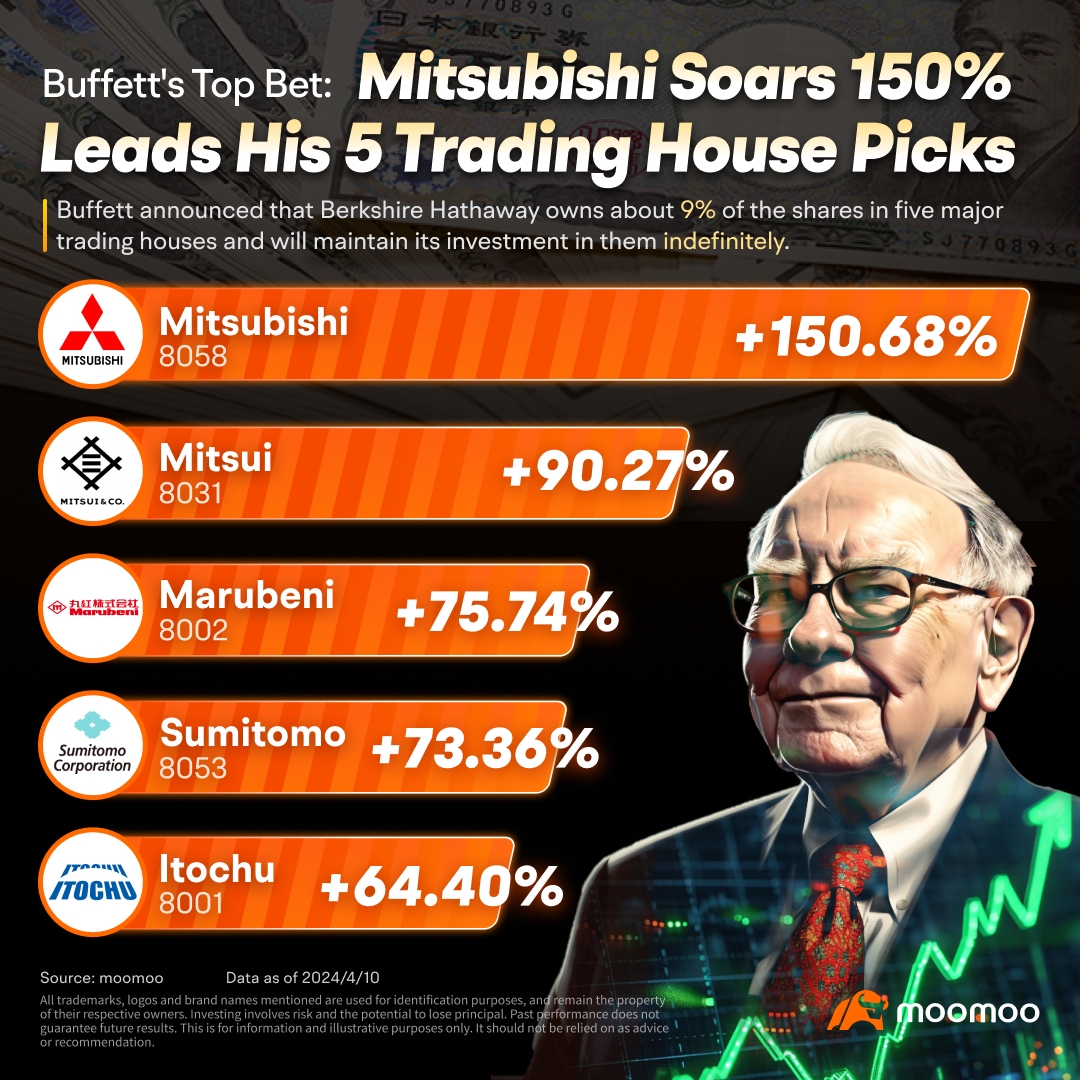

From January 1, 2023, to April 10, 2024, Japan's five major trading firms have demonstrated outstanding performance in the stock market. Leading the pack, $Mitsubishi(8058.JP$ witnessed a striking surge of 150.68% in its share price, outpacing the gains of its peers and significantly exceeding the $Nikkei 225(.N225.JP$'s increase of 51.69% during the same period. $Mitsui(8031.JP$ also showed remarkable growth with a 90.27% rise, followed by $Marubeni(8002.JP$ at 75.74%, $Sumitomo(8053.JP$ at 73.36%, and $ITOCHU(8001.JP$ at 64.40%.

Buffett's Investment Horizon:

Buffett is known for his long-term investment approach. In August 2020, Berkshire Hathaway announced it had passively acquired a 5% stake in each of the five major Japanese trading companies. This stake was later disclosed to have been increased to over 8.5% by June of the following year. In his shareholder letter, Buffett revealed that Berkshire holds about 9% of each company and has pledged not to purchase more than 9.9% without the approval of the companies' respective boards.

Since the summer of last year, when Berkshire disclosed the increased stake, it has accumulated shares in these companies. Masayuki Hyodo, the CEO of Sumitomo Corporation, mentioned in a recent interview that not only Sumitomo but all five companies have seen Berkshire increase its stake daily.

Regarding the length of time plans to hold these shares, Buffett indicated in his shareholder letter that he would continue to hold these companies for the long term. He has previously suggested that Berkshire plans to keep these investments for 10 to 20 years.

Why Buffett is Keen on the Big Five Japanese Trading Houses

Diversified Operations: Berkshire Hathaway values the highly diversified business models of Japan's five major trading houses, which mirror Berkshire's own approach to diversification.

Shareholder-Friendly Practices: These firms have been buying back their shares strategically at attractive prices, signaling a commitment to shareholder value.

Dividend Policy and Capital Use: The trading houses allocate roughly one-third of their earnings to dividends and use retained earnings effectively for business growth and modest stock repurchases, avoiding the dilution of shares through new share issuance.

Financing Strategy Against Currency Fluctuation: Berkshire financed its positions in these companies primarily with yen-denominated bonds, capitalizing on the unpredictable major currency market prices.

Anticipation of Commodity Price Rises: Buffett's significant investment may reflect his expectation of rising energy and commodity prices, areas where these firms have extensive involvement.

Global Resource Acquisition: Despite Japan's prolonged economic stagnation, these trading houses have been proactive in securing global oil, natural gas, and other resources.

Profit from Commodity Price Surge: Buffett's investment timed with the downturn in oil and gas prices due to COVID-19 has paid off with the recent surge in commodity prices, partly driven by the Russia-Ukraine conflict and the economic recovery.

Benefit from Yen Depreciation: The Bank of Japan's reluctance to raise interest rates has led to the yen's depreciation, providing a policy-induced advantage to these trading companies, especially as investment firms benefiting from favorable currency exchange when repatriating overseas earnings.

Introduction to the Five Major Trading Houses:

Japan's five major trading companies are long-established and sizable corporate groups playing a significant role in Japan's economy. Each company's operations are highly diversified and engage in trading a variety of products and materials, involving sectors including natural resources, energy, chemicals, metals, manufacturing, retail, real estate, and healthcare.

Mitsubishi Corporation, founded in 1873, eventually branched out into a conglomerate of independent companies collectively known as the Mitsubishi Group. This expansion led to a diverse portfolio encompassing sectors such as energy—including oil, natural gas, and nuclear power—metals like iron ore and aluminum, automotive, aerospace, chemicals, food, infrastructure, and the development of military equipment.

The company boasts significant competencies in the resources and energy sector, particularly in coal, liquefied natural gas (LNG), and copper, which make up roughly 53% of its business mix. Additionally, Mitsubishi has a widespread presence in non-resource sectors, including owning the well-known Lawson convenience store chain. The corporation is proactively investing in sustainable energy and the digital transformation space.

Mitsubishi is pivoting away from a heavy reliance on resource-based income, with projections indicating that by the fiscal year 2025, nearly half of its profits will be derived from its non-resource activities. Mitsubishi's mid-term financial outlook suggests a substantial outperformance in both return on equity (ROE) and return on assets (ROA) relative to its 10-year average. Among its industry peers, Mitsubishi is a front-runner in improving cash flow and delivering superior returns to its shareholders.

As the oldest trading house in Japan, Mitsui & Co., Ltd. was founded by Takatoshi Mitsui over three centuries ago. The Mitsui legacy continued with the establishment of Japan's first private bank, Mitsui Bank, in 1876, setting the stage for the birth of the largest trading conglomerate of its era. Today, Mitsui & Co. has evolved into a multifaceted titan, with its hands in a variety of sectors spanning from mineral and metal resources to energy, infrastructure, and transportation. The company's breadth extends to basic and specialty materials, agribusiness, steel, food products, consumer retail, healthcare, IT & communication technology, and initiatives aimed at catalyzing corporate development.

Mitsui boasts particular prowess in the resources and energy sectors with key interests in commodities like iron ore and liquefied natural gas. Its resource portfolio is heavily weighted towards iron ore, with significant investments in BHP's lucrative iron ore ventures in Western Australia. Beyond these traditional strongholds, Mitsui is steering towards the expansion of non-resource sectors, with healthcare being a notable area of development.

Among its industry contemporaries, Mitsui carries the highest leverage within the resource domain. Its performance metrics rank solidly in the middle when compared to its competitors. Forecasters anticipate that the company's return on equity (ROE) and return on assets (ROA) for 2023 and 2024 will comfortably exceed the 10-year average, thanks to a marked enhancement in cash flow. This financial uptick is translating into more generous remunerations for Mitsui's shareholders.

Marubeni Corporation, founded concurrently with Itochu, commenced over 160 years ago in the textile business. Today, it has stakes in prominent Japanese enterprises such as Mizuho Bank, Nissan Motor, Nippon Steel, Sapporo Beer, Hitachi, Canon, NSK Ltd.—Japan's top bearings manufacturer—and Kubota Corporation, a leader in agricultural machinery. Marubeni is particularly strong in the power and food (grains) sectors, with resources and energy making up 44% of its operations. The company is actively advancing into electric vehicle-related industries and offshore wind power.

Marubeni's resource investments are diversified, avoiding excessive dependence on any single commodity and maintaining satisfactory asset quality. Recent years have seen a decrease in asset impairment risks due to proactive measures. The company's strategic focuses include North American agricultural products like beef and grains, as well as aerospace leasing.

In the last decade, Marubeni experienced greater profit fluctuations due to asset impairment losses. However, since fiscal 2020, the company has outperformed its competitors in return growth, boasting a higher ROE. Its balance sheet has seen notable improvements thanks to effective deleveraging strategies. In the third quarter of fiscal 2023, Marubeni introduced a new policy aimed at returning 30-35% of profits to shareholders, underscoring its commitment to investor returns.

Originating from Sumitomo Bank in 1919 and transformed into Sumitomo Corporation in 1952, this enterprise spans a broad range of sectors, including Metal Products, Transportation & Construction Systems, Infrastructure, Media & Digital, Living Related & Real Estate, and Mineral Resources & Chemical. Renowned for expertise in real estate, media, leasing, and steel products, Sumitomo focuses on non-ferrous metals within its resource industry.

With a global footprint, Sumitomo Corporation draws around 40% of its revenue from Japan. The United States is another key market, contributing over 15%, while various Asian countries add nearly 20%. Europe, the Middle East, and additional regions make up over 15%, with the rest coming from the Americas. This distribution underscores Sumitomo's well-established international presence.

Itochu Corporation's journey began in 1858 with a modest linen trade and has since woven its way into a tapestry of global commerce, operating across diverse sectors including textiles, machinery, metals, energy, chemicals, foodstuffs, daily necessities, real estate, information technology, and financial services. The corporation not only partakes in domestic trading within Japan but also engages in import-export activities, complex triangular trade, and strategic trade investments both locally and internationally, showcasing its expansive commercial reach.

With resources and energy constituting approximately 45% of its business portfolio, Itochu also demonstrates particular expertise in textiles, food, information technology, and financial services. Among its prominent consumer brands is the well-known FamilyMart chain of convenience stores. Itochu's trading endeavors are notably extensive with China, having multiplied its international presence through the strategic acquisition of foreign enterprises and the formation of joint ventures.

A highlight of Itochu's expansion strategy was the 2005 acquisition of a 50% stake in Master Kong Beverages, which led to subsequent joint ventures with Master Kong Instant Foods and snack food giant Calbee in China. Itochu's aggressive growth continued with significant investments in a variety of companies including Hangzhou Xinhua Seas Trading, Kalahari Minerals PLC, CP Pokphand Co., Taipei Financial Center, FamilyMart, Big Motor, and others, thereby cementing its influence in industries ranging from metals and food to automotive.

Which company might become the next gem in your investment portfolio?

Feel free to share your thoughts in the comment section below~

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. All participants shall be responsible for the comparison and consideration of any relevant fees, charges and costs involved before investing. Moomoo is a financial information and trading app offered by Moomoo Technologies Inc.

In Singapore, investment products and services available through the moomoo app are offered through Moomoo Financial Singapore Pte. Ltd.regulated by the Monetary Authority of Singapore (MAS). Moomoo Financial Singapore Pte. Ltd. is a Capital Markets Services Licence (License No. CMS101000) holder with the Exempt Financial Adviser Status. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment