Besides Buffett's Favored Japan Trading Firms, Others with Nearly 55% Surge Are Drawing Attention

Following the BOJ's recent departure from negative interest rates and its first rate hike in 17 years, Berkshire Hathaway is planning to issue yen-denominated bonds globally once again. Daiwa Securities strategist Atsuko Ishitoya suggests this may lead to increased investment in Japanese trading firms.

Alongside Buffett, Wall Street giants like Goldman Sachs Asset Management are eyeing Japan, favoring energy and Japanese stocks amid U.S. tech uncertainties and valuing Japan's market reforms and attractive valuations. Citigroup has increased Japan-focused client outreach, with Citigroup's Kota Ezawa noting a surge in marketing and "Japan Day" events to highlight investment opportunities. Morgan Stanley, collaborating with Mitsubishi UFJ, has also deployed a large Tokyo research team to major Asian financial centers, showcasing Japan's resurgent economy to investors worldwide.

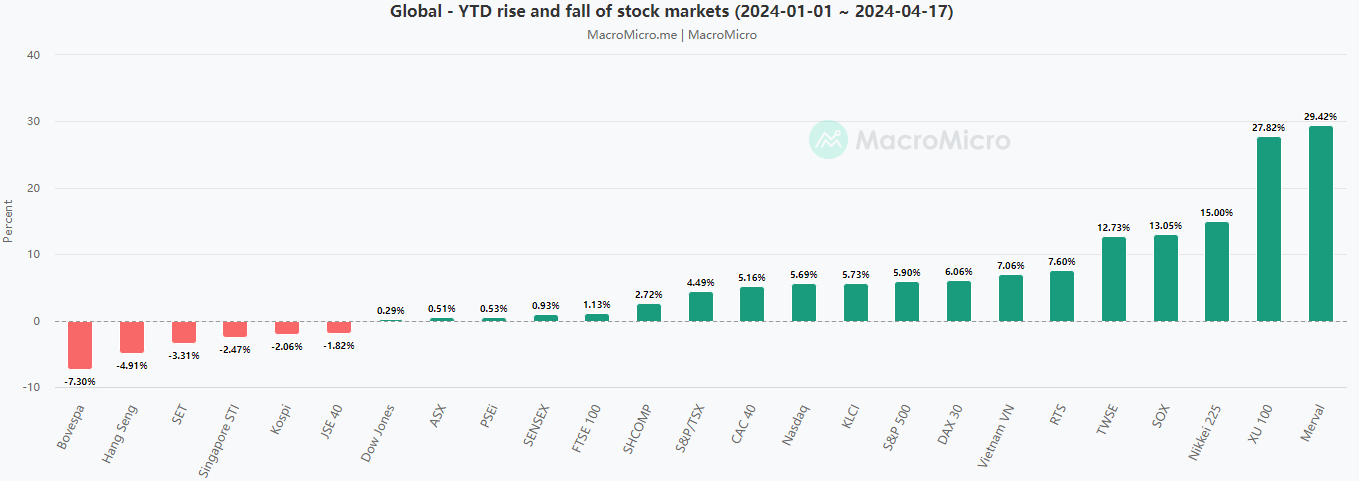

Japan's Nikkei 225 Takes the Lead in Global Equity Market with 15.00% YTD Surge

Since the beginning of the year, the Nikkei Index, Japan's premier stock market indicator, has shattered several records, reaching heights not seen in 34 years and crossing the 41,000-point threshold for the first time. As of today, the Nikkei 225 index has risen nearly 15% year-to-date, ranking among the top-performing global stock indices.

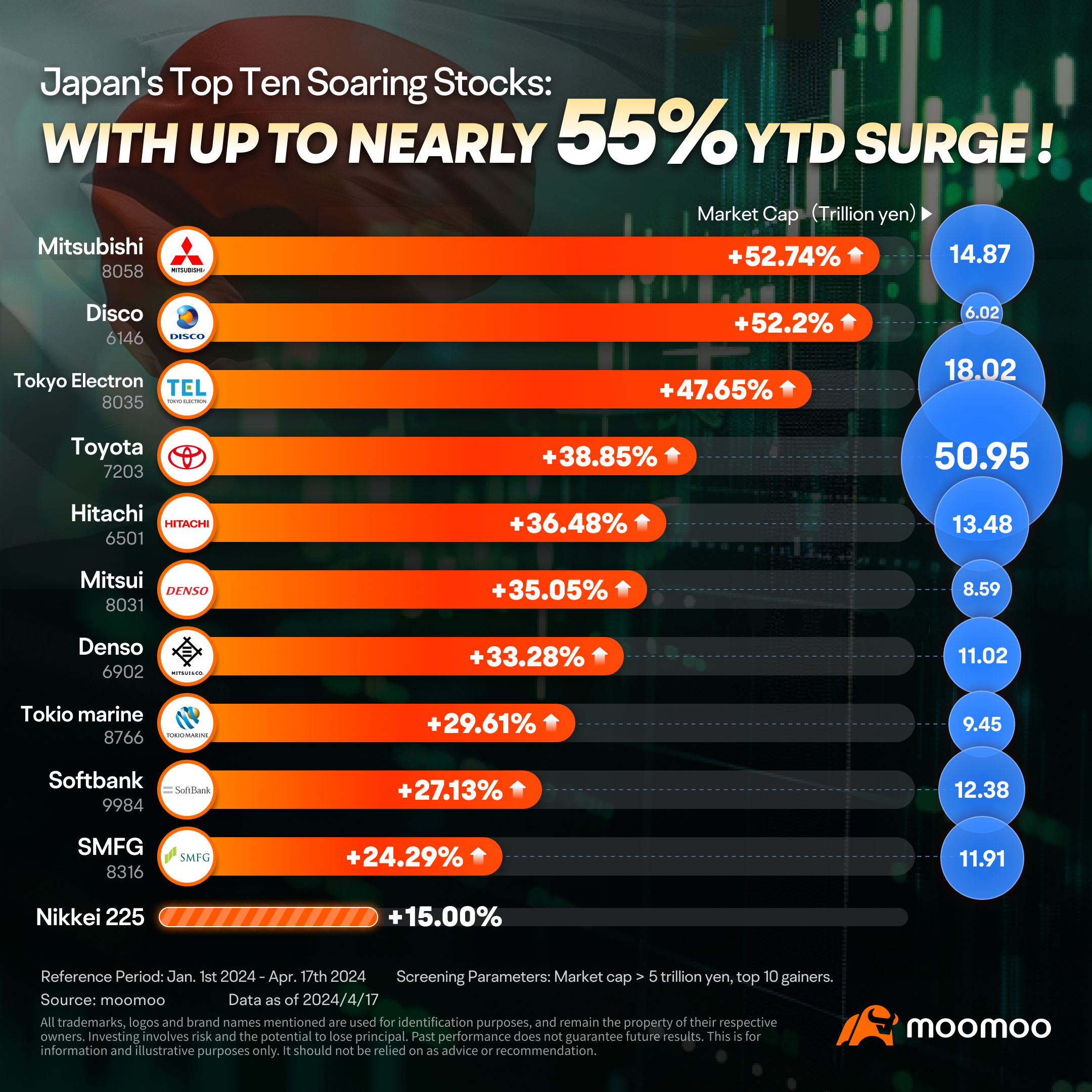

Analyzing this year's top-performing Japanese stocks reveals a notable change from 30 years ago, when banks and real estate led the market. Today, trading companies, automotive, semiconductors, and industrial tech have emerged as the main drivers of the rebound.

Overview of Top Ten Stocks

○ Two Trading Houses Favored by Warren Buffett among Top Ten

Among the top ten best-performing stocks, only two are the well-known major trading housesin Warren Buffett's portfolio, specifically Mitsubishi and Mitsui, which have seen their stock prices soar by 52.74% and 33.28% since 2024, outperforming the Nikkei Index's 15.00%.

Buffett's preference for the five major trading houses is anchored in their diversified operations, attractive dividend yields, strong free cash flows, and judicious approach to issuing new equity. Buffett's preference for these firms is due to their diversified operations, high dividend yields, robust free cash flow, and prudent approach to issuing new shares.

Overall, the share prices of Japan's trading houses have maintained a consistent upward trend in line with the broader Japanese stock market, buoyed by solid earnings foundations that have attracted a surge of investor interest. Buffett's investment has not only raised the profile of these Japanese firms but has also yielded substantial returns, reflecting the strong performance of the companies themselves.

○ Several Technology Companies Have Shown Astonishing Performance

In addition to the two trading companies mentioned above, some Tech-driven companies are also worthy of investors' attention under the influence of the global AI wave, such as the global semiconductor equipment and materials giant Disco, Japan's largest semiconductor manufacturing equipment supplier Tokyo Electron, and automotive giant Toyota. These companies have also achieved impressive gains this year, with increases of 52.20%, 47.65%, and 38.85%.

○ Three Financial-Related Stocks Worthy of Attention

Beyond the well-known five major trading firms and the 'Seven Samurai' of Japan, there are many other companies in the Japanese market that warrant attention. These include Hitachi, Denso, Tokio Marine, Softbank, and SMFG.

Some financial stocks have performed well, such as property insurance company Tokio Marine, investment powerhouse SoftBank, and banking titan SMFG.

Tokio Marine: Japan's Largest Property Insurance Company

Established in 1879, Tokio Marine Holdings has now grown into a global insurance company. Its international business is an important source of profits, contributing 56% to the company's earnings in 2023.

Around 2000, amid Japan's economic slump and reduced domestic insurance demand, Tokio Marine Holdings pursued specific regional strategies. In emerging markets, the company aimed to leverage growth in insurance, expanding its property and life insurance offerings. In established markets like Europe and America, it focuses on growing its market presence and share through mergers and acquisitions. The company also diversified its assets and optimized its portfolio by acquiring smaller firms and divesting less efficient operations.

Following a sustained period of growth and acquisitions, the company's property insurance premiums continued to increase, with a 15% year-over-year rise to 4.5 trillion yen in 2022. Looking at stock performance, since 2010, Tokio Marine's absolute and relative returns have been significantly positive. From 2010 to the present, Tokio Marine's stock price has cumulatively risen by 467.28%, while the Nikkei 225 Index has increased by 273.99%, resulting in an outperformance of +193% compared to the index. The significant rise in the stock price and the substantial positive excess return are primarily attributed to the company's excellent underwriting profitability.

SoftBank: Japan's Investment Giant

SoftBank Group is a multinational investment holding company from Japan, primarily investing in technology operating companies serving customers across a variety of markets and industries, from the internet to automation. The SoftBank Vision Fund, with an initial capital of over $100 billion, is the world's largest technology-focused venture capital fund.

Benefiting from a rebound in the stock values held by the Vision Fund and a windfall from the sale of its stake in T-Mobile US Inc., SoftBank Group returned to profitability after four consecutive quarters of losses.

In the fourth quarter of 2023, SoftBank achieved a net profit of 950 billion yen, a turnaround from a loss of 783 billion yen in the same period the previous year, marking its first quarterly profit since September 2022. Looking at this year's performance, SoftBank's stock has risen by more than 34%, registering its largest annual increase in nearly four years.

Sumitomo Mitsui Financial Group: A Top-Tier Japanese Bank

Sumitomo Mitsui Financial Group (SMFG) is Japan's second-largestfinancial institution, operating in various sectors including banking, leasing, securities, credit cards, and consumer finance.

With the Bank of Japan's decision to end its negative interest rate policy, Japanese bank stocks, including SMFG, have seen a collective rise. Sumitomo Mitsui Financial Group's stock has climbed over 31% year-to-date, surpassing the full-year gains of the previous year.

○ Two Manufacturing Stocks Demonstrate Impressive Performance

Apart from these three, two manufacturing industry giants are worth taking note of.

Hitachi: The Hidden King of Japanese Manufacturing

With a history spanning over a century, Hitachi has evolved from its beginnings as a small electric motor repair shop to a diversified conglomerate. It now covers a range of sectors including home appliances, energy, heavy machinery, information and communication technology, and semiconductors. With over 18 business segments and control over more than 1,000 subsidiaries, Hitachi has grown into one of Japan's largest manufacturing enterprises. It has been described by the industry as a company "capable of producing everything."

Since its low in 2020, the company's cumulative stock price increase has exceeded 350%. Since the beginning of this year, the stock has risen by nearly 40%.

Denso: The Mysterious Titan of the Automotive Industry

Denso Corporation, established in 1949, is a leading supplier of automotive components in Japan and ranks among the top suppliers of vehicle systems and parts in the world. Automotive giants such as Toyota, Honda, Mazda, Mercedes-Benz, BMW, Audi, Ford, Geely, and Changan are among the purchasers of Denso's equipment.

According to the 2023 ranking of the top 100 global automotive parts suppliers published by "Automotive News," Denso is hot on the heels of Bosch with revenues of $47.9 billion, placing it second on the list, narrowly trailing Bosch's $50.456 billion. In terms of stock performance, Denso's share price has approached a 40% increase since the start of the year.

moomooers

Which company are you most bullish on?![]()

Feel free to share your insights in the comments below~

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

cashbull918 : Go go go before Feb drops rate!!!

Thy GoD : I favor ToTo