Bitcoin as an Investible Asset: Franklin Templeton Talks Crypto Investing

Franklin Templeton, a financial-holding company that manages many ETFs, recently posted a white paper from its digital-assets division entitled "Bitcoin as an Investible Asset," where the firm explores the crypto in the spot-Bitcoin ETF age.

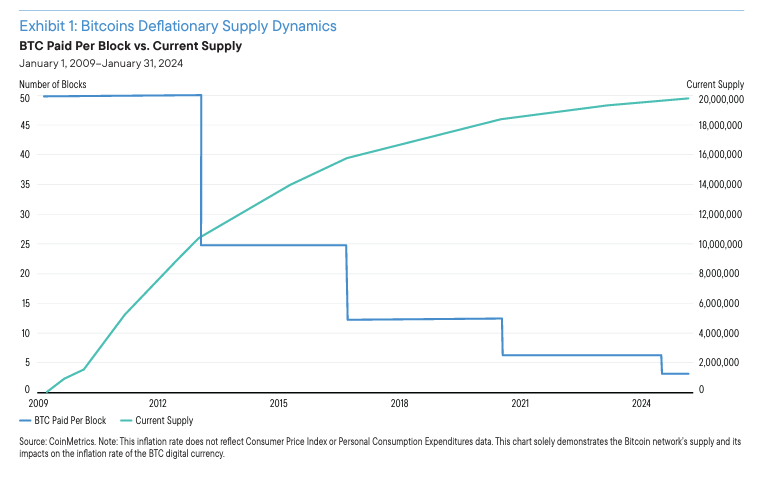

The paper looks at such things as Bitcoin's supply dynamics. The crypto's current rules limit the Bitcoin supply to no more than 21 million. Franklin Templeton argues that this could cause deflationary pressures on the coin's price action:

Bitcoin recently reached an all-time high, soaring above $73,000 per coin. The rally came some two months after the launch of multiple spot-Bitcoin ETFs.

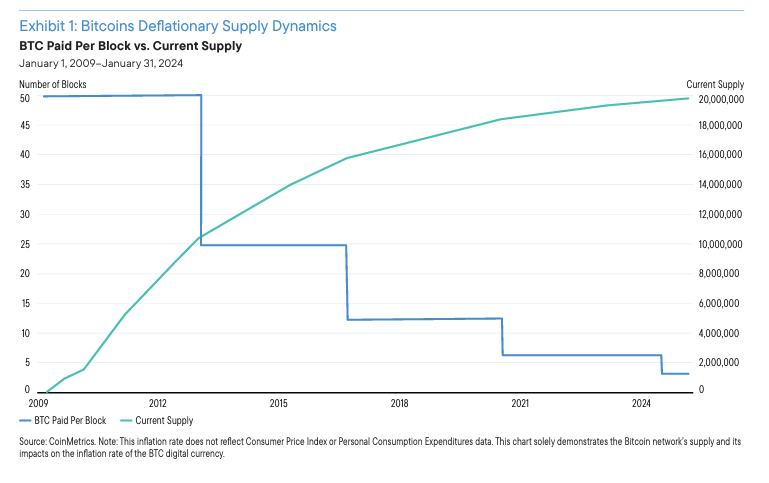

The white paper also looks at Bitcoin's upcoming "halving" event -- a built-in mechanism cuts the mining reward for new coins in half.

Franklin Templeton argues that the crypto's recent price run-up follows similar Bitcoin climbs near previous halvings. As Bitcoin approaches a halving, the price per coin has historically risen -- albeit with increased volatility as the market searches for a price consensus:

Franklin Templeton's Sandy Kaul and David Mann also joined Moomoo Mobile Money host Justin Zacks last month to discuss what Bitcoin ETFs mean for the market. Click here to listen to their full podcast.

Important Information: Before investing, Investors should consider the investment objectives, risks, and charges and expenses of any Exchange-Traded Fund (ETF). The current prospectus and, if available, the summary prospectus, contain this and other information about the ETF. You can find prospectuses on the websites of the financial firms that sponsor the ETF, as well as through your broker. Please read it carefully before investing.

A Word About Risk: Cryptocurrency ETFs are speculative and involve a high degree of risk. An investor may lose all or substantially all of an investment in the Fund. Bitcoin has historically exhibited high price volatility relative to more traditional asset classes, which may be due to speculation regarding potential future appreciation in value among other factors. The performance of these ETFs should follow bitcoin prices closely, minus fees and the fund’s trading costs.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment